Expectations of a pause on Fed rate hikes are growing even though recent statements from officials point to the need for further aggressive monetary policy. The main reason is the falling inflation data in the US, which could prompt a soft landing of the national economy rather than a hard entry into recession.

However, US stocks are down because some investors already made active purchases earlier. In the past, it was common for indices like the S&P 500 to hit a bottom when the economic crisis was in full swing, but this is no longer the case. Market players seem to be relying more on official statistics instead of what US statistical offices are saying.

Of course, there is a chance for US stocks to rally this week as ahead is the final monetary policy decision of the Bank of Canada. Forecasts say it will present another 0.25% rate hike, which could start a bull market. Accordingly, Treasury yields will fall, accompanied by a decrease in dollar.

Forecasts for today:

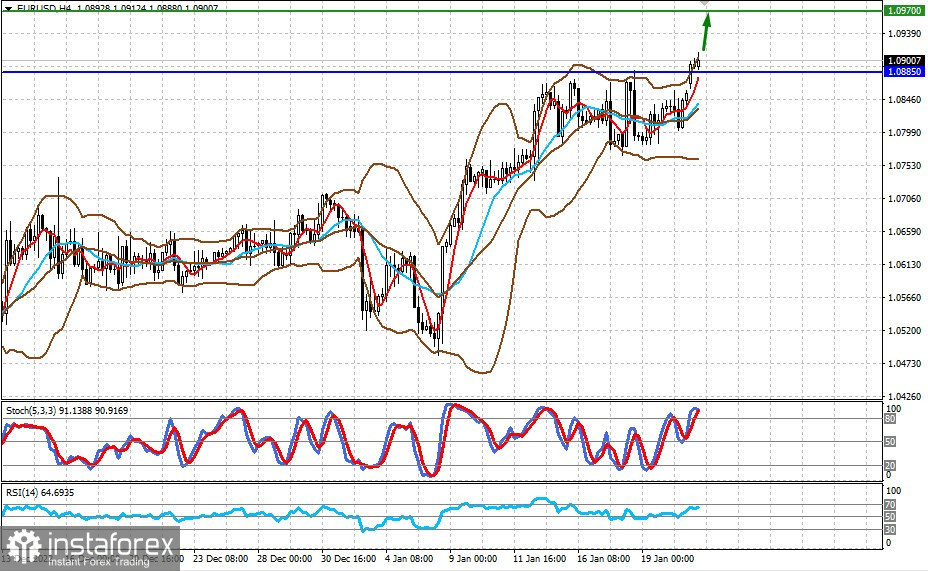

EUR/USD

The pair is trading above 1.0885. Growing positive sentiment in markets due to the expectation of a pause in the Fed's rate hike could push the pair towards 1.0970.

WTI

US oil is trading at 82.10. A break above this level is likely to prompt a rise to 83.00 and 84.45.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română