The EUR/USD currency pair is gradually increasing. On Tuesday, the European currency continued to "bask in the sun" above the moving average line while the British pound started another round of downward adjustment. The pair cannot even slightly drop below the moving average, let alone experience a correction or something more significant, as we have constantly highlighted. The technical picture and our findings are therefore unchanged from Tuesday. The market is still solely looking north, and there is currently essentially no correlation with the pound. And it doesn't happen very often.

In the European Union, three business activity indices were released yesterday. And because there was no market response to them, we will not even consider them. We would have alerted traders to the fact that one or more indices had experienced a major increase or decrease. However, since the market has not given these statistics any consideration, we don't think it's worthwhile to concentrate on them. It should be highlighted that recent relationships between the euro and its macroeconomic and fundamental background are illogical. Many reports are disregarded, and many reports are just used as justification for opening new long positions. As a result, the "foundation" and macroeconomics lose their essential substance. If the market is just engaged in purchasing euros, what use is it to analyze this or that report? Any news, message, or report can be evaluated from various perspectives. One of the major drawbacks of basic analysis is that every occurrence can be regarded as having both a positive and negative meaning. We make an effort to avoid adjusting the news to the movement of the pair, therefore we blatantly admit that the market now gives reports, speeches, and other events very little consideration.

It would be more accurate to state that there is currently only one betting factor in the market, which is honestly already beginning to annoy me. The ECB is expected to keep tightening monetary policy practically indefinitely, according to the market, but the Fed has run out of options. While the ECB rate is currently being increased by 1.25% for three meetings, the Fed rate is very readily capable of rising to 5.5%. There is just a 0.25% difference. Does this mean that the euro is expanding exponentially as a result of this 0.25%?

ECB members' remarks simply serve to perplex traders.

Even more unpleasant than the subject of trading is one more issue. These are the ECB representatives' remarks regarding the same rates. The chairman of the ECB delivered three speeches last week, and members of the monetary committee who are also the central bankers of their respective nations also delivered multiple speeches. Rates will increase at a noticeable rate going forward, and almost everyone agreed. This makes sense and is to be expected; otherwise, it cannot be. Recall that the ECB debated tightening in various ways for a very long time last year but was unable to make a decision. He is currently far behind the Fed as a result. No one will comprehend his refusal if he delays raising the rate for a moment. There is just no need to slow the rate of growth with off-scale inflation at this point because the European Union recession has not yet started. As a result, the ECB simply lacks formal justification for tightening monetary policy by 0.5%. We believe that even a single rise of 0.75% would not be harmful. Members of the ECB are aware of this.

What do we ultimately have? All of the ECB officials keep repeating their mantra about high inflation and hiking interest rates, and the market "digests" all of this by giving us more long positions in the euro currency. Nevertheless, there is nothing new that we discover every day. The market appears to be simply buying more euros by taking advantage of all formally "bullish" factors. Why sell the euro if you can ride the rising trend? We appear to be witnessing an inertial increase.

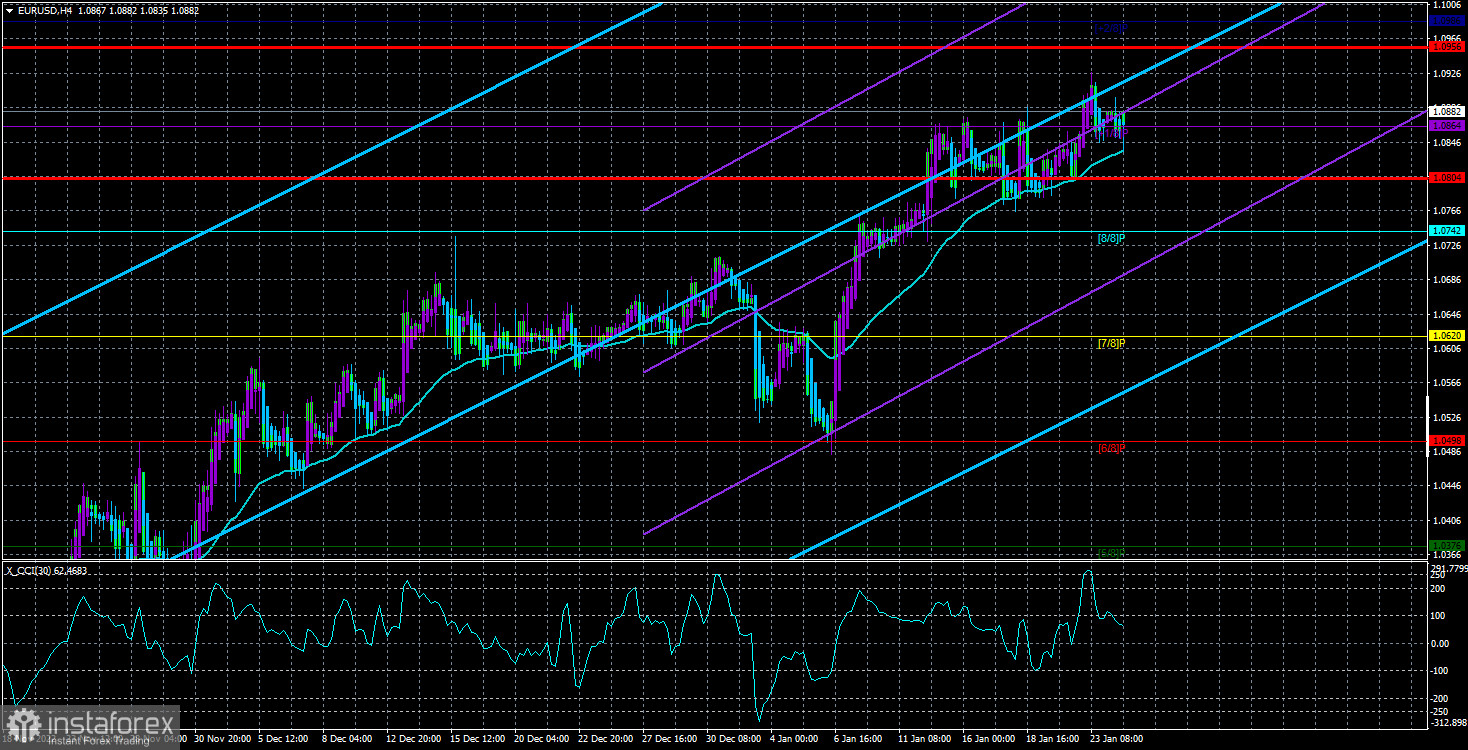

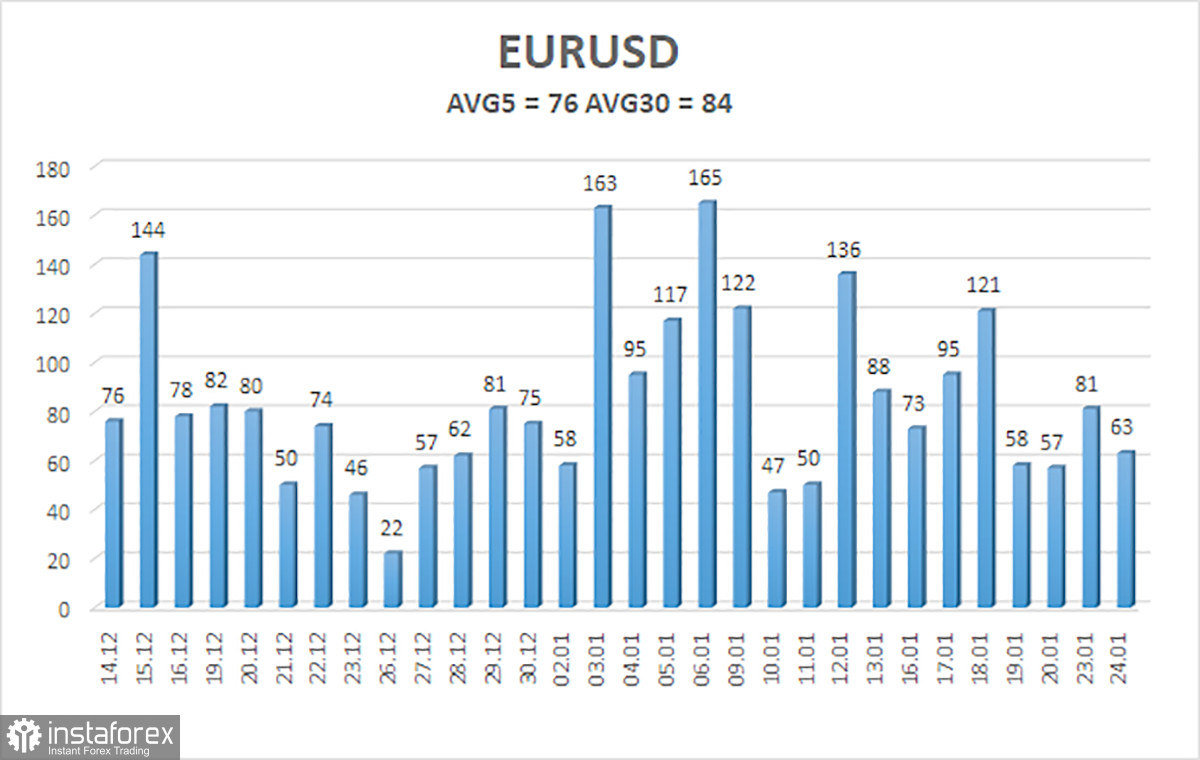

As of January 25, the euro/dollar currency pair's average volatility over the previous five trading days was 76 points, which is considered "normal." So, on Wednesday, we anticipate the pair to fluctuate between 1.0804 and 1.0956. The Heiken Ashi indicator's upward reversal will signal the restart of the upward momentum.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Suggestions:

The EUR/USD pair is still moving upward. Now is a good moment to think about opening new long positions with goals of 1.0956 and 1.0986 following the Heiken Ashi indicator's upward turn or when the price is recovering from a move. With goals of 1.0804 and 1.0742, short trades can be opened after the price is fixed below the moving average line.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română