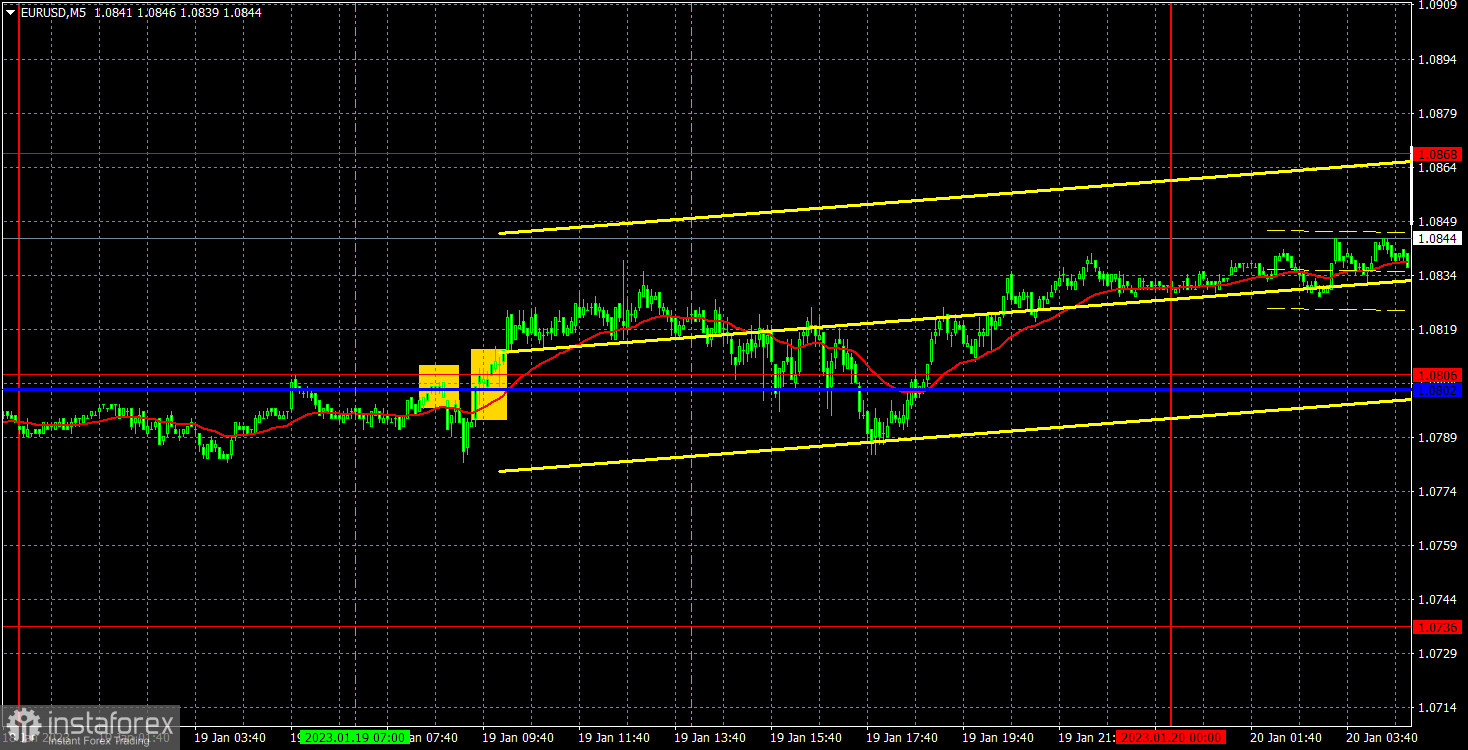

EUR/USD 5M analysis.

On the fourth trading day of the week, the EUR/USD currency pair failed to initiate a correction once more. Since there has been a total flat in the region of 1.0780 to 1.0868 for the past five days, the quotes have been mostly drifting sideways all day. On Thursday, there were no significant publications or events, so traders were unable to find any justification for engaging in active trading. Christine Lagarde spoke at the World Economic Forum in Davos and reaffirmed the ECB's willingness to keep hiking the key rate, but the market was already fully aware of this information before her remarks. Furthermore, we think that the euro's recent gains, possibly even months' worth of growth, are directly related to the prospect of future ECB rate hikes and the impending rejection of the Fed's rate hike. As a result, we think Lagarde hasn't provided the market with any new information.

Several trade signals emerged yesterday, however, they were all centered around the price range of 1.0806 to 1.0802. The pricing was never able to determine the closest goal level because there was essentially no movement. All of the signals were therefore erroneous. Only the first two of them could be figured out by traders. The pair were fastened below the designated area first, and then above. The purchase transaction was completed at a stop loss at breakeven in the second example since it could move 15 points in the right direction in the first. Consequently, traders suffered a slight loss. However, false signals are often formed in the flat, so nothing terrible happened.

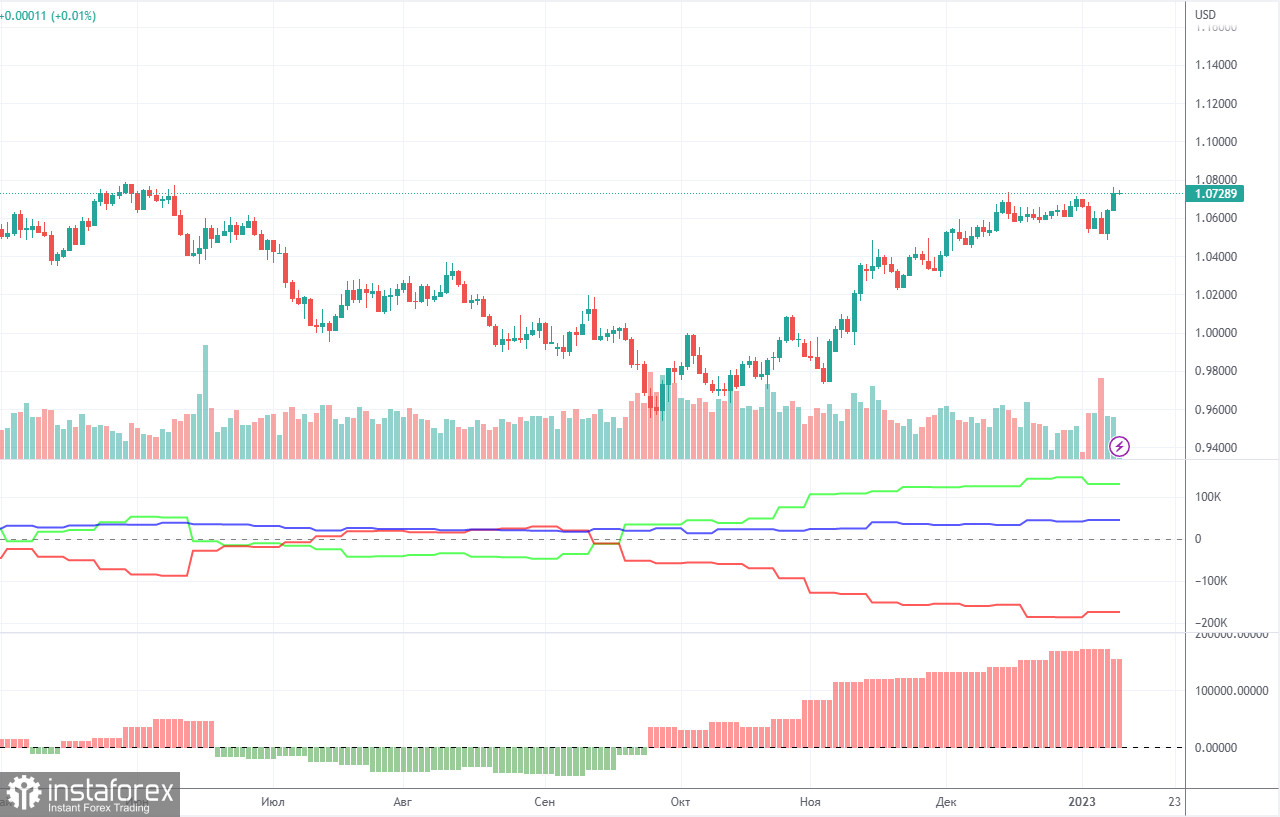

COT Report

The recent COT reports on the euro currency are entirely consistent with market activity. The aforementioned image makes it very evident that, from the start of September, the net position of significant players (the second indicator) has been improving. At about the same time, the value of the euro started to increase. Although the net position of non-commercial traders is currently "bullish" and growing virtually weekly, it is the relatively high value of the "net position" that now permits the upward trend's impending end. This is indicated by the first indicator, which frequently occurs before the end of a trend and on which the red and green lines are quite far apart. The number of buy contracts from the "non-commercial" group increased by 16,000 during the reporting week, while the number of short positions decreased by 11,000. The net position consequently increased by 5,000 contracts. For non-commercial traders, there are currently 135 thousand more buy contracts than sell contracts. What remains to be seen is how much longer the major players will boost their long positions. Moreover, a downward correction should have started long ago from a technical perspective. We think this process can't go on for another two or three months. You need to "discharge" a bit, or alter, even based on the net position indicator. Sales are 48 thousand more if you look at the overall indicators of open longs and shorts for all trading categories (702 vs. 655k).

EUR/USD 1H analysis.

The pair has been trending sideways for a week on the hourly timescale, albeit maintaining an upward mood. The euro currency is currently moving in the manner of bitcoin, which has been quite fond of sliding down during the past year, then going flat for a few weeks or months. However, the downward correction has not yet started. We corrected the Ichimoku indicator's last digestible value and did not transfer the weak Ichimoku indicator lines to the flat's end. We reserve the following levels for trade on Friday: the Senkou Span B (1.0679) and Kijun-sen (1.0802) lines, as well as the range of prices between 1.0658 and 1.0669, 1.0736, 1.0806, 1.0868, 1.0938, 1.1036, and 1.1137. The Ichimoku indicator's lines might move during the day, therefore, this should be considered when choosing trade signals. Additional support and resistance levels exist as well, but no signals are created close to them. Levels, extremes, and lines can be "bounced" and "overcome" by signals. Remember to place a break-even stop-loss order if the price moves up or down by 15 points. If the signal turns out to be bogus, this will shield against potential losses. Christine Lagarde will give another speech in the European Union on January 20, but the market indicated yesterday that it was not very interested in what she had to say. Furthermore, Lagarde herself didn't offer anything essentially novel. In the United States, nothing noteworthy will happen today.

Explanations for the illustrations:

Price levels of support and resistance (resistance/support) are thick red lines, near which the movement may end. They are not sources of trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, transferred to the hourly timeframe from the 4-hour one. Are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They are sources of trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română