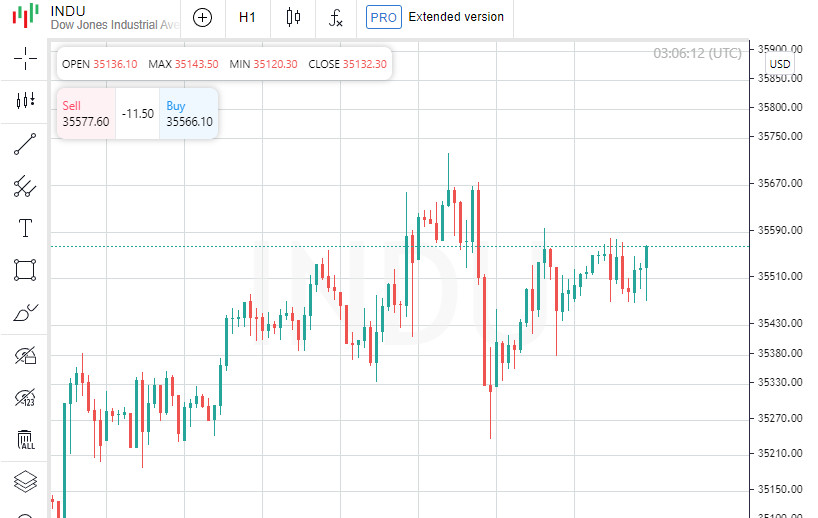

American stocks are on the rise: the Dow Jones Industrial Index (.DJI) added a fresh 0.28% and stands at a height of 35,560.19, S&P 500 (.SPX) extended its positions by 0.15% to 4,589.15, and Nasdaq Composite (.IXIC) proudly added 0.21% to 14,346.02. Real tech giants - Apple Inc (AAPL.O) and Amazon.com (AMZN.O) - are preparing to present their reports on Thursday. They are joined by such powerful players as Caterpillar Inc (CAT.N), Starbucks Corp (SBUX.O), and Advanced Micro Devices (AMD.O), whose results are also eagerly awaited. Meanwhile, in distant Europe, stocks are gaining momentum, even after inflation in the eurozone continues to decline in July. Most indicators of core price growth are also decreasing, which markets perceive as an encouraging signal for the European Central Bank (ECB), developing a strategy to end the endless cycle of interest rate hikes. The pan-European index STOXX 600 (.STOXX) marked its second consecutive month of growth at 0.12%. The MSCI World Equity Index (.MIWD00000PUS) also added 0.15%.

Modest progress against the backdrop of China's manufacturing activity falling for the fourth consecutive time in July. Domestic and foreign demand continues to remain low, as indicated by official surveys published on Monday. "Markets have become much more sensitive to information, and people are closely analyzing new data," notes Florian Ielpo, Head of Macroeconomics at Lombard Odier Investment Managers. Important economic metrics that investors will be closely following this week include US ISM surveys for manufacturing and services, as well as the July wage report.

"Today's data is quite consistent with the 'soft landing' storyline," market strategists from Citi note in their latest review. "However, a possible return to employment growth, which easily beats expectations, may raise questions about the possibility of low inflation co-existing with a tight labor market."

All three key US indices recently rose as evidence of slowing inflation and economic stability eased investor fears about whether the economy could withstand high rates over a longer period. At the same time, lively earnings reports from such large-cap giants as Alphabet (GOOGL.O) and Meta Platforms (META.O), as well as from chipmakers Intel (INTC.O) and Lam Research (LRCX.O), stoked investor enthusiasm. Approximately 30% of the companies in the S&P 500 reported their results this week. Overall, the index has seen nearly a 20% rise over the year. However, Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute, calls for prudence, warning of the potential for slower economic growth, lower inflation, and reduced corporate earnings.

"This year brought a stunning stock rally, which was supported not so much by profit growth or improved economic indicators as by a general emotional uplift, not providing a real basis for current market multipliers and evaluations," Christopher noted in his memo.

Chicago Federal Reserve Bank President Osten Gulsby expressed confidence on Monday that the US central bank is "successfully navigating a fine line," trying to reduce inflation without risking a recession. He emphasized that the bank will closely monitor economic data as September approaches to decide on the advisability of further tightening of monetary policy. At the same time, the Bank of England is expected to make at least a quarter-point rate hike. Traders are cutting bets on the continued rise of the British pound, reaching the highest level since mid-June in anticipation of the Bank of England's interest rate decision, which is expected on Thursday. The British pound is confidently moving upwards, showing a 24% increase from a record low of $1.033 in September after a devastating budget, and reached a 15-month peak of $1.314 in mid-July.

The US dollar rose on Monday when a Federal Reserve survey showed that US banks reported tighter credit policies and lower demand for loans in the second quarter, indicating that interest rate hikes are beginning to affect the economy.

The Japanese yen weakened by about 0.8% against the dollar as investors continued to assess the Bank of Japan's decision made on Friday to abandon bond yield constraints, a departure from previous ultra-loose monetary policy. The yield on 10-year Japanese bonds rose to a 9-year high of 0.6% on Monday, approaching a new threshold value of 1.0%. At the same time, the yield on US Treasury bonds slightly declined as investors await new employment data to assess the impact of the Federal Reserve's monetary policy tightening campaign on the economy. The 10-year US bonds decreased by 1 basis point to 3.961%.

In the commodities sector, gold prices rose, making the past month the best in the last four years. This happened due to a weakening dollar and expectations that major global central banks may be approaching the peak of the interest rate hiking process. The price of spot gold increased by 0.3% to $1965 per ounce.

Oil prices rose to a new three-month high, showing the most significant monthly increase since January 2022. This happened due to signs of a reduction in global supply and an increase in demand expected by the end of the year. US West Texas Intermediate (WTI) oil increased by 1.63% to $81.89 per barrel, and Brent crude oil rose by 0.67% to trade at $85.56 per barrel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română