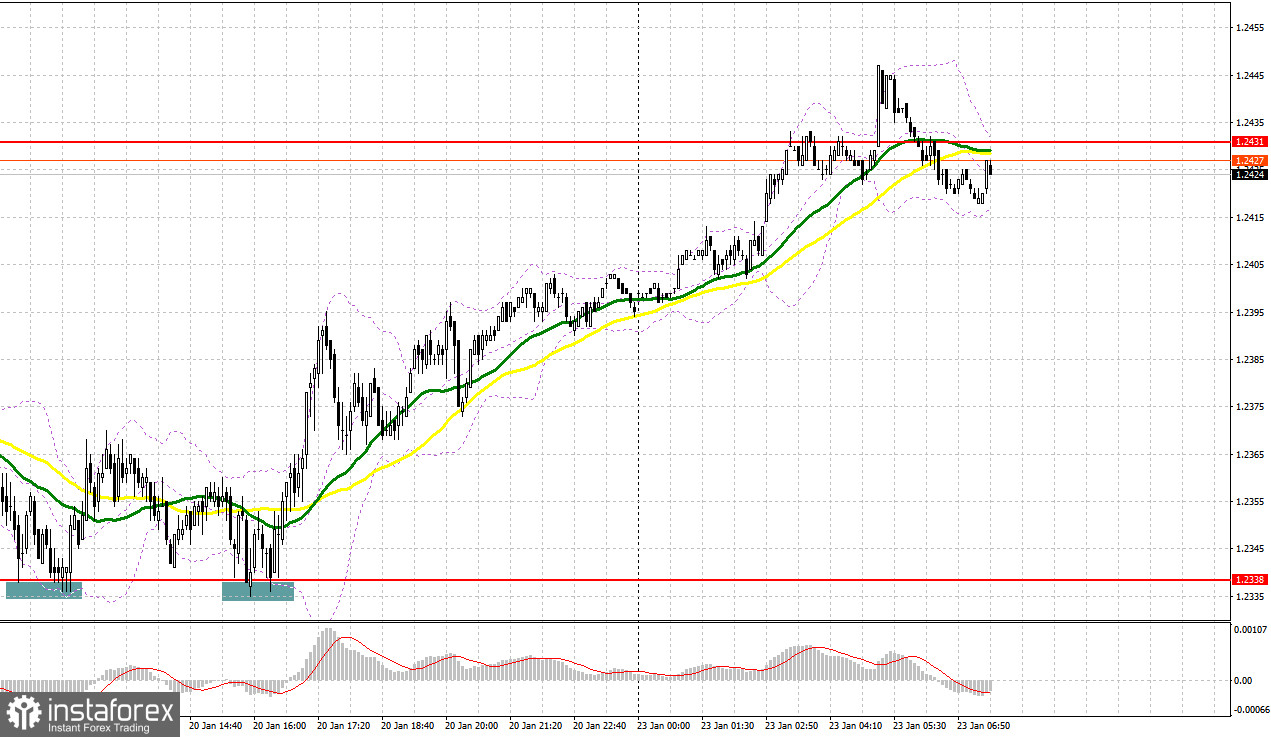

A few entry signals were generated on Friday. Let's take a look at the M5 chart to get a picture of what happened. A fall and a false breakout through 1.2338 generated a buy signal. The pair grew by 30 pips. In the North American session, the bears unsuccessfully attempted to break below 1.2338. Another buy entry point was created and the quote advanced by more than 60 pips.

When to open long positions on GBP/USD:

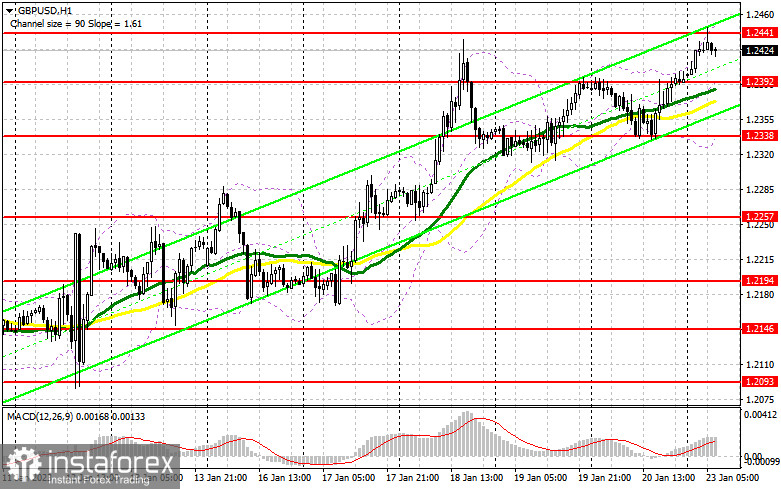

Today, no macro releases are scheduled in the UK. Therefore, after updating the monthly high in the Asian session, the bullish pressure is likely to decrease. That is why long positions should be considered if the pair goes down. After a false breakout through new support at 1.2302, in line with the bullish average moving averages, the price may return to 1.2441, a new monthly high. If the quote consolidates there, I will bet on a surge to a high of 1.2499. Meanwhile, a breakout through 1.2499 along with a downside retest may result in growth to 1.2553 where it is wiser to lock in profit. If the bulls lose control over the 1.2392 mark, which is highly likely, pressure on the GBP/USD will increase and a bearish correction will occur. In such a case, long positions could be opened after a fall and a false breakout through 1.2338. It will also become possible to buy GBP/USD on a rebound from 1.2257, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

If the bears settle below 1.2392, it will fuel pressure on the pair. In addition, they should protect the new monthly high. A surge and a false breakout through 1.2441 will generate a sell signal with a target at 1.2392, in line with the bullish average moving averages. A breakout and a retest of this mark to the upside will create a sell entry point with the target at 1.2338. If the quote then tests the mark, the pair will get stuck in a sideways channel. The most distant target stands at 1.2257 where it is wiser to lock in profits. In case of growth in GBP/USD and the absence of the bears at 1.2441, we will see a bullish continuation. A sell entry point will form after a false breakout through the high of 1.2499. If there is no trading activity at the level, GBP/USD could be sold on a rebound from the high of 1.2553, allowing a bearish correction of 30 to 35 pips intraday.

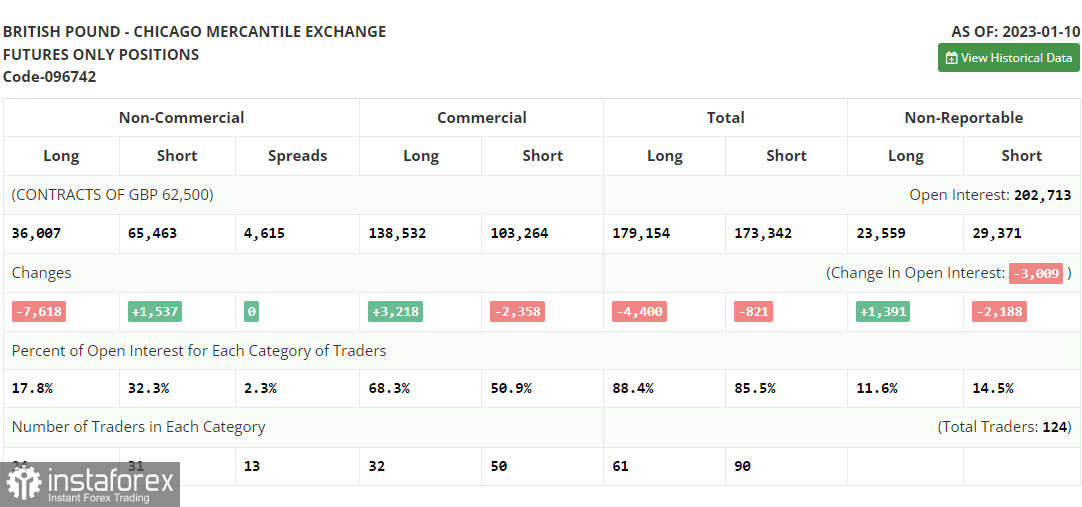

Commitments of Traders:

The COT report for January 10 logged a rise in short positions and a steep fall in long ones. However, this report does not take into account the latest US inflation data, released on Thursday. Therefore, the actual situation might be different. Demand for risk assets, including the sterling, was fuelled by a slowdown in US inflation. Traders should keep an eye on speeches from the BoE and Fed officials as they may hint at the steps the regulators might take in the future. According to the latest COT report, short non-commercial positions increased by 1,537 to 65,463. Long non-commercial positions plunged by 7,618 to 36,007. Consequently, the non-commercial net position came in at -29,456 versus -20,301 a week ago, marking the third weekly expansion of the negative delta. This may indicate that large traders no longer believe in the pair's growth. Therefore, they are on a selling spree. Traders should be extra careful at the current highs. The weekly closing price of GBP/USD increased to 1.2182 from 1.2004.

Indicator signals:

Moving averages

Trading is carried out slightly above the 30-day and 50-day moving averages, indicating an uptrend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.2441, in line with the upper band. Support stands at 1.2338, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română