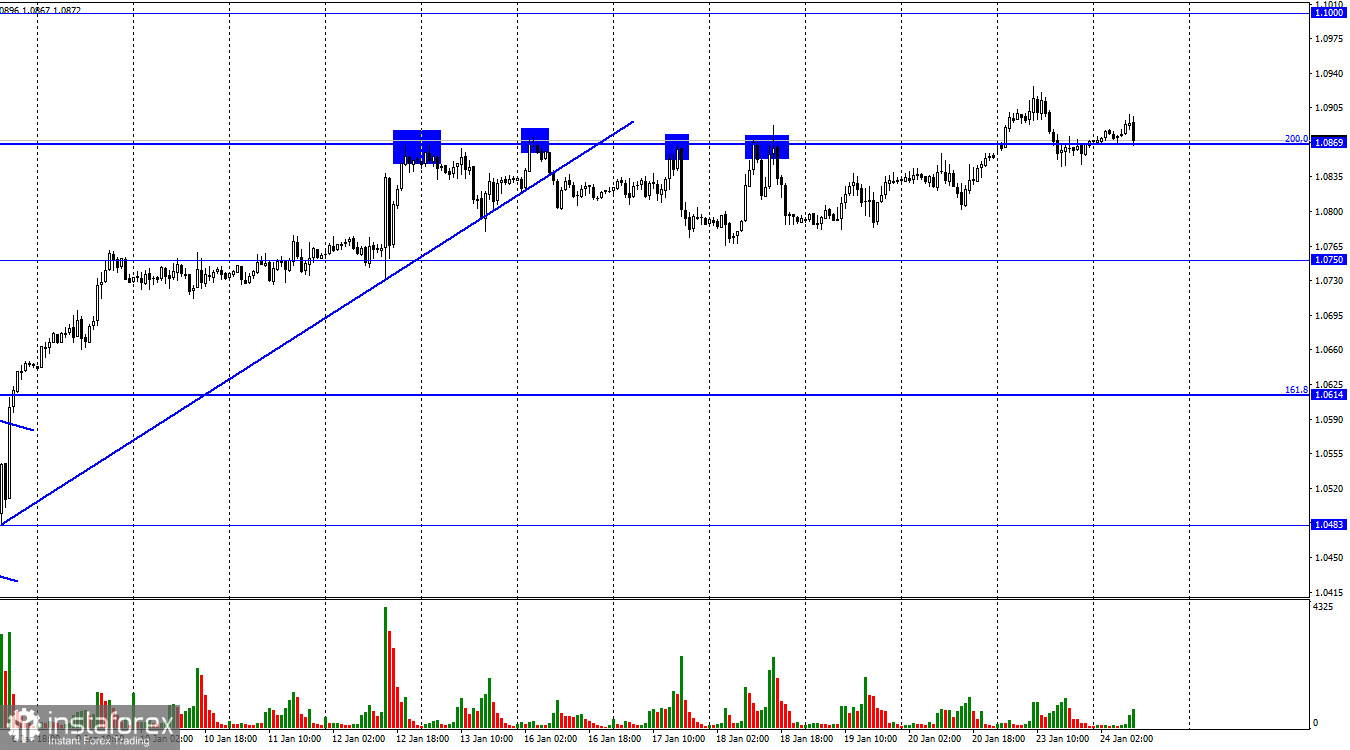

Hello, dear traders! On Monday, the EUR/USD pair consolidated above 1.0869, the Fibonacci correction level of 200.0%. Thus, there is a likelihood that the pair may extend gains to the next level of 1.1000, which comes as no surprise. ECB President Christine Lagarde has repeatedly noted that inflation could start rising again, so the Fed should continue to lift interest rates. Of course, such comments make bulls keep buying the euro. In my view, Lagarde's rhetoric is logical. However, it seems that traders are putting too much emphasis on it. In other words, Lagarde has said nothing new over the past week. Economists realize that inflation has begun to decline not only thanks to the ECB's interest rate hikes. The main factor contributing to its cooling is a decline in oil and gas prices.

Thus, Lagarde's concerns are justified along with the ECB's commitment to keep monetary policy tight. Inflation may indeed stop cooling. In this case, the regulator will need to stick to its aggressive rate hike path. At the same time, this is also a problem for the Fed as rising energy prices will drive inflation higher in the United States. It turns out that both central banks may face the need to raise interest rates for a longer period. In the case of the Fed, the size of increases may be lower since the rate has already been lifted to 4.5%, while the EU regulator has raised it to only 2.5%. In my opinion, this could lead to a protracted rally in the foreign exchange market.

On the 4-hour chart, the EUR/USD pair turned around towards the upside and headed for the correction level of 50.0% - 1.0941. If the quotes bounce off this level, the US currency will gain value, moving towards the Fibo level of 38.2% - 1.0610. In the meantime, the ascending trend channel indicates that market sentiment is bullish. I think that the euro will hardly post strong losses and fix below the channel before the market closes. At the same time, bearish divergence at the CCI indicator suggests a slight decline within the coming days.

Commitments of Traders (COT) report:

Last week, speculators closed 10,344 long contracts and opened 2,346 short contracts. The sentiment of major traders remains bullish but has eased a bit. The total number of long contracts is currently 228,000, and short contracts - 101,000. The European currency continues to trade upwards, in line with COT reports. At the same time, the number of long positions is almost two and a half times higher than that of short ones. Over the past few months, the euro has been on the rise, having great upside potential. However, fundamental factors do not always support it. The situation is becoming increasingly favorable for the euro after a prolonged downtrend. So its outlook remains positive at least as long as the ECB sticks to a 50-basis-point interest rate increase.

News calendar for US and EU:

EU - Manufacturing PMI

EU - Markit Composite PMI Output Index

EU - Service PMI

EU – ECB President Christine Lagarde's speech

US - Manufacturing PMI

US - Markit Composite PMI Output Index

US - Services PMI

On January 24, the macroeconomic calendar is full of important releases from both the European Union and the United States, including data on business activity and another speech by Christine Lagarde. The impact of fundamental factors on the mood of traders is likely to be medium today.

EUR/USD forecast and trading tips:

If the price closes below 1.0869 on the hourly chart, it will be possible to go short with a view to reaching the target levels of 1.0750 and 1.0614. Short positions can also be considered on a rebound at the level of 1.0941 on the 4-hour chart. Long positions will be relevant if the price closes above the 1.0869 mark on the 1-hour chart. In this case, the levels of 1.0941 and 1.1000 can be seen as targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română