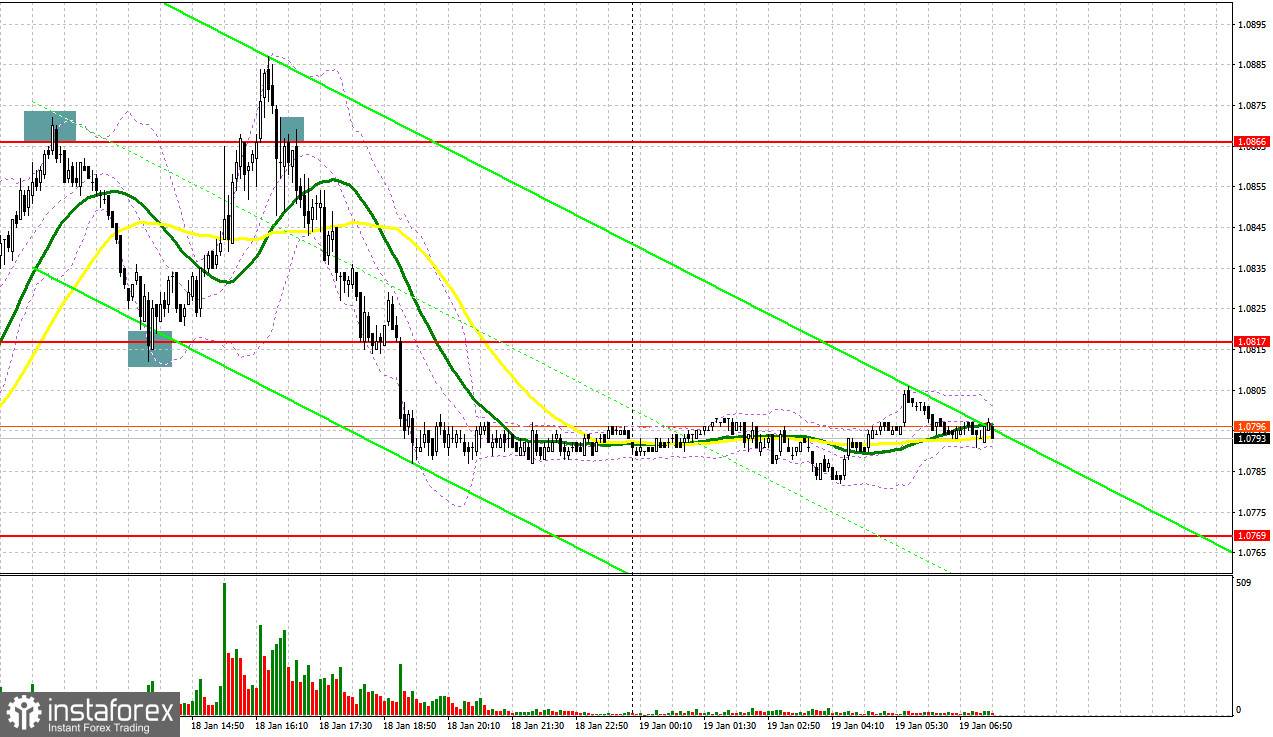

Yesterday, several entry signals were generated. Let's take a look at the M5 chart to get a picture of what happened. In the previous review, we focused on the level of 1.0817 and considered entering the market there after a false breakout. When a false breakout through 1.0817 occurred, it generated a sell signal. However, I incurred losses because the price did not go further down. The quote went up and after failed consolidation at 1.0866, another sell signal was made. The pair dropped by more than 50 pips, which allowed me to offset losses from the previous trade and make a profit. In the second half of the day, a false breakout through 1.0817 created a buy entry point, and the price went up by over 70 pips. When the price returned below the level of 1.0866, short positions were quite profitable as well.

When to open long positions on EUR/USD:

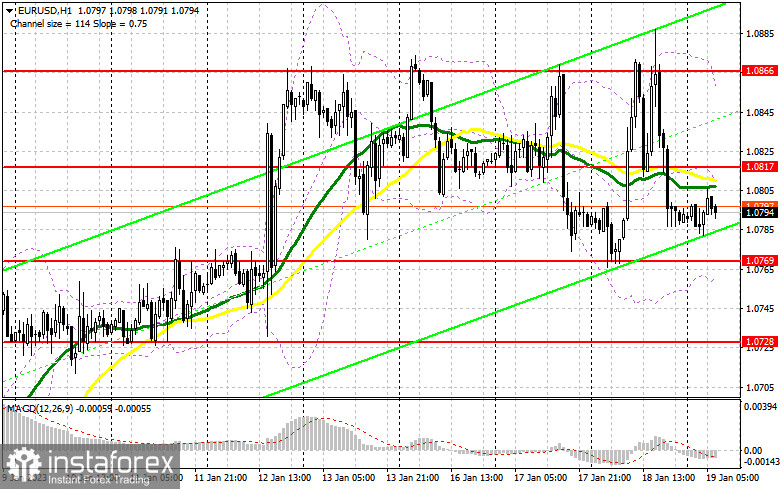

Today, the buyers will try to break through the January high. This level has already been tested more than 4 times. Anyway, that will become possible if macro data in the eurozone comes upbeat and ECB President Lagarde delivers a hawkish speech. The ECB Minutes will hardly be of any interest to investors. Still, it is important to keep an eye on the report. Therefore, long positions could be opened if the buyers are active at the nearest support level of 1.0769. If EUR/USD falls there in the first half of the day, a false breakout will generate a buy signal with the target at 1.0817. The bearish moving averages located there are limiting the pair's growth potential. In the case of upbeat data in the eurozone, a breakout and a downside test of this range will create an additional buy entry point with the target at 1.0931, where I am going to lock in profits. If EUR/USD goes down and there is a lack of bullish activity at 1.0769 in the first half of the day, a deeper correction may occur, and the pair will come under pressure. Therefore, I will focus on the next support level of 1.0728. A false breakout through the mark will make a buy signal. It will also become possible to go long on a rebound from the low of 1.0687 or 1.0653, allowing a bullish correction of 30 to 35 pips intraday.

When to open short positions on EUR/USD:

The pair is also facing pressure due to a new pension reform in France that sparked protests across the country. That is why there is a high likelihood of a deeper bearish correction. Yesterday, the price closed below 1.0817. Should EUR/USD surge in the European session, it will become possible to open short positions against the trend after failed consolidation above 1.0817. The quote may then drop to 1.0769. A breakout and a retest of the 1.0769 mark will generate an additional sell signal with the target at 1.0728. The pair will face stronger pressure. Consolidation below this level will push the price to 1.0687. The most distant target stands at 1.0653. If the quote tests this mark, the market will turn bearish. This is where I am going to lock in profit. If EUR/USD goes up in the European session and there is a lack of bullish activity at 1.0817, it will become possible to open short positions at 1.0866 after the pair's failed attempt to consolidate. EUR/USD could be sold on a rebound from 1.0931, allowing a bearish correction of 30 to 35 pips intraday.

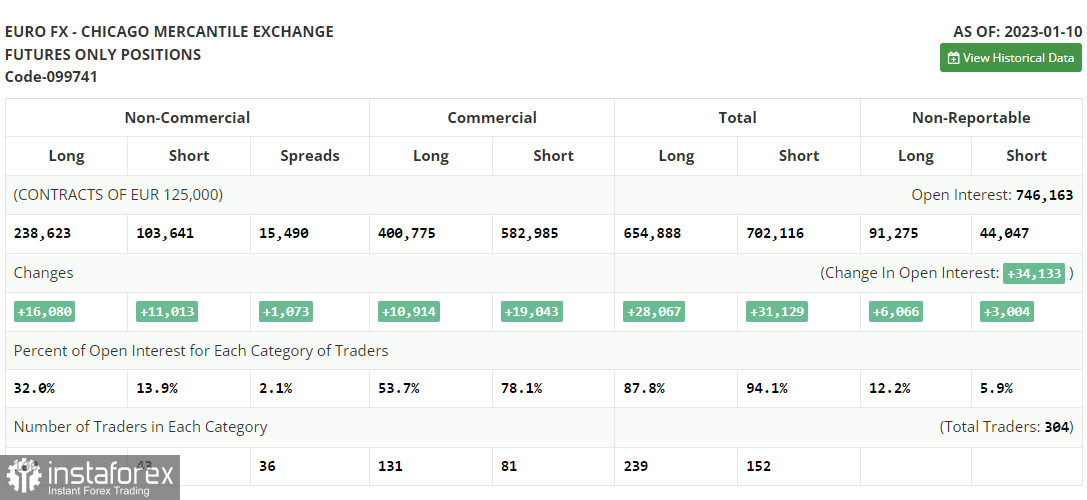

Commitments of Traders:

The COT report for January 10 illustrates a steep rise in long and short positions. Trading activity is clearly on the rise after the winter holiday season and the release of US inflation statistics for December. A fall in inflation allows the Federal Reserve to reduce the pace of rate hikes at the February meeting. If the central bank announces a 0.25% rate increase, this will inevitably lead to a weaker dollar against the euro. Demand for risk assets is also growing. Indeed, a more dovish stance of the American regulator brings back risk appetite, which decreased significantly last year. According to the latest COT report, long non-commercial positions grew by 16,080 to 238,623 and short non-commercial positions rose by 11,013 to 103,641. Consequently, the non-commercial net position came in at 134,982 versus 129,915 a week ago. Investors are now betting on the euro on expectations of a less aggressive stance of world central banks this year. Still, for a surge in price, new fundamental factors are needed. The weekly closing price ascended to 1.0787 versus 1.0617.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating the possibility of a downtrend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.0855, in line with the upper band. Support stands at 1.0760, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română