EUR/USD

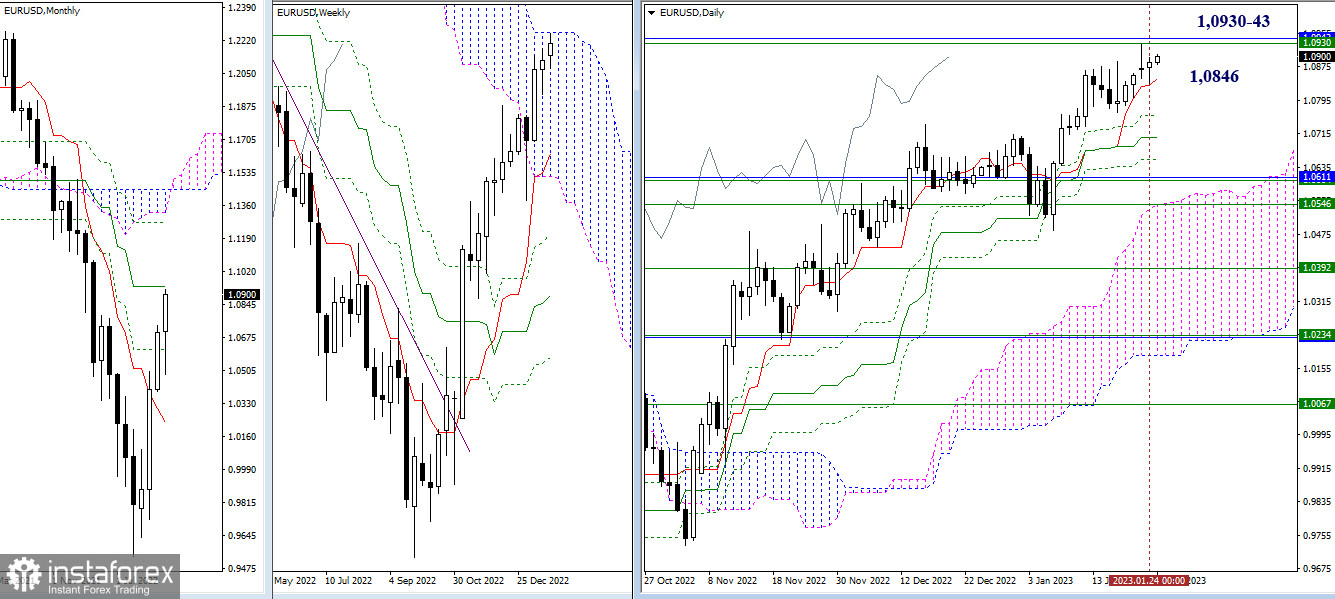

Higher time frames

The movement slowed. Yesterday, uncertainty was felt across the market. The bulls should protect the important resistance zone of 1.0931-43 which is represented by the upper limit of a one-week cloud and a one-month medium-term trend. In case of a downtrend, support is seen at the levels of the daily Ichimoku cross (1.0846 – 1.0757 – 1.0705 – 1.0653).

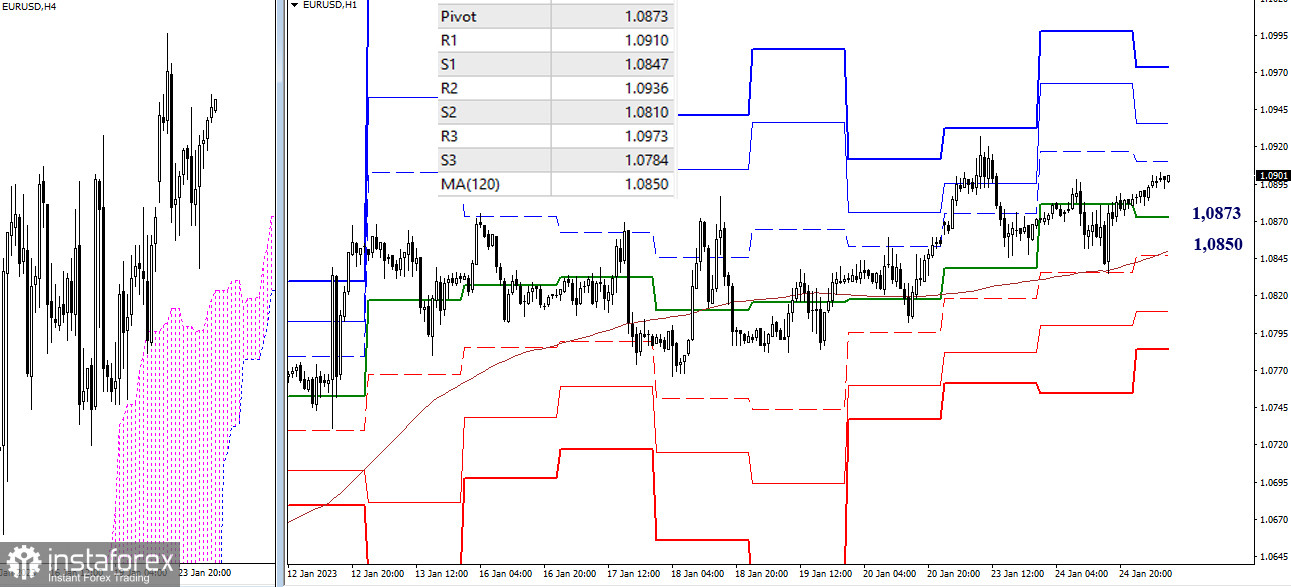

H4 – H1

Yesterday, the bulls protect the one-week long-term trend line. In lower time frames, sentiment is currently bullish. Upward intraday targets are seen at the resistance of classic pivot levels (1.0910 – 1.0936 – 1.0973). Support stands at 1.0873 (central pivot level) and 1.0850 (one-week long-term trend). Consolidation below these levels may change the balance of trading forces.

***

GBP/USD

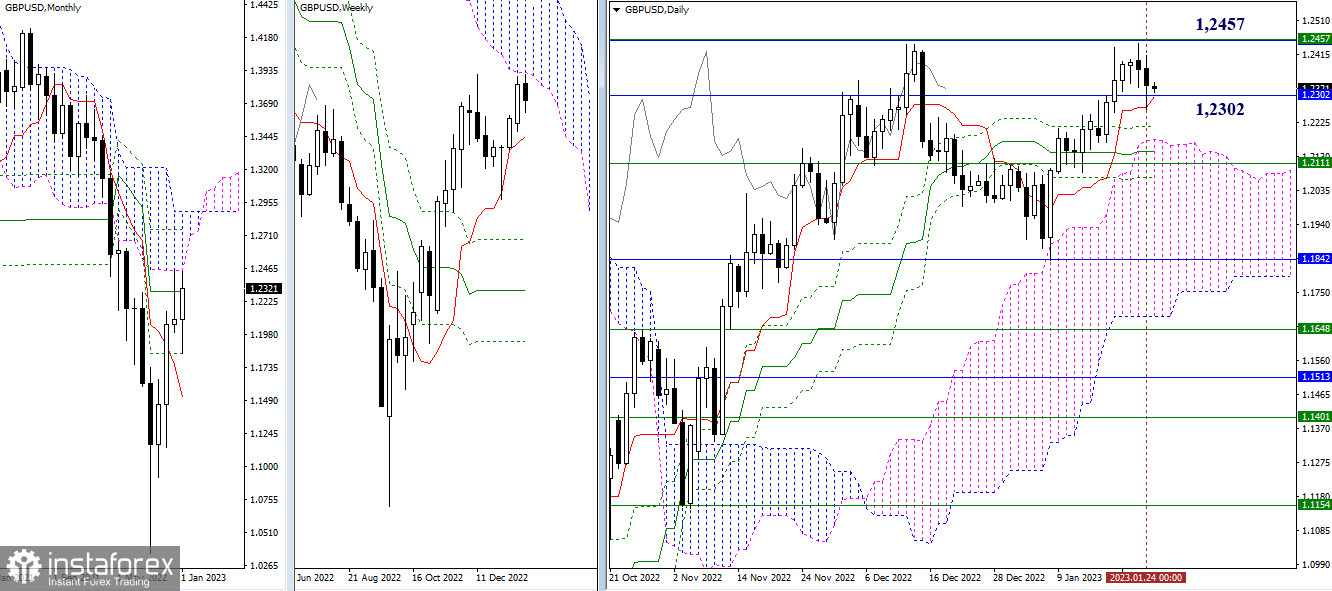

Higher time frames

Yesterday, the pair failed to update the daily high. It fell to the nearest support level. Today, the quote is likely to move in the range limited by 1.2457 (upper limits of the Ichimoku cloud of one-month and one-week time frames) and 1.2302 (intraday short-term trend line + one-month medium-term trend line).

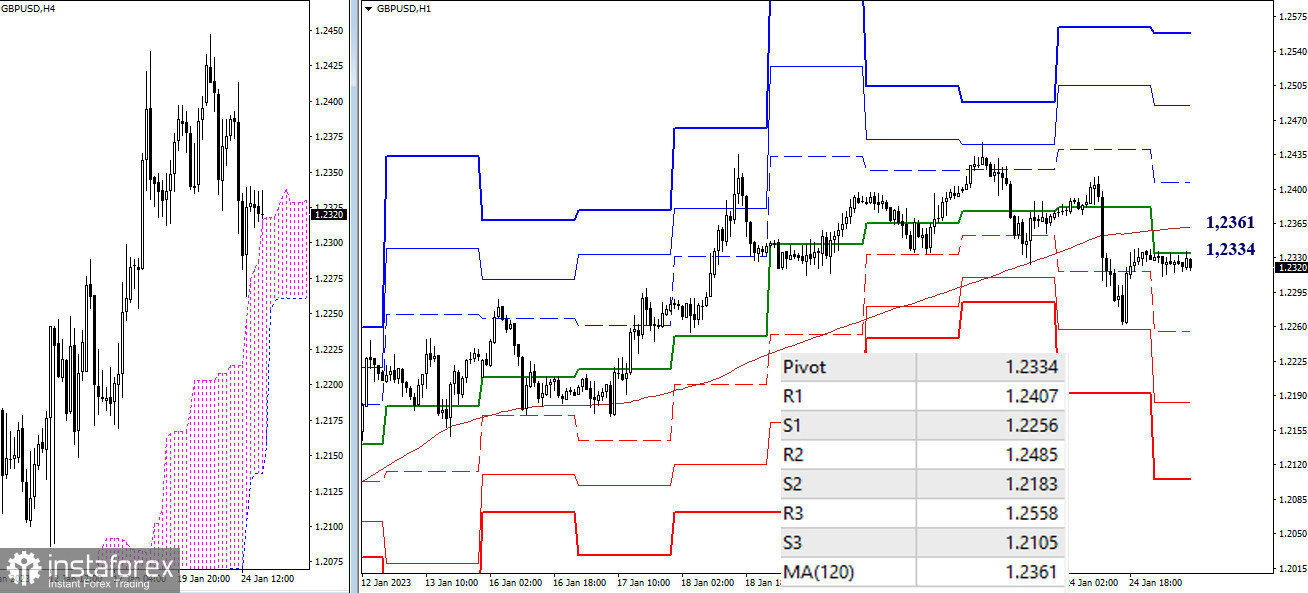

H4 – H1

In lower time frames, the pair went below the key levels and the likelihood of a bearish trend increased. Intraday targets are seen at classic pivot support (1.2256 – 1.2183 – 1.2105). Bullish sentiment will increase if the quote breaks through 1.2334 (central pivot level) and 1.2361 (one-week long-term trend line). Upward intraday targets stand at 1.2407 – 1.2485 – 1.2558 (classic pivot resistance) today.

***

Indicators used in technical analysis:

Higher time frames - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română