British and European currencies are still in strong demand and are not declining. I have already discussed the potential complexity of the rising sections of the trend, as well as the development of both currencies practically from scratch, numerous times in my evaluations. Therefore, they won't be done again. Drawing judgments before the meetings of the ECB, Fed, and Bank of England is simply useless. It is doubtful that both instruments will start to decrease sharply a week before the first meetings in 2023 if they merely increased throughout January. Only waiting remains.

So, it won't be pointless to discuss when the time of high rates will end while the market is waiting. It makes no sense to discuss this subject in the context of the ECB and the Bank of England because both central banks are dealing with the biggest inflation, which they are unable to pay back in any way. Therefore, it stands to reason that UK and EU interest rates will continue to rise. You can think about this subject, though, in the context of the Fed. Morgan Stanley, an investment bank, thinks it is useless to wait for a rate cut until inflation reaches 3%. According to the bank's analysts' predictions, 3% inflation is to be anticipated by year's end and a slowdown to 2% by year's end for the consumer price index. The Fed rate may therefore start to decrease no earlier than the end of 2023.

How might this impact the EUR/USD currency pair? In my opinion, the American economy is stronger than the European one and has significantly fewer hazards. Therefore, I don't think the dollar will get weaker throughout the current year. Given that the ECB should objectively raise rates more swiftly than the Fed, we may continue to see "bullish" market sentiment for another two to three months. But both instruments still appear to have been bought for way too much. Corrective sets of waves are required, and once they are over, a new upward part of the trend may start if the Bank of England and the ECB continue their "tough" stances. But eventually, British and European regulators will also start to oppose rate increases, and at that point, the market won't have any more justification for driving up demand for the euro and the pound (unless other factors appear by then).

Based on the foregoing, I continue to anticipate a drop in both instruments, although I admit that the current phase of the trend may occasionally become more problematic. The possibility that the Fed will pause its tightening of monetary policy in March also works against the currency. James Gorman, the CEO of Morgan Stanley, said this. If so, the US dollar won't gain any assistance in the upcoming months because the ECB plans to increase the interest rate by 100 basis points in February and March. The wave analysis now conflicts with the news context.

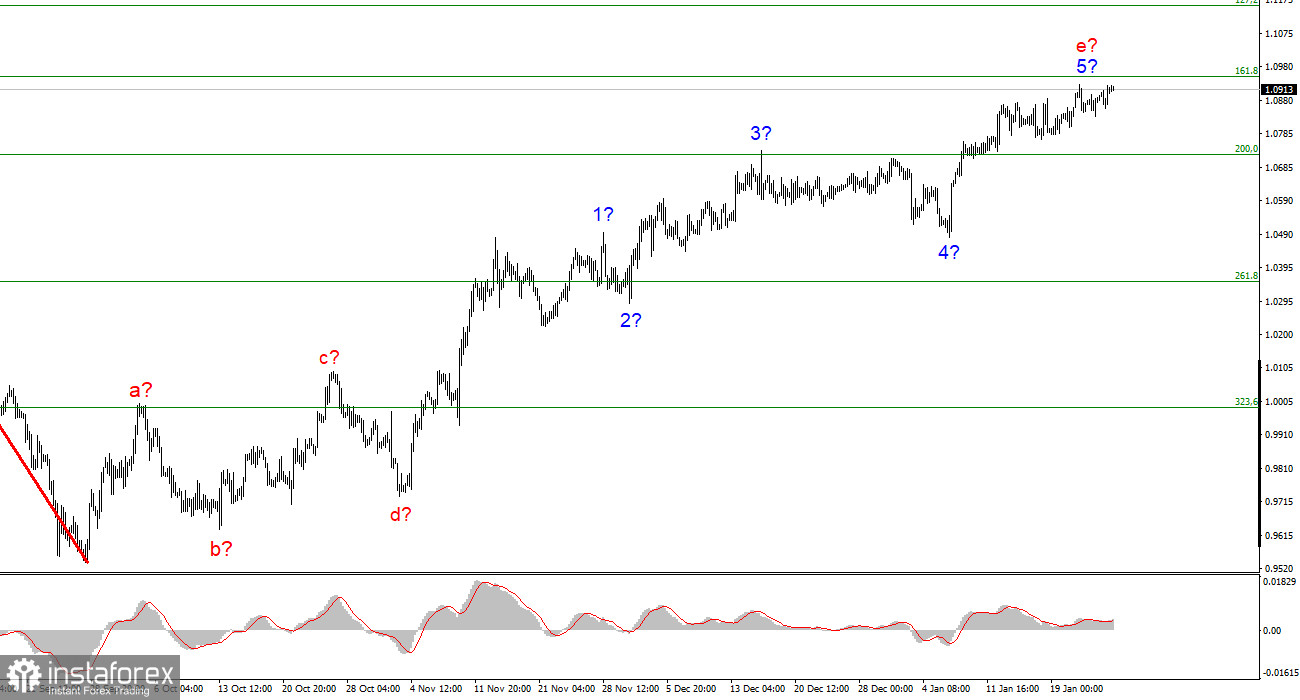

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted 0.9994 level, or 323.6% per Fibonacci. The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening. The market will be ready to finish the wave e when a bid to break through the 1.0950 level fails.

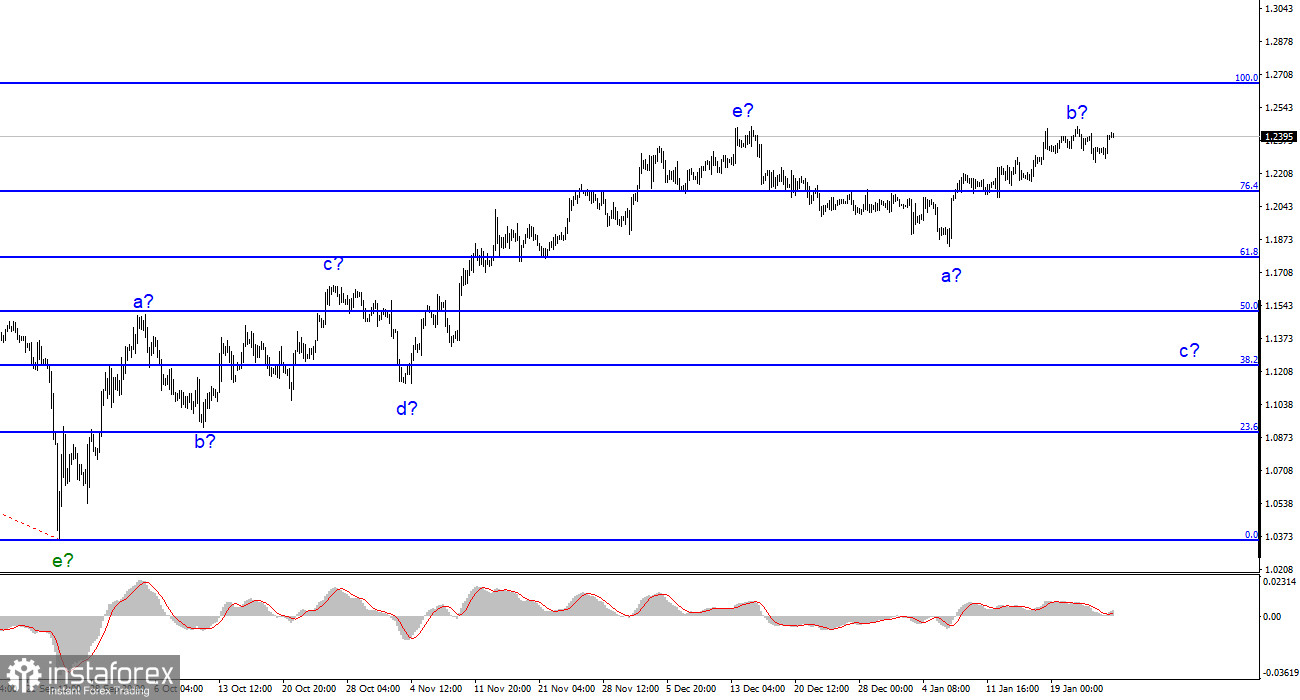

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound has a significant tendency to rise.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română