When to open long positions on EUR/USD:

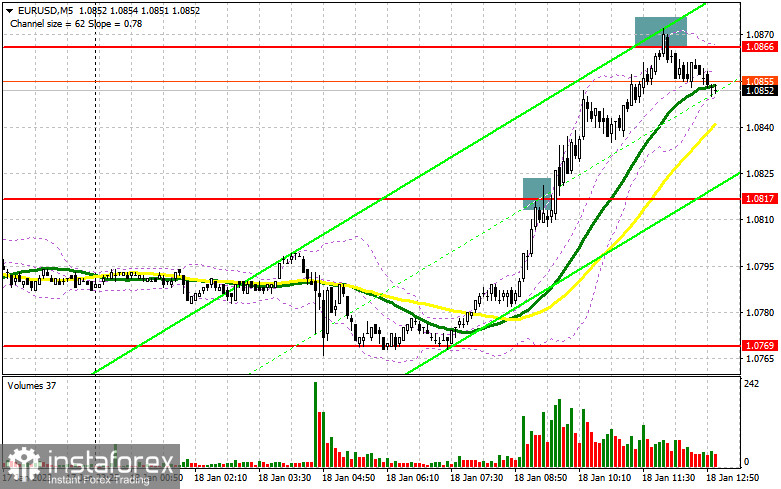

In the morning, there was only one entry point. Let's look at the 5-minute chart and try to figure out what actually happened. In the morning article, I turned your attention to 1.0817 and recommended going short after a false breakout. Frankly speaking, I did not expect such a sharp jump without any reason. A false breakout of 1.0817 created a sell signal but I had to close Stop Loss orders. The downward movement did not take place. A rise and a false breakout of 1.0866 also provided a sell signal. It is relevant at the time of writing the article. For the afternoon, the technical outlook was not revised considerably.

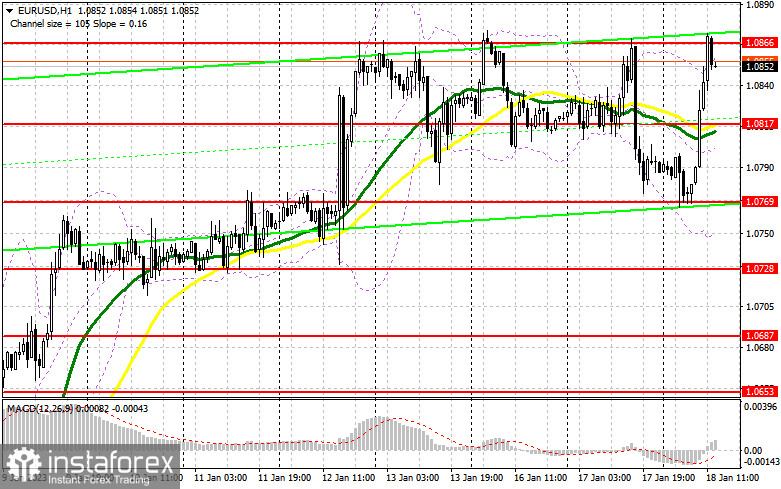

Now, traders are looking forward to the US retail sales report. If the figure rises, it will indicate that inflation could remain high for a longer period of time. As a result, the Fed is sure to stick to its aggressive tightening. In other words, retail sales data may boost the US dollar or push the euro to 1.0817 – the middle of the sideways channel. The US Producer Price Index and industrial production data are on tap. Upbeat figures may provide more buying opportunities for the US dollar. If the pair declines amid strong reports, it is better to wait for a false breakout near 1.0817, which is the middle of the sideways channel. It will help bulls push the pair to a high of 1.0866. The pair has been unable to break out of this channel for the last few days. A breakout and a downward test of this level will give an additional buy signal with a rise to 1.0931. It will facilitate the formation of a new bullish trend. A breakout of this level will force bears to close their Stop Loss orders. So, there could be another buy signal with the prospect of a jump to 1.0970 where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 1.0817, the pressure on the pair will increase greatly. At that level, the moving averages are benefiting them. In this case, it would be wise to pay attention to the support level of 1.0769, which acts as the lower border of the sideways channel. Only a false breakout of this level will give a buy signal. You could open long positions at a bounce from the low of 1.0728 or 1.0687, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

The bears failed to defend a rather controversial resistance level of 1.0817. They are now trying to protect 1.0866. Everything will depend on US data. However, one should also focus on the speeches of Rafael Bostic, James Bullard, and Patrick T. Harker. Their hawkish comments will help the US dollar advance and push the pair below 1.0866. A sell signal appeared in the morning at this level. As long as trading is carried out below this range, there is a chance of a fall in the euro. It would be appropriate to wait for another false breakout of 1.0866. It will finally confirm the presence of large sellers in the market. A breakout and an upward test of 1.0817 amid upbeat US data will initiate a short-term downward correction, giving an additional sell signal. The pair could return to 1.0769. A drop below this level will cause a larger downward movement to 1.0728, which will lead to a bear market. There I recommend locking in profits. If EUR/USD grows during the American session and bears show no energy at 1.0866, and such a scenario looks likely given the high volatility it is better to go short only at 1.0931 after a false breakout. You could sell EUR/USD after a bounce from 1.0970, keeping in mind a downward intraday correction of 30-35 pips.

COT report

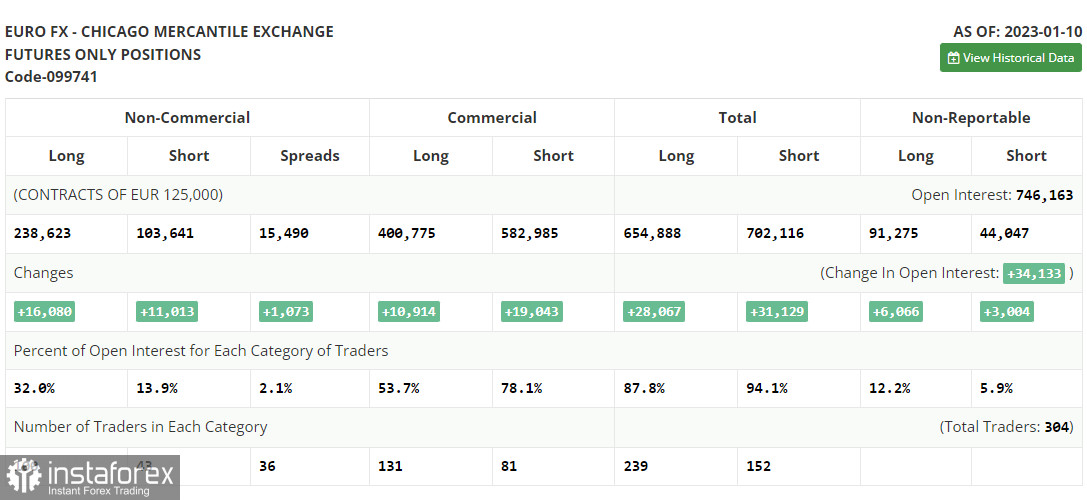

The COT report (Commitment of Traders) for January 10 logged a sharp increase in both long and short positions. Traders are returning to markets after the New Year holidays. They have also studied the fresh inflation report, showing a decrease in the CPI in December 2022. The Fed could undertake a smaller rate increase at its February meeting and raise the interest rate by only 0.25 basis points. Such a scenario will be extremely bearish for the US dollar. It is likely to drop significantly against the euro. Demand for risky assets is also growing thanks to expectations of a slowdown in monetary tightening. Assets that have fallen in price over the past year are now attractive to investors. Now, it is necessary to focus on the speeches of Fed policymakers and draw certain conclusions about the February meeting results. The COT report revealed that long non-profit positions increased by 16,080 to 238,623, while short non-profit positions jumped by 11,013 to 103,641. At the end of the week, the total non-commercial net position advanced to 134,982 against 129,915. Hence, investors continue to increase long positions on the euro amid expectations of a smaller rate hike. However, the euro needs new drivers for further growth. The weekly closing price rose to 1.0787 against 1.0617.

Signals of technical indicators

Moving averages

EUR/USD is trading above 30- and 50-period moving averages. It indicates that the bulls don't give up attempts to carry on with an upward movement.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD climbs, the upper indicator's border at 1.0860 will act as resistance.

Definitions of technical indicators:

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română