Global inflation remains high, continuing to rise in selected and economically important regions. The Australian Bureau of Statistics released its inflation report today, stating that the country's inflation has again accelerated. Consumer price index (CPI) rose in Q4 2022 to 1.9% against the forecast +1.7% and the previous quarterly value of +1.8%. On an annualized basis, the index also rose to 7.8% from 7.3% in the previous quarter, stronger than the +7.5% growth forecast.

These data increase the pressure on the Reserve Bank of Australia to further tighten its policy. At the same time, the country's weak macro data reflects a slowdown in the economy. Australian services PMI fell again in December to 47.3 against 47.6 last month and the forecast of 46.9 points. This figure has been declining for the sixth month in a row. The preliminary data on the number of building permits in Australia for November was also weak, which declined by -9.0% after falling by -5.6% in the previous month. It seems that the housing market, and hence the construction sector of the economy, began to feel pressure from the RBA's interest rate hikes, which is already negatively affecting the entire Australian economy.

Thus, the leaders of the RBA are in a difficult position: inflation continues to grow, despite the previous increase in the interest rate in the country; the economic situation is also deteriorating, feeling pressure from the Australian central bank's tighter monetary policy.

Other major world central banks are in a similar situation: the economy is slowing down and inflation continues to rise. In particular, this applies to the Bank of Canada, which today will announce its decision on interest rate.

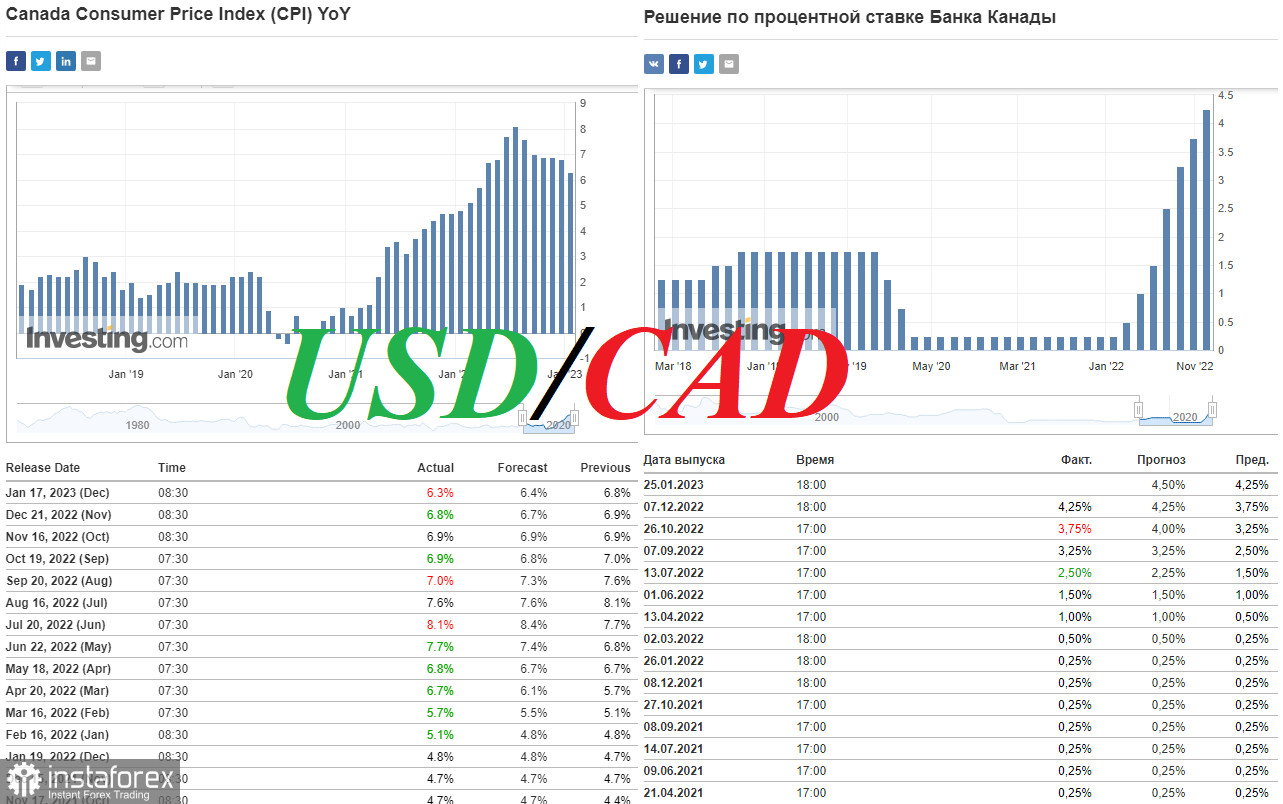

Rising commodity prices, especially oil, which Canada is the largest supplier, creates a favorable background for the Canadian dollar. At the same time, the annual consumer inflation index fell to 6.3% in December after consecutive declines in previous months from its multi-year peak of 8.1% reached in June.

However, and given the fact that the inflation target for the Bank of Canada is in the range of 1%–3%, the value of the indicator above this range is a harbinger of a rate hike. It is widely expected that the Bank of Canada will raise it again, but not by 0.50%, as it was at the previous two meetings, but by 0.25%. This will be the highest in the last 15 years and the level of 4.50%. However, such a decision is unlikely to cause a strong strengthening of the Canadian dollar. Although, much will also depend on the bank's accompanying statements. The tough tone of these statements will cause the Canadian dollar to strengthen. The inclination of the bank's leaders to pursue a soft policy or hints that the cycle of monetary policy tightening will soon be stopped in order to assess the consequences of measures already taken may provoke a weakening of the Canadian dollar.

The decision of the Bank of Canada on the interest rate will be published at 15:00 GMT, and at 16:00, a press conference will begin, during which the head of the bank, Tiff Macklem, will explain the decision and assess the current economic situation in the country. If the tone of his speech is tough on the monetary policy of the BoC, then the Canadian dollar will strengthen in the foreign exchange market. If Macklem speaks in favor of loose monetary policy, the Canadian currency will fall. In any case, high volatility in CAD quotes is expected during the period of publication of the decision on the interest rate and the speech.

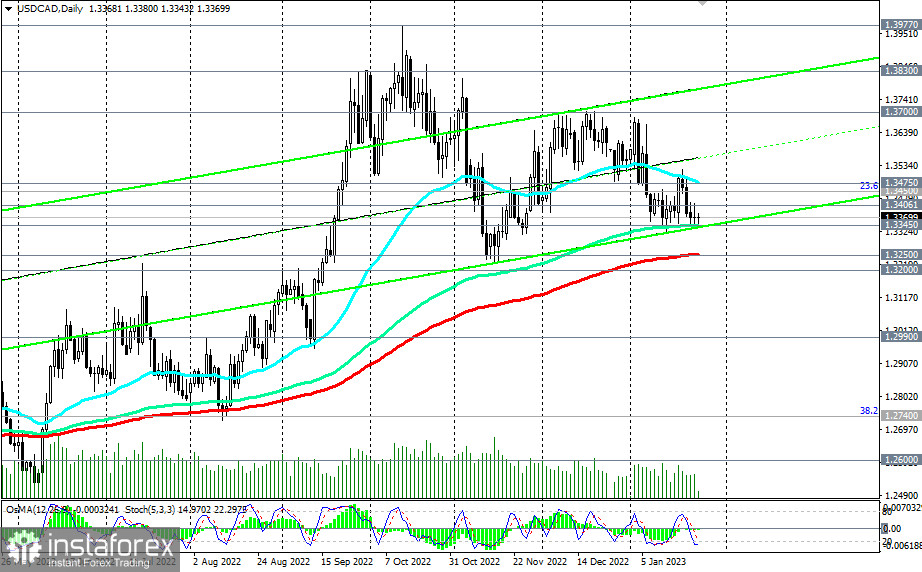

From a technical point of view, USD/CAD is developing a short-term downward trend, remaining within the global upward trend, above the key support levels 1.3345, 1.3250, 1.3200. As of writing, the pair is trading near the 1.3370 mark, in close proximity to the strong support level 1.3345. If today's decision of the Bank of Canada disappoints market participants by being soft, then there will be a rebound and a resumption of USD/CAD growth near the current levels and the support level 1.3345.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română