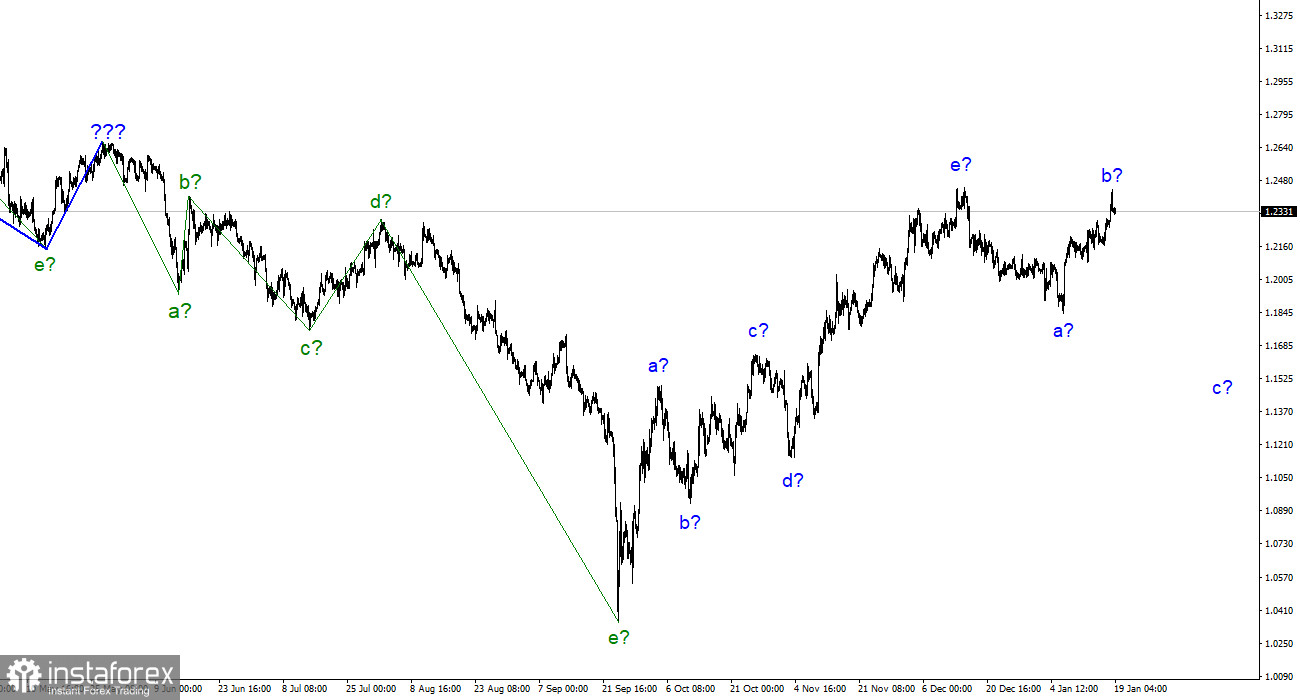

The wave markup for the pound/dollar instrument currently appears rather complex, but it doesn't call for any explanations and starts to diverge dramatically from the markup of the euro/dollar instrument. Our five-wave ascending trend section has the form a-b-c-d-e and is most likely already finished. Since there was a very active departure of quotes from previously established highs between December 15 and January 6, there is a much greater likelihood that the British pound will finish the upward segment of the trend. As a result, I can say that the downward part of the trend has started to take shape and will include at least three waves. And as part of this segment of the trend, which can take both a five-wave and a five-wave impulse, the increase in the instrument's quotes over the past several days may be wave b. However, the drop in the British pound should continue because there has only been one downward wave created thus far, and it has not been in the strongest or most compelling form. There is no limit to how many times or how long the rising phase of the trend can become more convoluted, but this is not a typical occurrence. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

The UK's inflation rate has remained unchanged.

On Wednesday, the pound/dollar exchange rate increased by 60 basis points. The pound could have increased the price much further, but in the afternoon, the quotes started to decline from the day's high points. The preservation of the current wave marking is essentially at stake with this departure. The marking of wave b will change, and the entire upward segment of the trend will assume an even more complex shape if the instrument's increase persists today or tomorrow. While this hasn't happened, I'm hoping for a decrease in quotes given this week's major British news events that have already transpired. But because there is no background news on Thursday and Friday, the market sentiment might not shift.

When compared to November, there were no appreciable changes in the UK's inflation data for December. From 10.7% y/y to 10.5% y/y, the consumer price index slowed. Core inflation stayed the same at 6.3%, indicating no change at all. As a result, the decrease in inflation proved to be official. A 0.2% slowdown is almost equivalent to no slowing at all. The market quickly deduced that even after the Bank of England rate increased to 3.5%, inflation was still rising and that we could expect an increase in early February of at least 50 basis points. This conclusion led to an increase in demand for the British pound yesterday. Now that this aspect has been taken into account, the demand for the pound can gradually decline.

Conclusions in general

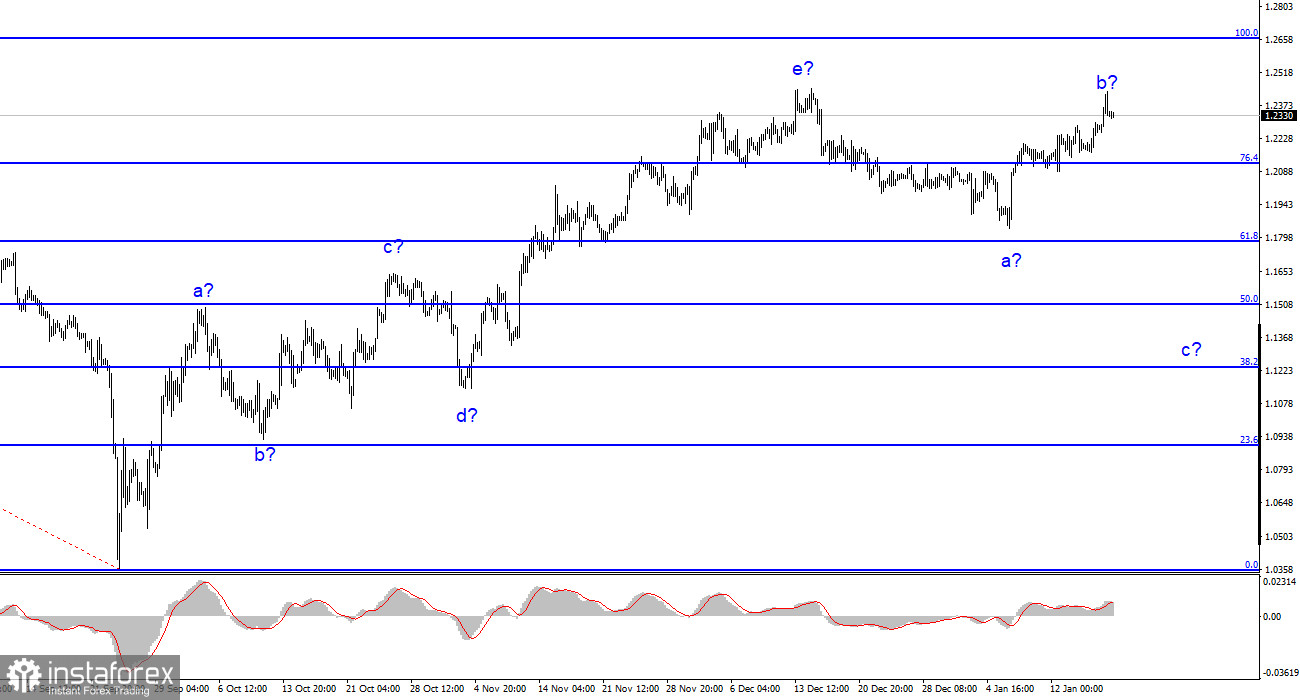

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. At this point, sales with objectives at the level of 1.1508, or 50.0% by Fibonacci, might be taken into consideration by the "down" reversals of the MACD indicator. The upward portion of the trend is probably over, however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound has a significant tendency to rise.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this is the case, a downward portion will likely be built for at least three waves, with the possibility of a drop in the region of figure 15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română