Christine Lagarde has spoken four times since the start of last week. Today, Lagarde delivered a speech at a gathering in Germany as part of the international conference in Davos. Her lectures undoubtedly captured the markets' interest, but did they also provide them with the knowledge they needed to continue working? I don't believe the markets have learned anything new for themselves as a result of the ECB president's numerous statements. But let's examine this in greater detail.

First of all, Christine Lagarde reaffirmed that interest rates would rise further. Rate increases of another 100 basis points are currently anticipated for the meetings in February and March, after which a further rise of 25 basis points is possible. As a result, the ECB rate might increase to 3.75% in four months. Such a rate level, in my opinion, cannot be described as "restrictive." In recent years, the Fed or the ECB has frequently used this phrase to describe a rate level at which economic growth is impractical and indicators of corporate activity, demand, and inflation are falling. But does the growth rate mean that inflation is now decreasing? Let me remind you that prices have come down considerably over the past few months in the major oil and gas hubs across the world. The cost of crude oil has decreased by $40 and that of some of its varieties by 60%. The cost of gas has decreased by three times. This is not a typo; in fact, it's very feasible in the present world. So, perhaps the terrible energy crisis that was expected to cause inflation in the Eurozone is not the reason why the ECB rate has been raised to 2.5% right now?

Second, Christine Lagarde brought up China's decision to ditch its zero-tolerance COVID policy and fully open its economy. The volume of gas supply after the actual denial of supplies from Russia at many hubs is not very large, according to Lagarde, and such a decision will raise the demand for gas, which is necessary at many production facilities. A shortage of "blue fuel" and a rise in its price may result from China starting to increase output. Additionally, it appears as though the drop in gasoline costs is only a passing occurrence. It should be understood that although the European Union has located additional "blue fuel" providers, there is still a shortage. I think there's a good chance that in 2023 or 2024, gas prices will rise again, which would lead to another spike in inflation.

Third, Christine Lagarde reaffirmed the ECB's commitment to taking all necessary steps to bring inflation back to the predetermined level. But nothing was revealed about the time of this return, the rate increase's speed, or the rate's ultimate level. Will the market's response to what is happening to be the same as it is now if the recovery of the consumer price index takes five years? I think the ECB is maintaining a "good face with a poor game" by not being willing to make any concessions to get inflation down to 2%. Demand for the euro will start to fall as soon as the market learns that controlling inflation in the EU may prove to be a challenging assignment for the regulator.

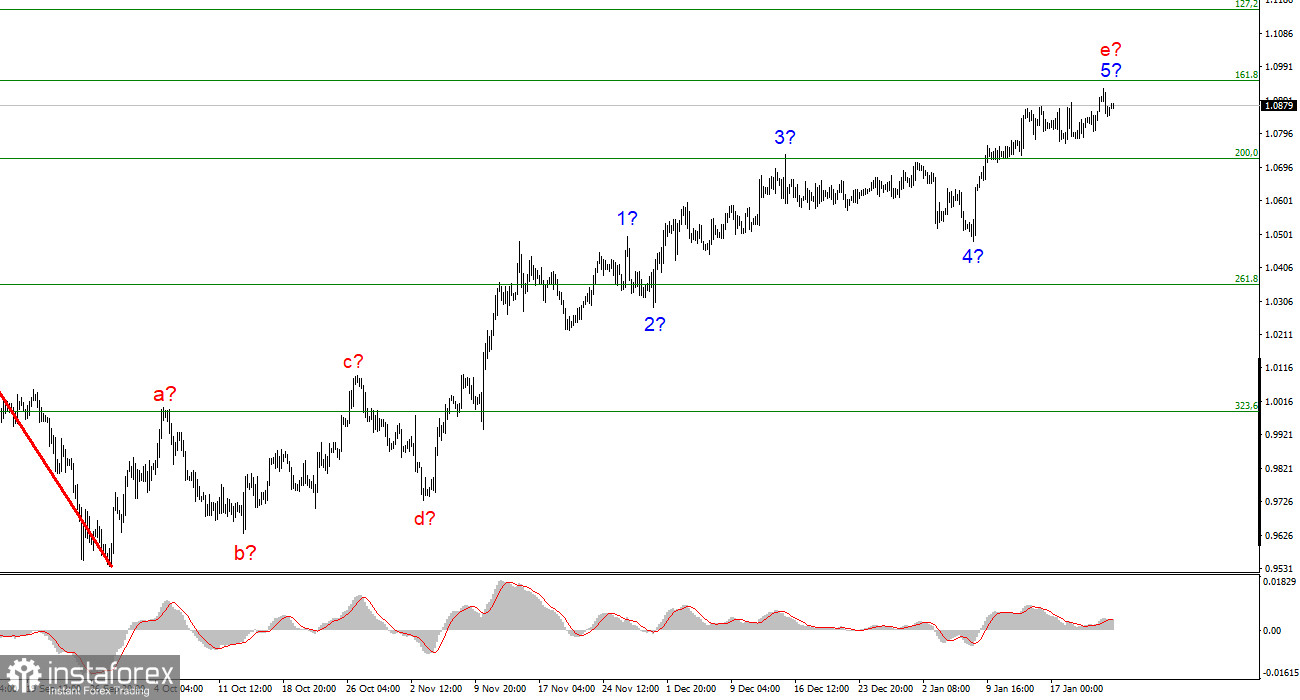

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted 0.9994 level, or 323.6% per Fibonacci. The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening. The market will be ready to finish the wave e when a bid to break through the 1.0950 level fails.

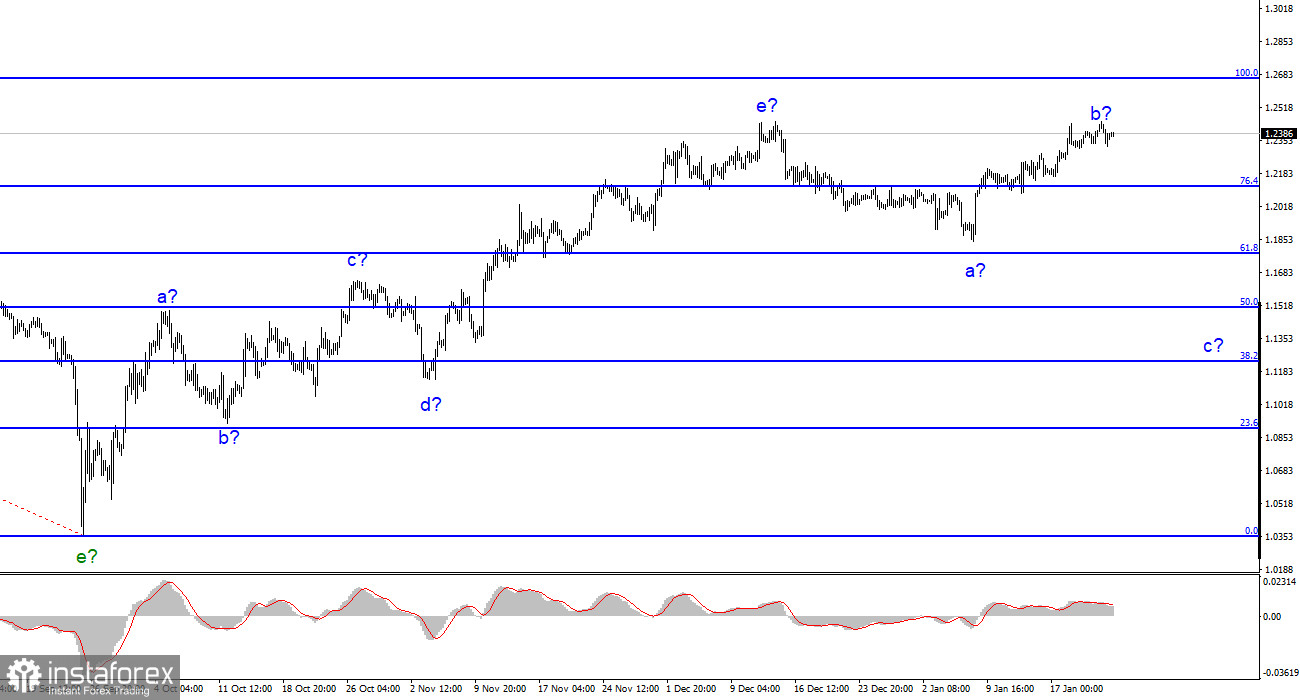

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound has a significant tendency to rise.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română