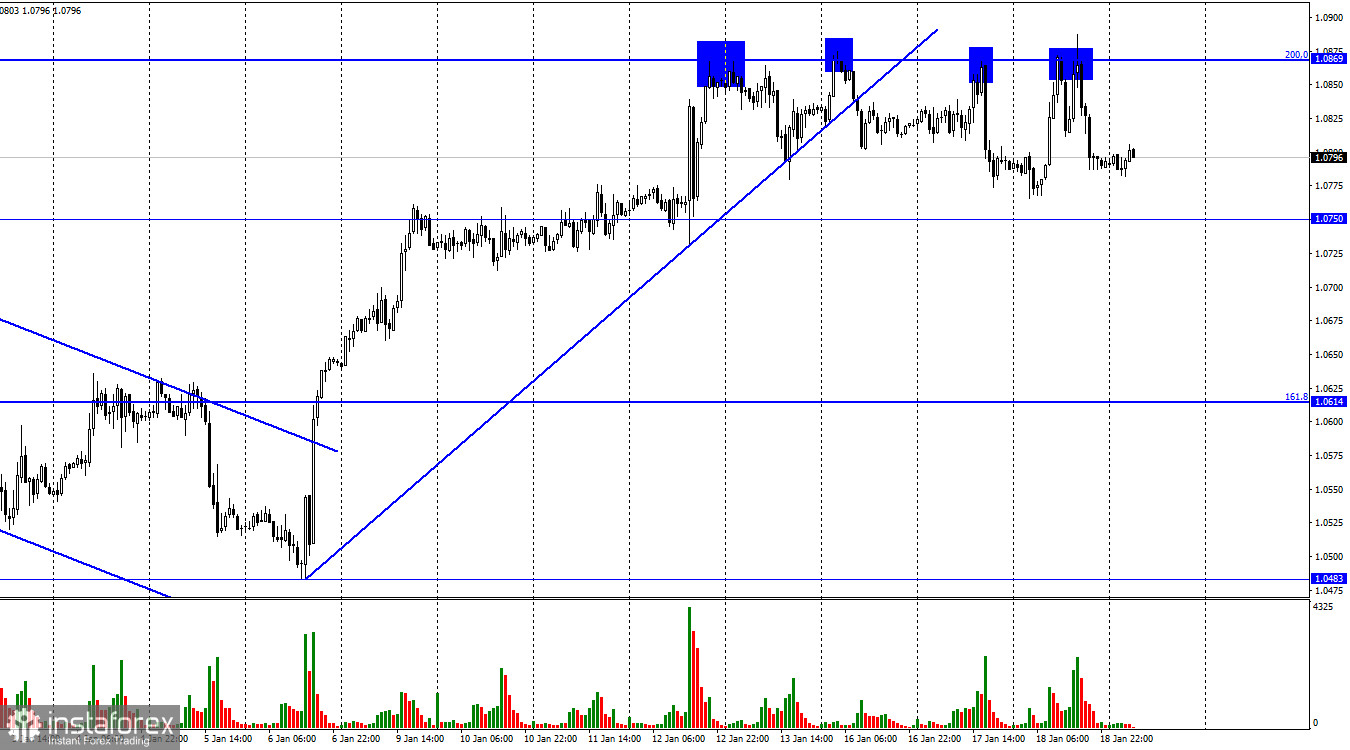

On Wednesday, the EUR/USD pair had a new rise to the corrective level of 200.0% (1.0869), a new rebound from it (the fourth consecutive one), and a new decline toward the level of 1.0750. I wouldn't be shocked if today saw a new comeback to the level of 1.0869 and a new rebound. The possibility of continued expansion toward the following level of 1.1000 will increase if the pair's rate is fixed above the level of 1.0869.

Although there were several news stories and reports, I can't say that yesterday was particularly intriguing in terms of the information background. Similarly, I cannot claim that all of these events had an impact on traders' moods because, in addition to reports from the EU and the USA, speeches by FOMC members were also made, and their comments may be read in a variety of ways. However, James Bullard asserted that the Fed's interest rate should keep rising, which might have led to a surge in the dollar if Bullard's speech had not occurred at night. Given that yesterday's movements resembled those of the preceding three days almost exactly, I believe that the informational context had little impact on the traders' attitudes.

I do, however, draw attention to the fact that the consumer price index for the European Union dropped to 9.2% in December, US industrial production declined by 0.7% in the same month, and retail trade volumes fell by 1.1%. But as I already indicated, I cannot claim that any particular report had an impact on how the euro/dollar pair moved. Given that ECB President Christine Lagarde will be giving remarks today and tomorrow, the conclusion of the week could prove to be more exciting. Comments that are "hawkish" can aid bull traders in taking the level of 1.0869. And the market is now specifically anticipating Lagarde's "hawkish" remarks. The next three sessions are expected to see a rate increase of at least 1.25% because inflation is still too high. The rate, in the opinion of ECB Chief Economist Philip Lane, should continue to grow and significantly increase.

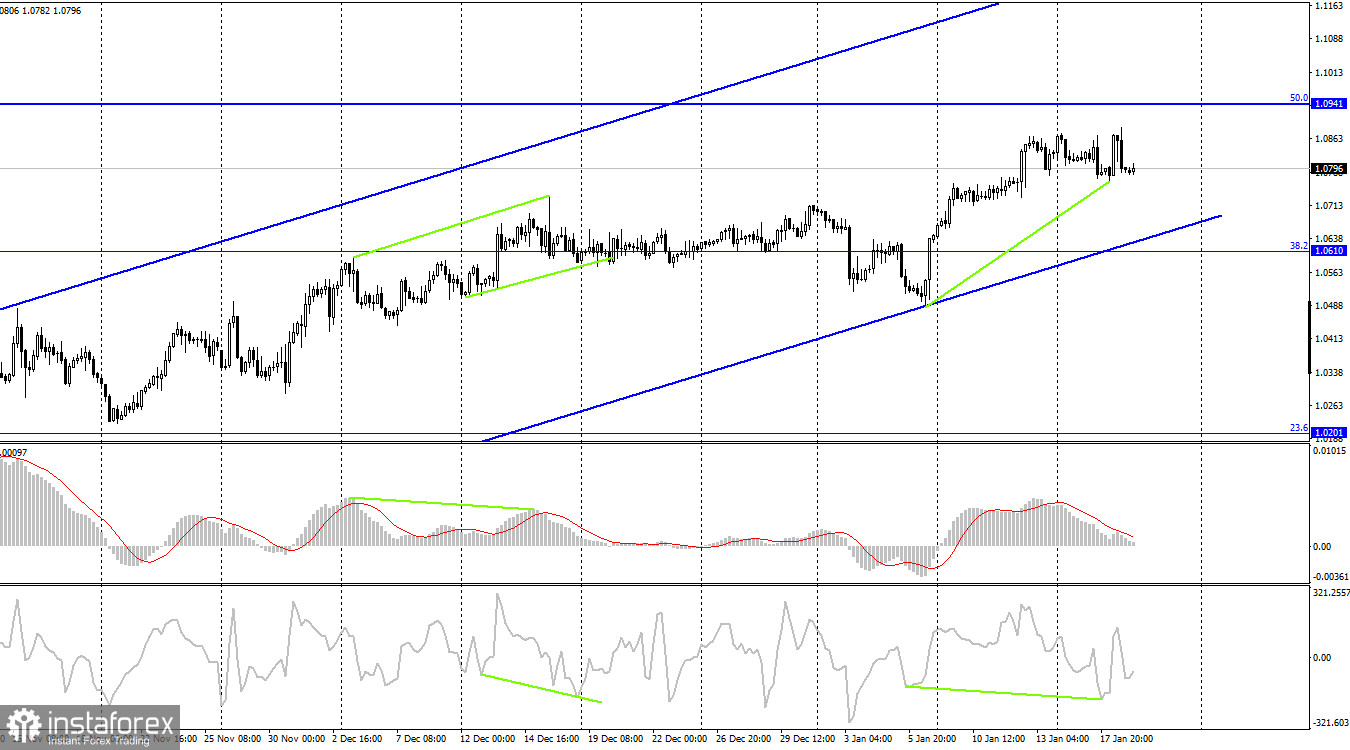

The pair had a new turnaround in favor of the euro on the 4-hour chart, and it is now advancing toward the corrective level of 50.0% (1.0941). The US dollar will benefit from the quotes rising from this level, while some will decline in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish." Before the corridor, I do not anticipate a significant decline in the value of the euro.

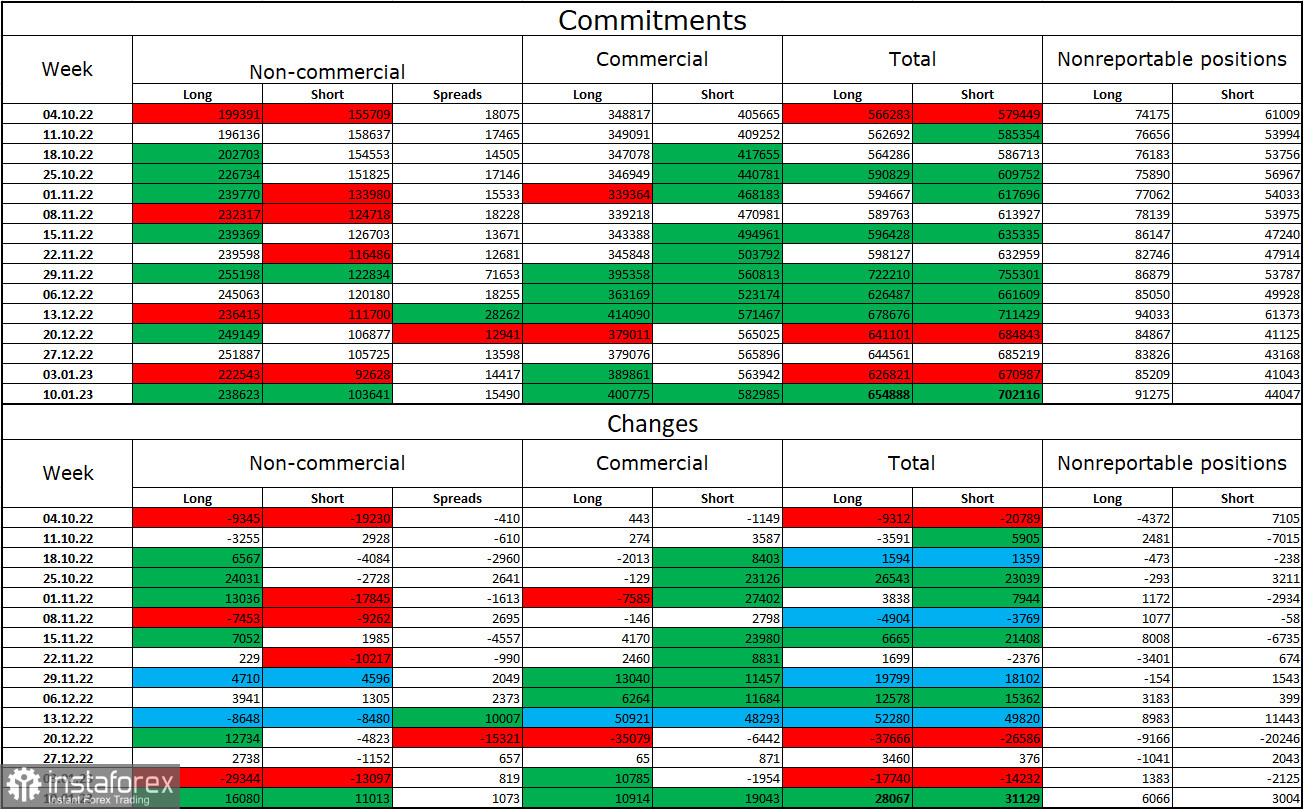

Report on Commitments of Traders (COT):

Speculators opened 11,013 short contracts and 16,080 long contracts over the previous reporting week. Large traders' attitude is still "bullish" and getting stronger once more. Speculators now have 239 thousand of long contracts, while just 104 thousand short contracts are concentrated in their hands. The COT figures show that the European currency is now growing, but I also see that the number of long positions is 2.5 times larger than the number of short positions. The likelihood of the euro currency's expansion has been increasing over the past few weeks, much like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Going beyond the ascending corridor on the 4-hour chart, however, would signal a strengthening of "bearish" positions soon.

News calendar for the USA and the European Union:

EU – ECB President Lagarde will deliver a speech (10:30 UTC).

EU – publication of the minutes of the ECB monetary policy meeting (12:30 UTC).

US – number of construction permits issued (13:30 UTC).

US – index of manufacturing activity from the Philadelphia Federal Reserve (13:30 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

There are quite a few events scheduled for January 19 on the economic calendars of the European Union and the United States, but Lagarde's speech is expected to generate the most attention among traders. The information background may have a weak to moderate impact on traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, sales of the pair are probable if it recovers from the level of 1.0869 with goals of 1.0750 and 1.0614. With goals of 1.0941 and 1.1000, purchases of the euro currency are conceivable when the hourly chart closes above the level of 1.0869. For initial purchases, the rebound from 1.0750 is also favorable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română