Traders of the EUR/USD pair are stuck in the quagmire of a sideways flat. Bulls cannot overcome the resistance level of 1.0880 (upper line of the indicator Bollinger Bands on the timeframe D1), bears, in turn, are unable to consolidate in the area of the 7th figure.

As a result, a price range was formed, within which the pair has been trading for the second week, alternately pushing away from its limits. Macro data, as well as comments of the Federal Reserve and European Central Bank representatives influence the price values, but upward/downward momentum flare up and fade within the price echelon. Market participants are locking in profits near the upper (or lower) limit of the range, thereby showing their indecisiveness.

Weak statistics from the U.S.

The latest macro data from the US were very negative for the greenback, as retail sales continued to fall in December, another sign that inflation is starting to ease in the country. The market reacted accordingly: the U.S. dollar index reached a 7-month low and EUR/USD almost hit a 9-month high and rose to 1.0889. It seemed that all the conditions for testing the 9th figure were created (at least in the context of the battle reconnaissance). But bulls didn't even try to approach 1.0900. By the end of Wednesday, they lost all gained points, ending the day at 1.0795. But again, traders also didn't linger within the 7th figure. Bulls were active on Thursday, although it is obvious that their potential to attack is very limited.

Circling back to Wednesday's reports, after their release, the CME FedWatch tool showed a 94% probability of a rate hike of 25 basis points in February.

The US Commerce Department said retail sales fell by 1.1 % in December (with a forecasted decrease of 0.8%). Excluding car sales, the figure was also in the red zone, at -1.1% (the forecast being -0.5%). According to Wells Fargo analysts, 10 of 13 retailers saw sales fall in December. They "expect a gradual spending slowdown, and on goods specifically, is underway as tighter financial conditions, a slowing labor market and low-confidence weigh on spending this year."

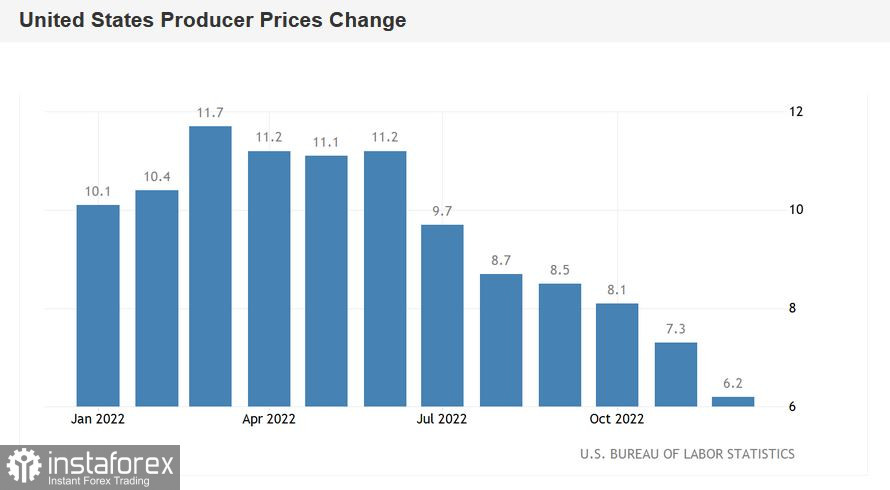

The Producer Price Index was released on Wednesday. As you know, it can be an early signal of a change in inflationary trends or a confirmation of them. In this case, the index served as confirmation of the already formed trend: all components of the release came out in the red zone.

Thus, the headline PPI rose 6.2% year over year in December. This is the weakest result since April 2021. The index has been falling for the sixth straight month. The Core PPI, excluding food and energy prices, was also in the red zone, falling to 5.5% year over year (the weakest result since May 2021). This component of the inflation report showed a downtrend for the ninth straight month.

Dollar bulls were also disappointed by another US report. It turned out that industrial production fell 0.7% in December. It was in negative territory (and in the red zone) for the second month in a row. December's decline in manufacturing is the worst since September 2021.

All these reports suggest that the market is quite right in assessing the likelihood of slowing down the interest rate hike to 25 points. But why can't bulls conquer the 9th figure and storm the 1.1000 mark?

The Fed has mixed all the cards

In my opinion, the whole point is in the conflicting statements of the Fed representatives. We can say that the market won back the slowdown in rate hikes, having risen to the price level of 1.0750(70) - 1.0880. Whereas, in order to develop an uptrend they would need more information drivers, related, for example, to the readiness of the Fed to revise the final rate of the current cycle downward. Another "information bomb" may be the news that the Fed is ready to consider among the possible scenarios the option of lowering the interest rate in the second half (or at the end) of the current year.

But, to the dismay of the bulls, Fed representatives either refuse to comment on such scenarios or refute them. For example, James Bullard, known for his hawkishness, said that he sees a rate hike to the range of 5.25%-5.50%, while adding that his colleagues should raise it to the final point "as soon as possible". Even Patrick Harker, who has publicly backed the idea of slowing the pace of monetary tightening to 25 points, said he sees "a few more increases" in borrowing costs before the subsequent pause. Dallas Fed Chair Lori Logan voiced a similar position. She advocated for slowing the pace of rate hikes but adds that if necessary, the Fed needs "to remain flexible and raise rates further if changes in the economic outlook or financial conditions call for it,". In turn, Kansas City Fed President Esther George supported Harker and Logan, noting that she was also ready to move in smaller steps. However, she stressed that rates would "have to move higher than many of her colleagues anticipate."

Findings

Take note that after the release of the latest US inflation report, not all representatives of the Fed have voiced their position. Therefore, it is impossible to make any final conclusions here. But if we proceed from the available information, we can conclude that the Fed is ready to reduce the rate hike, but not ready to revise downward the final point of the current cycle. There is no talk of a rate cut in 2023 at all.

That is why bulls do not dare to play against the dollar in excess of what is allowed, that is, they do not risk holding long positions when approaching the limits of the 9th figure. Given the current fundamental picture, we can assume that in the medium term, the pair will fluctuate within the price range of 1.0750-1.0890. Accordingly, it would be wise to consider short and long positions in the pair when the upward/downward momentum is fading in the area of the corresponding limits of the range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română