Futures on US stock indices continue to trade in a channel with no clear direction as investors continue to be concerned about the Federal Reserve System's monetary policy and the upcoming quarter's disappointing corporate earnings reports. After the Bank of Japan maintained its monetary policy, the yen decreased in value relative to the dollar.

Following a volatile day on Tuesday due to varying Wall Street bank results, the S&P 500 and Nasdaq 100 index futures contracts remained essentially unchanged. The dollar index decreased.

As mentioned above, the Bank of Japan refuted market speculation about additional policy changes by stepping up efforts to defend its stimulus package to sustain the economy, which caused the Japanese yen to fall substantially versus the US dollar. The yen fell more than 2% to 131.25 per dollar. The yield on benchmark 10-year notes decreased by more than 10 basis points to below 0.4% at the same time.

To determine precisely when the Federal Reserve and other major central banks will cease raising interest rates, investors will today concentrate on statistics on producer inflation in the US. It is also worthwhile to take into account a very significant report on American retail sales for December of this year. Due to the negative effects that positive changes in sales will have on inflation and the Fed's future policy, the indicator's growth could result in a decrease in stock indices.

Fed officials Rafael Bostic, Lorie Logan, and Patrick Harker are among those anticipated to provide information about the outlook for interest rates in the United States in the near future.

The sixth day in a row that the European Stoxx 600 index has increased marks the longest streak since November 2021. It was unable to build on its previous highs due to share price declines in the real estate and chemical industries.

The price of US Treasury bonds increased along the whole curve, while long-term bonds' yields decreased more than short-term ones. After the consumer price index declined for the second consecutive month in December, a sign that the country's inflation had peaked, the price of UK bonds increased.

Oil futures are rising for the seventh day in a row amid expectations that Chinese demand will increase now that COVID Zero has been rejected.

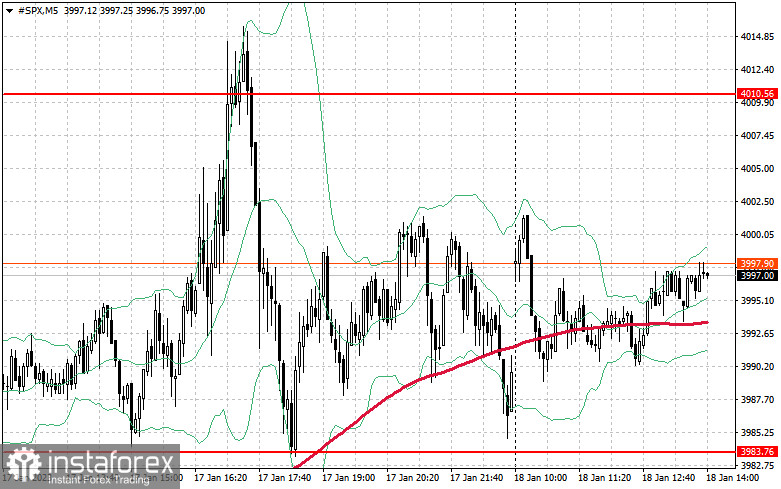

Regarding the S&P 500's technical picture, little has changed. The closest level of $3,980 needs to be protected for the index to continue to rise, therefore, doing so will be a top priority today. Only then can we anticipate a stronger upward movement to push the trading instrument above $4,020. The threshold of $4,038, which is a little higher, will be challenging to surpass. Purchasers are only required to declare themselves at roughly $3,920 in the event of a downward movement and a lack of support around $3,980 and $3,960. The trading instrument's breakdown will swiftly send it to $3,866, and the $3,839 region will be the furthest goal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română