The ECB intends to stick to the current course, and Christine Lagarde sincerely hopes that fiscal policy will not cross the path of monetary policy in 2023. There is no need to test the European Central Bank for decisiveness—it will go all the way in the fight against inflation. However, there are many obstacles on the road that could undermine investors' confidence in the EURUSD rally. The main currency pair closes the week with caution amid partial profit-taking by speculators.

If no one doubts the hawkish ECB these days, then the eurozone stock and bond markets are capable of delivering surprises. The EuroStoxx 600 might lose some steam after its 7% gain in January, which is a strong bid for the best start of the year in history. According to the consensus forecast of Bloomberg experts, the stock index will end 2023 slightly below current levels. Aggressive monetary restrictions and the weakness of the eurozone economy will reflect badly on the stock market. Bank of America expects it to fall 20% to 365 by the middle of the year, with a subsequent recovery to 430.

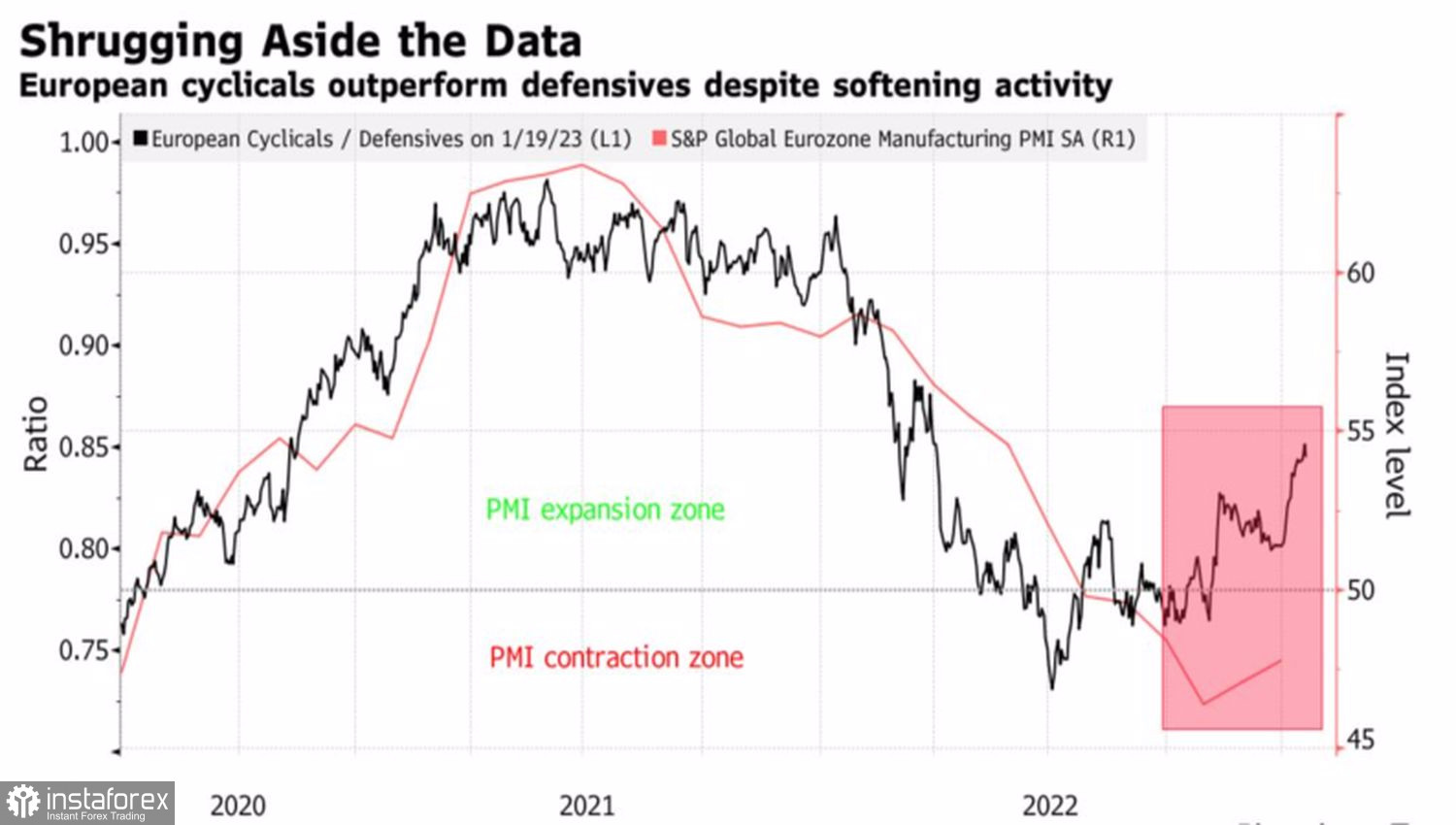

Dynamics of EuroStoxx 600 and European business activity

Note that the EuroStoxx 600 gained 19% from the September bottom, outperforming the S&P 500 by 11 percentage points in local currencies. The flow of capital from North America to Europe has become one of the key drivers of the EURUSD rally. If the process goes back, we expect a correction.

In my opinion, Bloomberg experts decided to play it safe. It is doubtful to expect weakness from an economy that never ceases to pleasantly surprise everyone, including the ECB. In this regard, strong statistics on European business activity for January can become a catalyst for a rally not only in the stock indices of the eurozone, but also in EURUSD.

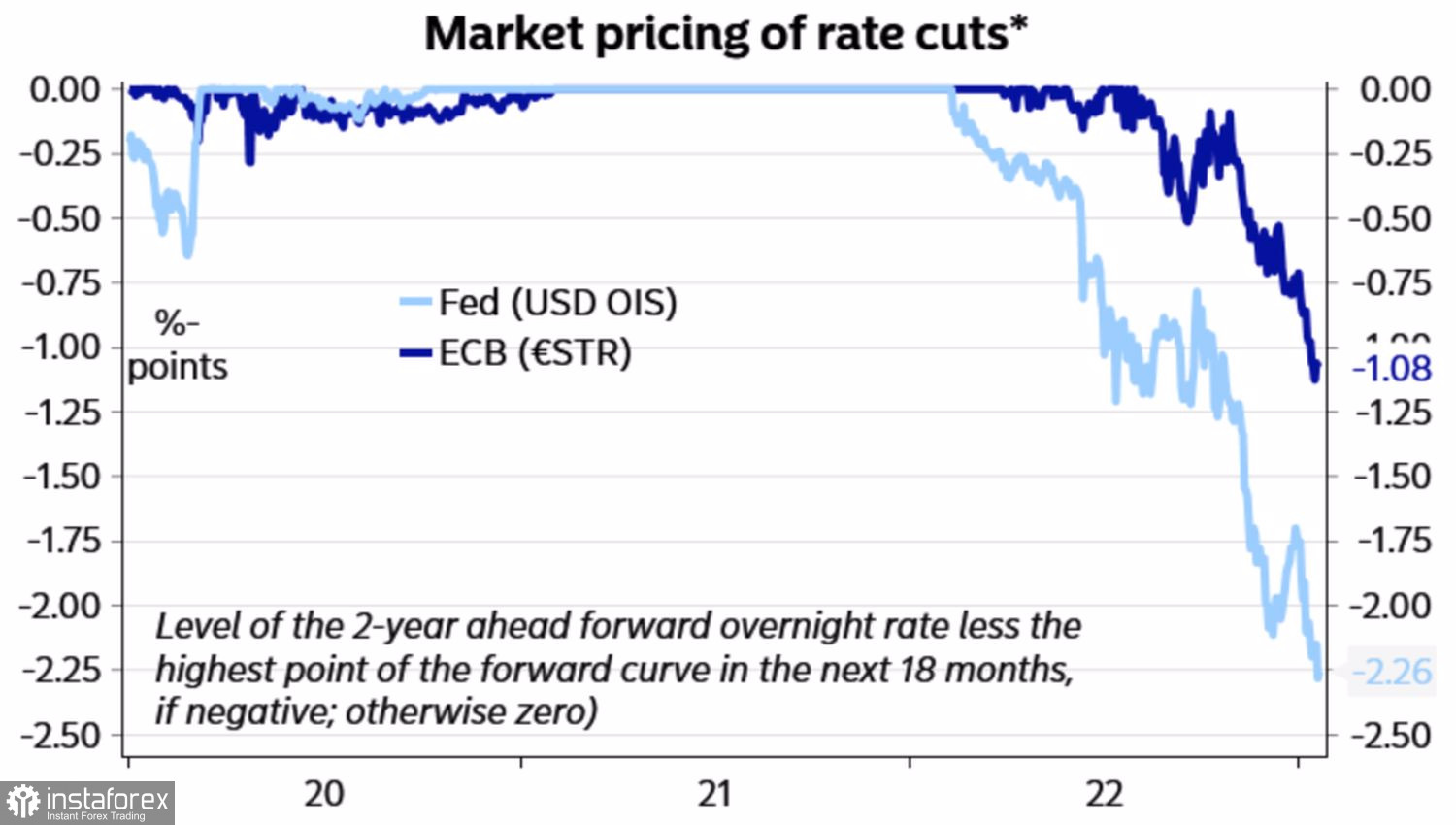

The rates of the futures market on reducing the ECB borrowing costs in 2023 look rather doubtful. The European Central Bank started tightening monetary policy later than the Fed and will finish the cycle also later than its American counterpart. The determination of Lagarde and her team to turn the back of inflation is visible to the naked eye, so it is unlikely to expect a "dovish" reversal from the regulator this year.

Dynamics of expectations of ECB and Fed rate cuts

Another thing is that too rapid growth in eurozone bond yields can badly affect weak economies, specially Italy. The growth of interest rate spreads can force the ECB to launch a protection program, which will be regarded as a deterrent for further tightening of monetary policy and provoke a EURUSD correction. However, it's too early to talk about it. Everything will depend on the events taking place and the incoming data.

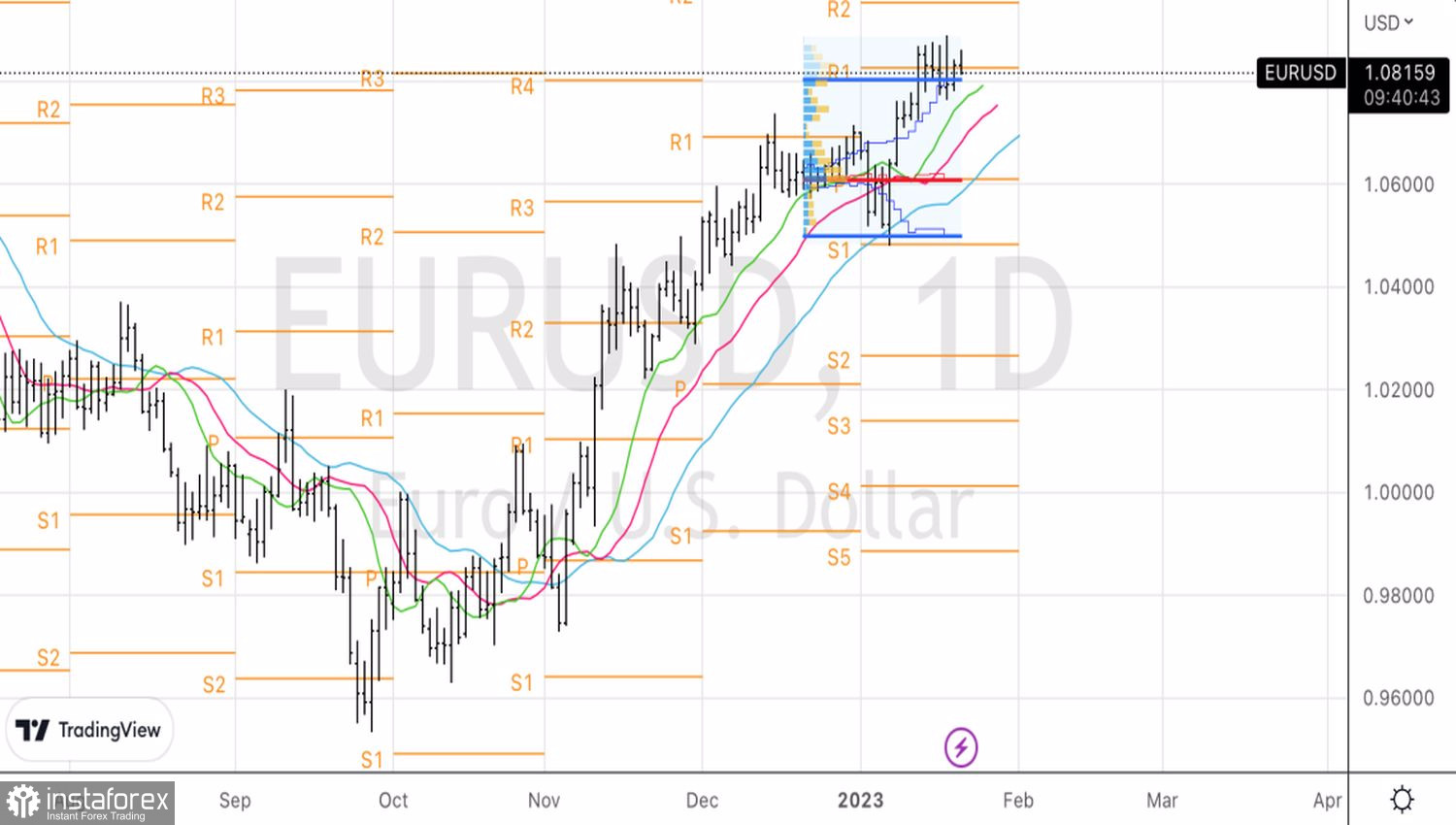

Technically, the tug of war continues on the EURUSD daily chart near the 1.083 pivot point, which translates into a short-term consolidation. The unsuccessful attempt of the bulls to win back the inner bar should not be misleading. On the contrary, the return of the pair above 1.0865 can inspire buyers for a new attack.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română