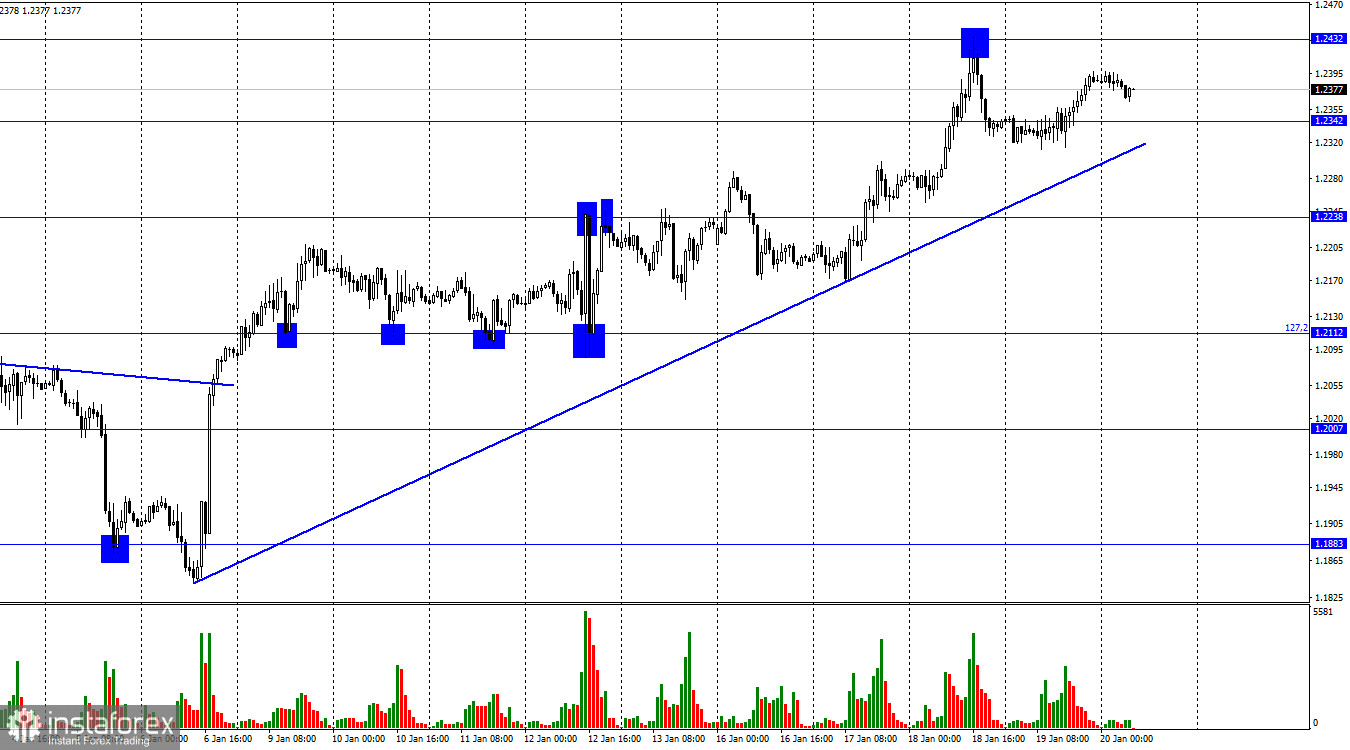

On Thursday, the GBP/USD pair reversed in the British favor and increased in the direction of the level of 1.2432, according to the hourly chart. Bullish traders were unable to move the pair to this level this time, but they did manage to keep it above the rising trend line. Therefore, I do not anticipate a significant decline in the British pound until the quotes are fixed below the trend line.

The most recent UK news was incredibly conflicting. Naturally, inflation statistics, which have indicated a minor drop over the past two months, are of the utmost importance to traders right now. However, this drop is insufficient to suggest a genuine reversal of the decreasing trend. The unemployment and wage numbers, however, surprised traders because the first indication remained at its lowest value and the second increased more than they had anticipated. However, I should point out that the Bank of England views wage growth as a risky element that could re-increase inflation. It turns out to be a paradox: salaries are increasing faster than anticipated while inflation is growing slower (which is harmful to the British populace); the Bank of England views practically any wage growth as a negative development; and the UK government boosts taxes.

Although there are ongoing market speculations that the regulator will stop tightening the PEPP in 2023, traders continue to view all the data acquired as favorable for the British. It is advantageous if this occurs at a rate of roughly 5% (the "golden mean") because this amount may be sufficient to significantly lower the consumer price index. Inflation will remain high for a very long period if the stop is much earlier, and the British pound will lose its main source of strength. I believe that the British pound will soon be unable to expand further. Soon, the central banks of the Fed and Bank of England will meet, and the second meeting could disappoint if the rate is only increased by 0.25% in February.

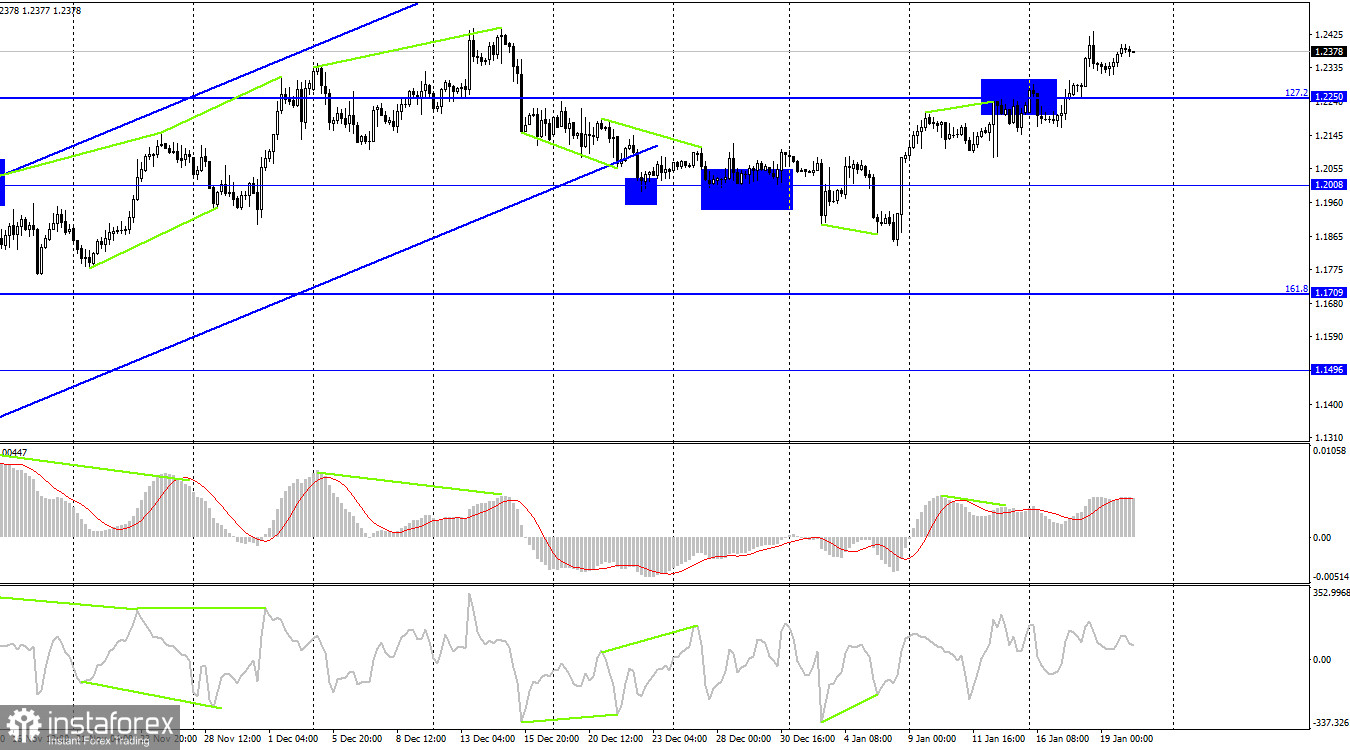

On the 4-hour chart, the pair has maintained above the corrective level of 127.2% (1.2250), which gives us confidence in additional gains to the next Fibo level of 100.0% (1.2674). The divergence that was "bearish" has been reversed. There are no new divergences in the making. Fixing the exchange rate for the pair at 1.2250 would tempt the market's bears back for a spell and let the dollar rise as high as 1.2008.

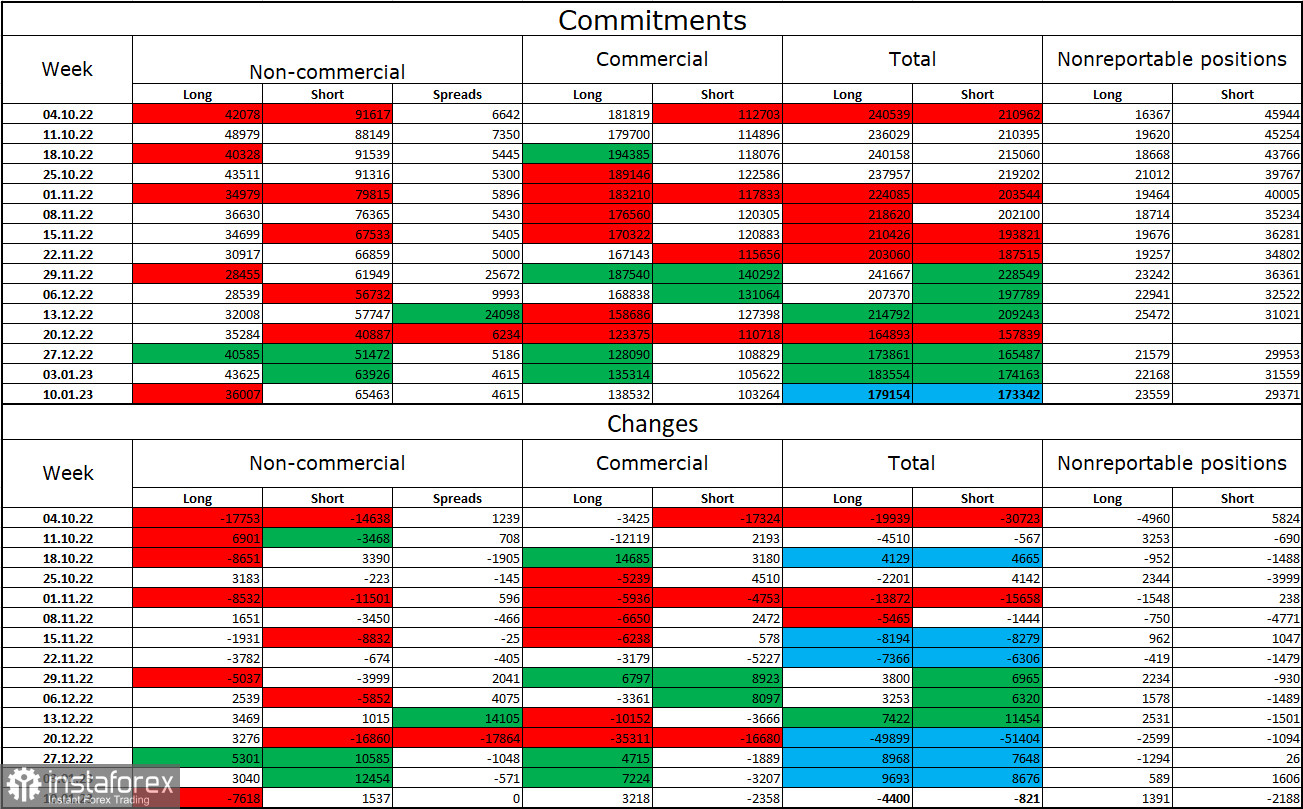

Report on Commitments of Traders (COT):

The sentiment among traders in the "non-commercial" category over the last week has shifted more "bearish" than it did the week before. Speculators' holdings of long contracts declined by 7618 units, while their holdings of short contracts grew by 1537. The big players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has been shifting in favor of the British pound over the past few months, but now the number of long and short in the hands of speculators has nearly doubled once more. As a result, in recent weeks, the outlook for the pound has once again declined. On the 4-hour chart, there was an escape beyond the three-month ascending corridor, and this development may prevent the pound from continuing its recent rise trajectory.

The UK and US news calendars are as follows:

Retail sales in the UK (07:00 UTC).

The calendars of economic events in the US and the UK only list one report for Friday. The impact of the background information on the traders' attitudes for the remainder of the day may be very minimal.

Forecast for GBP/USD and trading advice:

With goals of 1.2238 and 1.2112, sales of the pound are conceivable if quotes are fixed beneath the trend line on the hourly chart. On the hourly chart, I suggested buying with a target price of 1.2432 when the price closed above the level of 1.2342. This objective has been completed. When the price closes above 1.2342 with a target of 1.2432 or when it reverses from the trend line with the same objective, new purchases are available.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română