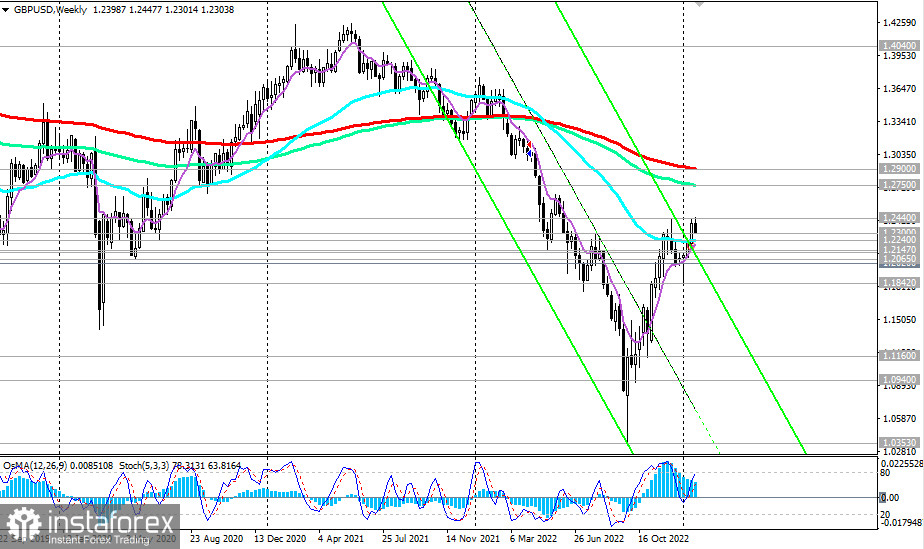

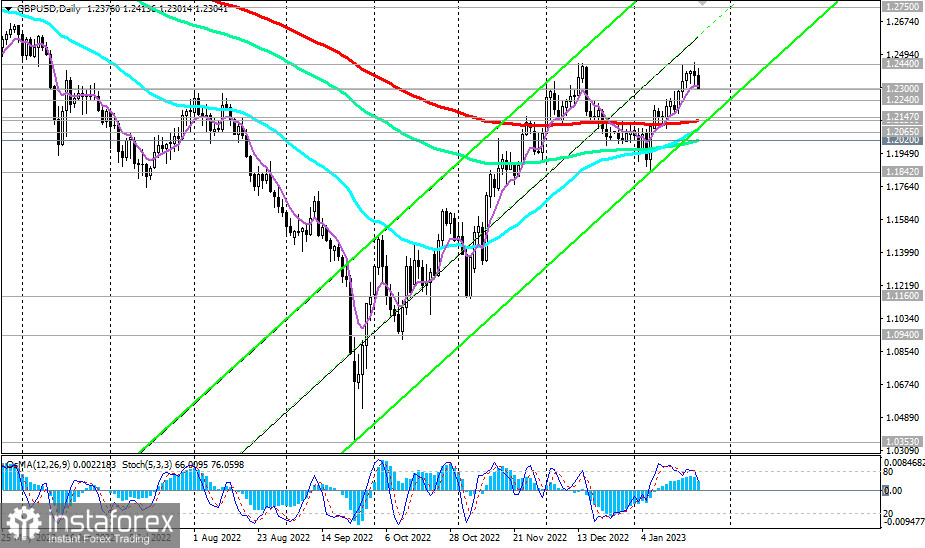

Against the background of the weakness of the U.S. dollar, the GBP/USD pair managed to correct into the medium-term bull market zone, rising above 1.2130, 1.2240, through which important support levels pass: 200 EMA on the daily chart and 200 EMA on the weekly chart.

Despite the corrective growth (since the end of September, when the Bank of England unexpectedly intervened in the government bond market) below the key resistance levels 1.2750 (144 EMA on the weekly chart) and 1.2900 (200 EMA on the weekly chart), the long-term and global downward trend of the pair remains, making short positions preferable.

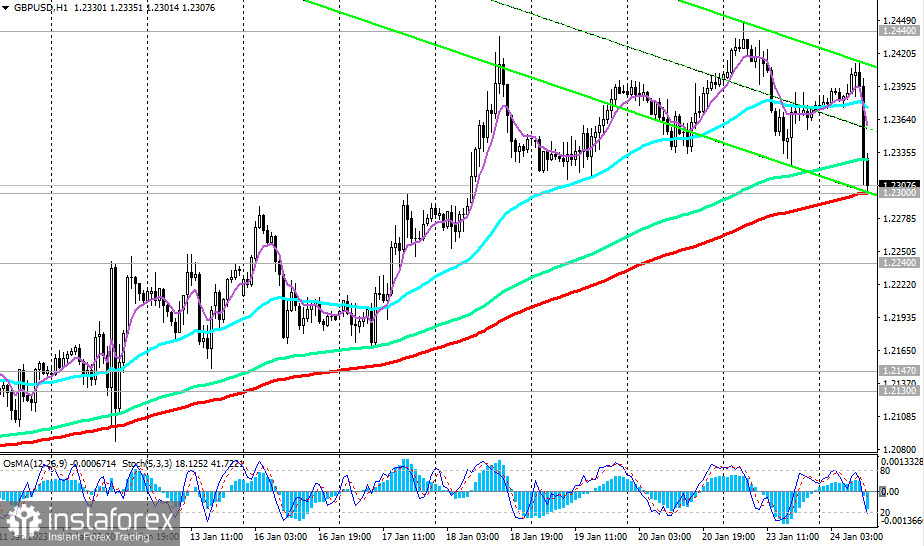

A consecutive breakdown of the support levels 1.2130, 1.2065 (144 EMA and the lower limit of the upward channel on the daily chart), 1.2020 (50 EMA on the daily chart) will return GBP/USD to the long-term bear market zone, sending it towards the September lows near the 1.0400 mark. The first signal to build up short positions may be a breakdown of the important short-term support level 1.2300 (200 EMA on the 1-hour chart).

In an alternative scenario, GBP/USD will continue to rise towards the key resistance levels 1.2750, 1.2900. The signal for the resumption of long positions will be the breakdown of today's high at 1.2413 and the local resistance level (and this month's high) at 1.2440.

Support levels: 1.2300, 1.2240, 1.2147, 1.2130, 1.2065, 1.2020, 1.2100, 1.2000, 1.1160, 1.0940

Resistance levels: 1.2410, 1.2440, 1.2500, 1.2750, 1.2800, 1.2900

Trading scenarios

Sell Stop 1.2285. Stop-Loss 1.2375. Take-Profit 1.2240, 1.2147, 1.2130, 1.2065, 1.2020, 1.2100, 1.2000, 1.1160, 1.0940

Buy Stop 1.2375.Stop-Loss 1.2285. Take-Profit 1.2400, 1.2440, 1.2500, 1.2750, 1.2800, 1.2900

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română