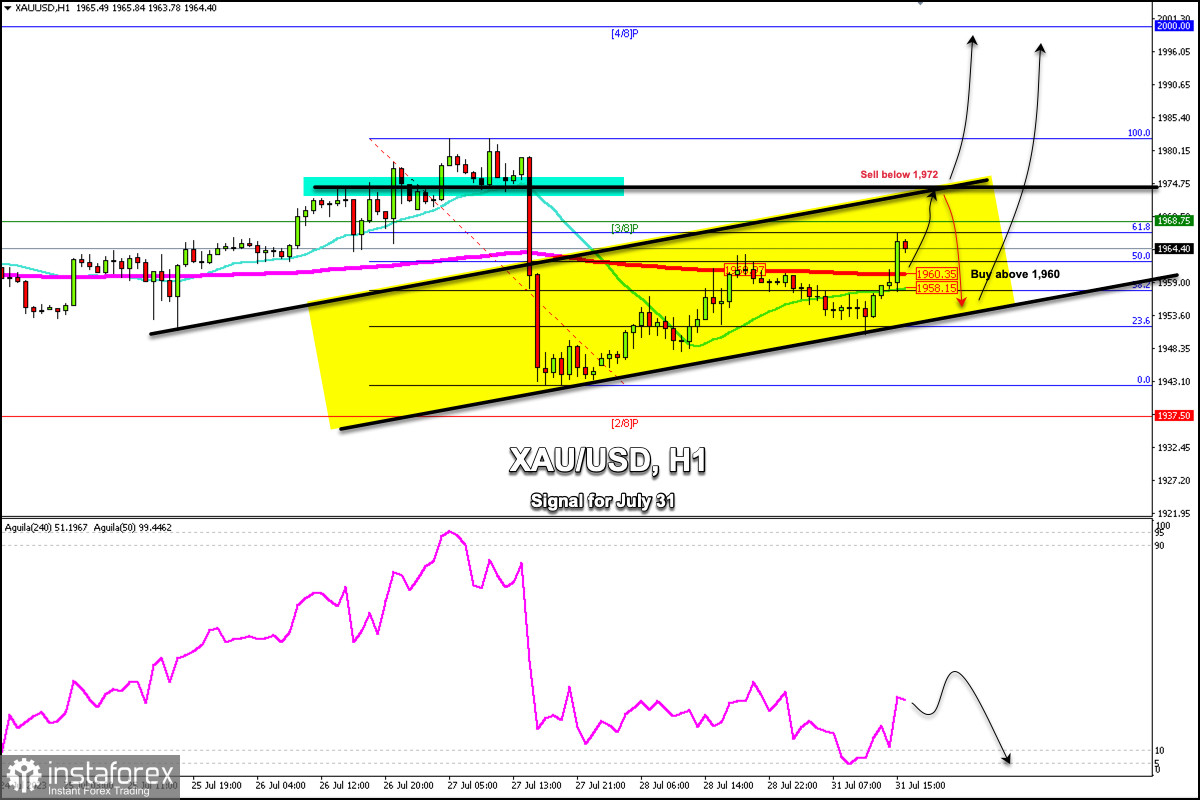

Early in the American session, gold (XAU/USD) is trading at 1,964.40, above the 200 EMA, and above the 21 SMA. The instrument has been extending the uptrend since July 27.

According to the 1-hour chart, we can see that gold is moving within an uptrend channel and it could reach the top of the trend channel around 1,972, a level that coincides with strong weekly resistance. In case the metal fails to break above it, we could expect a technical correction and it could fall towards the 200 EMA located at 1,960 and even towards the bottom of the uptrend channel around 1,955.

If the bullish force prevails and gold consolidates above 1,972, we could expect it to reach the high of July 27, around 1,984 and even reach the psychological level of $2,000.

For the trend to resume and remain bearish, we should expect a daily close below the 23.6% Fibonacci level. If this scenario occurs, it is expected that there will be a continuation of the downward movement and the price could reach 2/8 Murray at 1,937 and finally, it could slip to 1/8 Murray at 1,906.

In the next few hours, we can buy above 1,960 with targets at around 1,972 or we could sell below 1,972 with targets at about 1,955. We expect this to be the price range for the next few days.

On July 31, the Eagle indicator reached the extremely oversold zone on the H-1 chart. So, the instrument is expected to continue rising in the next few hours until it reaches 1,972 and 1,984. From there, we could expect a technical correction which means selling.

In the medium term, as long as it remains below 4/8 Murray located at $2,000, any movement towards this area will be seen as a signal to sell up to 1,863, the level where it left a gap in February that still needs to be covered.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română