Key labor market and inflation data was released in the UK this week. As a result of these releases, the GBP/USD currency pair tried to develop an upward movement, rising to a four-week high at 1.2434. A month ago, in December 2022, buyers made a similar attempt to break through to the boundaries of the 25th figure. But when they reached the midpoint of the 24th price level, they were forced to retreat, succumbing to the onslaught of sellers. A similar situation is developing at the moment. Having reached a local peak, traders fixed their profit, thus extinguishing the upward impulse. Apparently, market participants are skeptical about further upward prospects of the British pound, although the GBP/USD pair rose by almost 600 points this year (2023 low was fixed at 1.1840, high at 1.2434).

Conflicting statistics

In general, GBP/USD traders reacted positively to the labor and inflation figures. But at the same time, the releases did not become a springboard for the development of the upward trend since the reports contained flaws that spoiled the overall fundamental picture. Based on the published figures, it is impossible to draw unambiguous conclusions regarding possible further actions of the Bank of England. While this issue is the most significant one for GBP/USD traders (along with the Fed's monetary policy outlook).

So, on the one hand, the unemployment rate in the UK remained at 3.7% (as in the previous reporting month). The level of average earnings also pleased, which increased by 6.4% (against the forecast of 6.2% growth). On the other hand, the growth rate of claims for unemployment benefits was disappointing, which rose by 19,000 (the highest growth rate since February 2021). This indicator has been growing for the second month in a row.

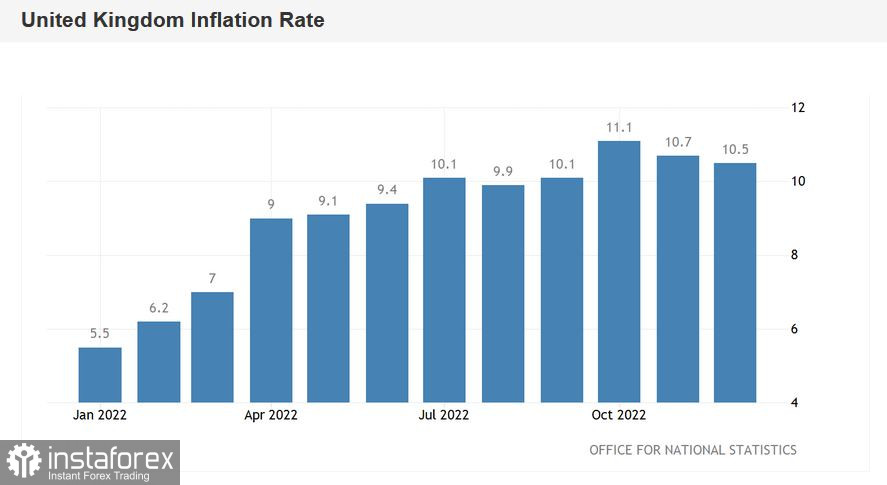

As for inflation, the overall consumer price index came out at 10.5%. Despite the fact that the indicator remains at an unacceptably high level (for the Bank of England), it is gradually decreasing for the second month in a row after reaching a peak of 11.1% (in October last year). The main consumer price index remained at 6.3% in December—the same level as in November. The peak values were reached in September and October (6.5%). Meanwhile, retail price index came out in the red at 13.4% YoY, while forecast was 13.9% YoY. There is also a two-month downward trend here.

Outlook

The market views the above reports through the prism of the December meeting of the Bank of England, of which the regulator voiced quite ambiguous message. On the one hand, the central bank has implemented the base case scenario, making a hawkish decision. The central bank increased the interest rate by 50 points and, at the same time, indicated the further course of rate hike. On the other hand, market participants are largely skeptical about the declared course of the central bank. According to a number of experts, the Bank of England will either slow down the pace of monetary policy tightening this year, or take a pause altogether.

BBH Global analysts said the probability of a 50-point rate hike at the end of the February meeting is 65%, while the probability of a 25-point hike is 35%. Accordingly, the experts do not consider the 75-point scenario to be a hypothetical one. Also, according to BBH currency strategists, the British regulator will complete the current cycle of monetary tightening at 4.5% (during fall, the upper bar was much higher, at 6.25%). According to some analysts, the final point will be even lower, at 4.25%.

The reports released this week did not tip the scale towards a more dovish or more hawkish scenario. On the one hand, British inflation is at a high level amid relatively good data in the labor market. On the other hand, the consumer price index and the retail price index are still consistently declining, allowing the British regulator to at least consider the option of slowing down the rate hike or even take a break. Recall that at the December meeting, two (out of 9) members of the Monetary Policy Committee voted against raising the rate. They advocated keeping it at the 3% level, as this, in their opinion, is "more than enough" to bring inflation back to the target level.

Conclusions

In my opinion, the GBP/USD currency pair will organize another upward rally in the medium term—not so much due to strengthening of the pound, but due to weakening of the U.S. dollar. But in order to develop a large-scale upward offensive, an additional information impulse from the Bank of England is needed. Until such support is absent, the "ceiling" of a possible rally is 1.2460, which is the bottom line of the Kumo cloud on the weekly chart, which coincides with the upper line of the Bollinger Bands indicator.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română