Details of the economic calendar on January 24

Particular attention was paid to the preliminary assessment of business activity indices in Europe, United Kingdom and the United States.

Details of PMI statistics:

Eurozone manufacturing PMI rose to 48.5 in January from 47.8 in the previous month. Meanwhile, services PMI rose from 49.8 to 50.7 points. And composite PMI rose from 49.3 to 50.2 points.

The euro, which is at the peak of the upward cycle and smoothly moved to a pullback, slowed down the weakening. As a result, there was stagnation.

UK manufacturing PMI rose from 45.3 to 46.0 against the forecast of 46.7 points. Services PMI was estimated to rise from 49.9 to 50.0, but actual data fell to 48.0. Composite PMI was expected to rise from 49.0 to 49.6, but actual data came out at 49.6.

The pound sterling reacted with a decline in value in line with negative statistics.

U.S. manufacturing PMI rose from 46.2 to 46.8, with forecast of a decline to 46.0. Services PMI rose from 44.7 to 46.6, with a forecast at 45.0. And composite PMI rose from 45.0 to 46.6 points.

The dollar played positively on the statistical data, and as a result, it moved to strengthening.

Analysis of trading charts from January 24

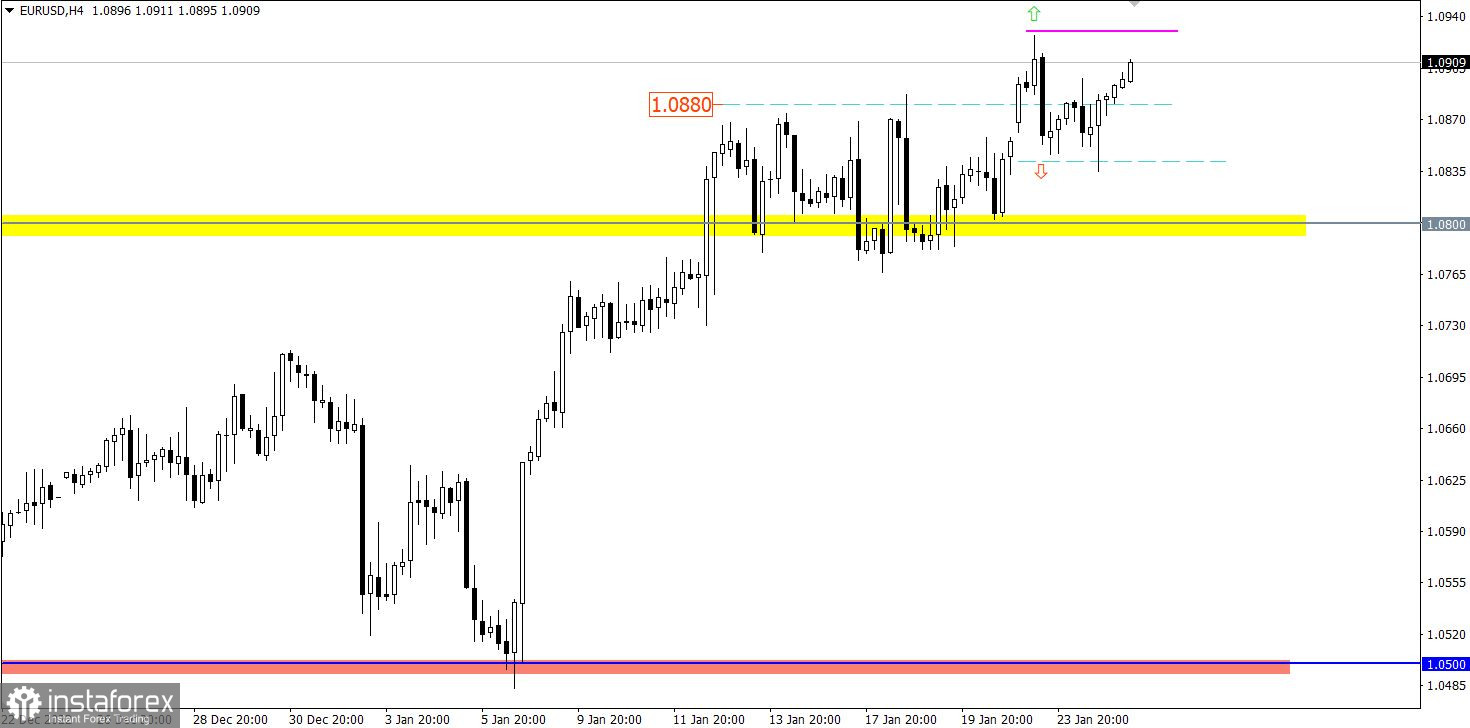

The EUR/USD currency pair managed to restart long positions. As a result, the quote went above 1.0900, which indicates an upward trend among traders.

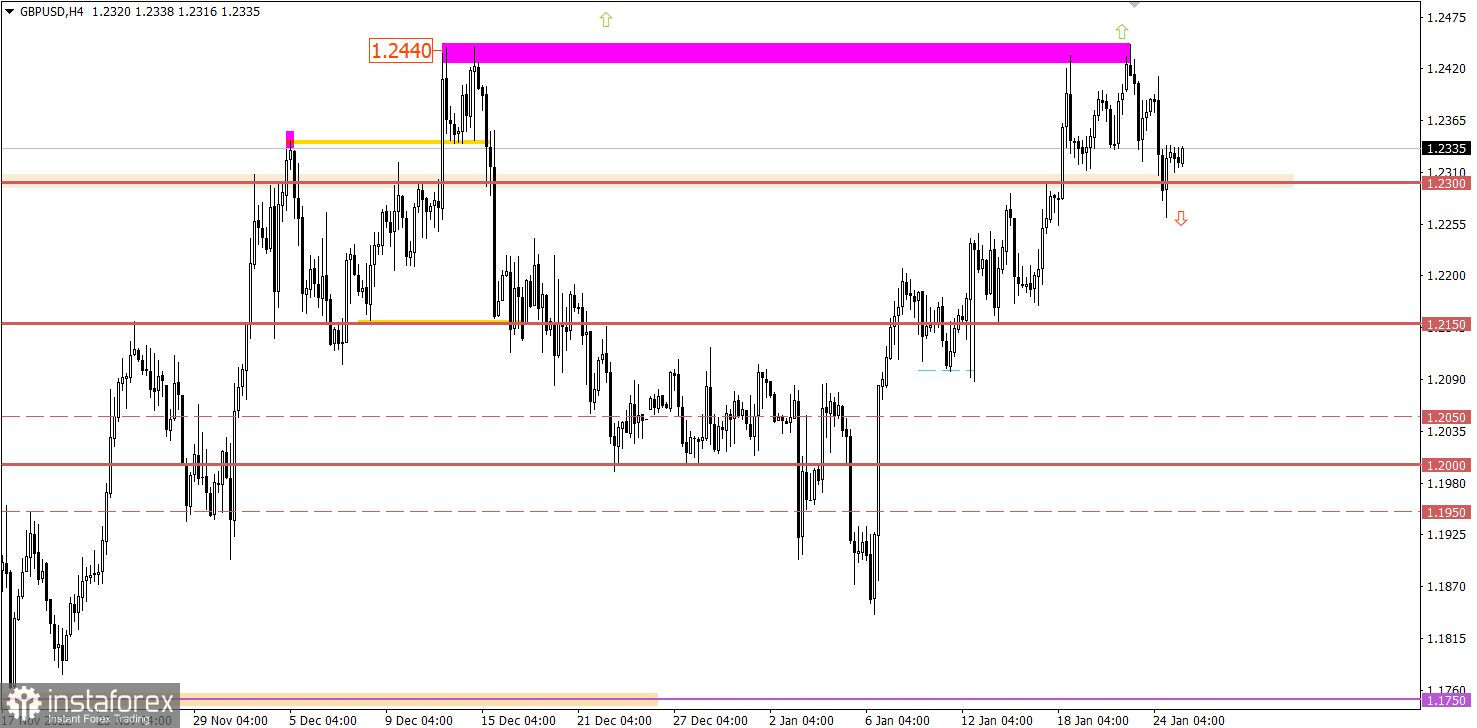

The GBPUSD currency pair showed speculative activity on the market. During which, the quote first fell below the level of 1.2300, and then rolled back.

Economic calendar for January 25

Despite the release of inflation data in Australia and Bank of Canada's meeting today, the macroeconomic calendar for trading instruments is empty. Important statistical indicators in Europe, the United Kingdom and the United States are not expected.

EUR/USD trading plan for January 25

For the subsequent jump, it is necessary to update the local high of the upward trend, i.e., to stay above the 1.0927 mark. In this case, there may be a subsequent round of growth of the euro exchange rate in the direction of the 1.1000 psychological level.

As an alternative scenario, traders consider a price rebound with a return to the amplitude of 1.0840/1.0880.

GBP/USD trading plan for January 25

In this situation, it is necessary to keep the price below the level of 1.2300 for a long time for a full-fledged transition from the pullback stage to a full-blown correction for the pound sterling to occur. Otherwise, it is impossible to exclude the resumption of movement along the amplitude of 1.2300/ 1.2440.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română