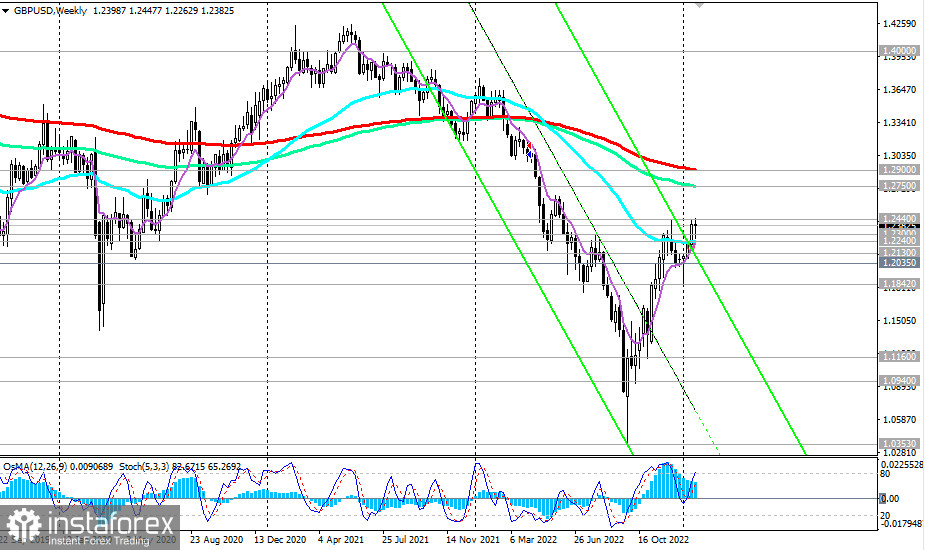

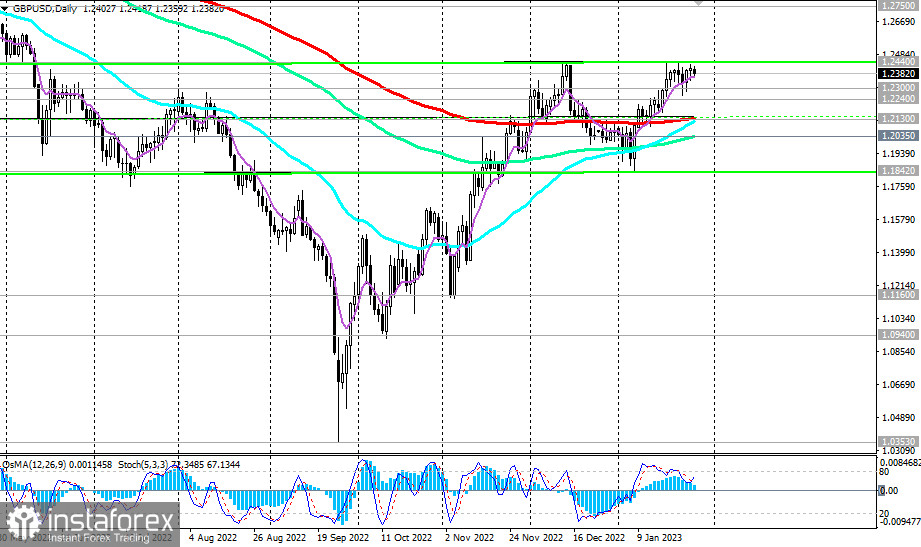

GBP/USD managed to correct into the medium-term bull market zone amid a weak U.S. dollar, rising above 1.2130, 1.2240, through which important support levels pass: 200 EMA on the daily chart and 200 EMA on the weekly chart.

Despite the pair's growth, there is still a long term global downward trend below the key resistance levels 1.2750 (144 EMA on the weekly chart) and 1.2900 (200 EMA on the weekly chart), which makes short positions preferrable.

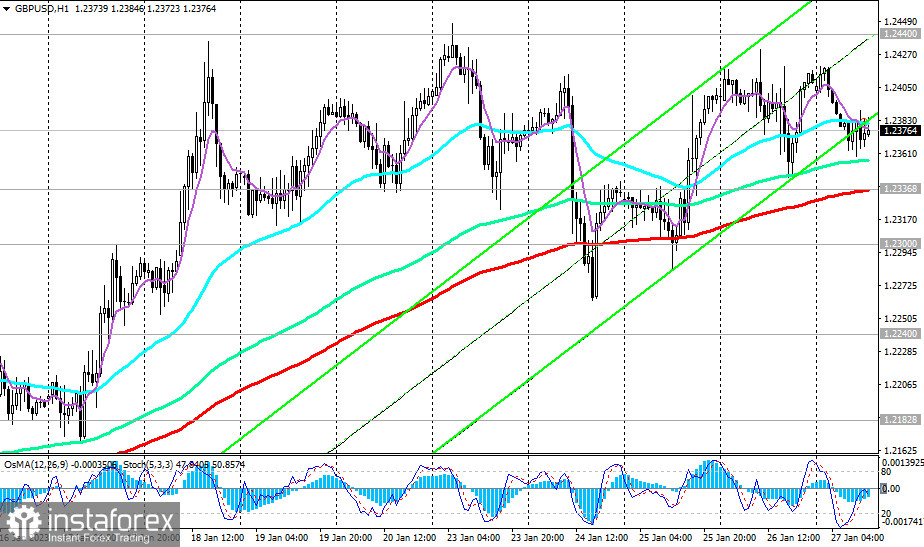

A consecutive breakdown of the support levels 1.2130, 1.2035 (144 EMA on the daily chart and the upper limit of the downward channel on the weekly chart) will return GBP/USD to the long-term bear market zone, sending it towards the September lows near the 1.0400 mark. The first signal to build up short positions may be a breakdown of the important short-term support level 1.2337 (200 EMA on the 1-hour chart).

Alternatively, GBP/USD will continue to rise towards the key resistance levels 1.2750, 1.2900. The signal for the resumption of long positions will be the breakdown of today's high at 1.2418 and the local resistance level (this month's high) at 1.2447.

Support levels: 1.2337, 1.2300, 1.2240, 1.2183, 1.2130, 1.2100, 1.2035, 1.2000, 1.1842, 1.1160, 1.0940

Resistance levels: 1.2400, 1.2447, 1.2500, 1.2600, 1.2750, 1.2800, 1.2900

Trading scenarios

Sell Stop 1.2330. Stop-Loss 1.2420. Take-Profit 1.2300, 1.2240, 1.2183, 1.2130, 1.2100, 1.2035, 1.2000, 1.1842, 1.1160, 1.0940

Buy Stop 1.2420.Stop-Loss 1.2330. Take-Profit 1.2440, 1.2500, 1.2750, 1.2800, 1.2900

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română