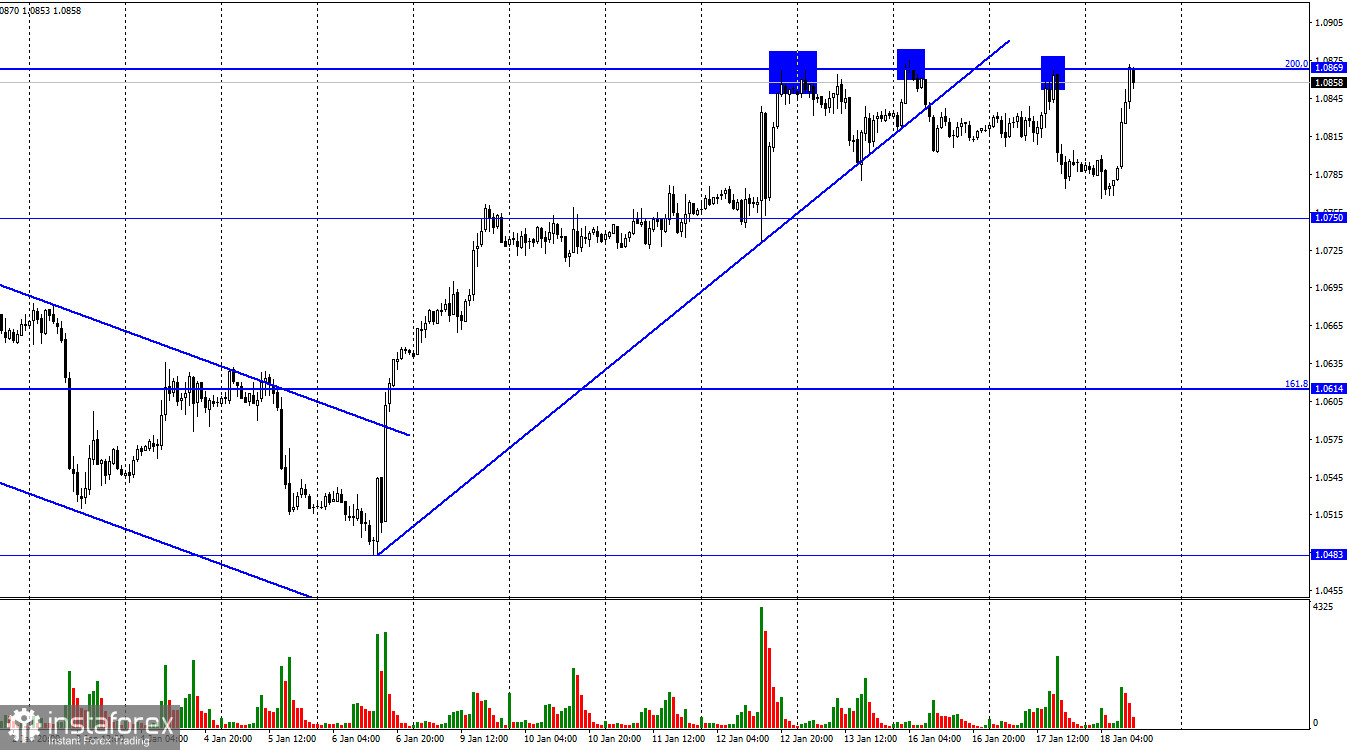

On Tuesday, the EUR/USD pair showed a recovery from the corrective level of 200.0% (1.0869) and a small decline in the direction of 1.0750. But today, the quotes were only able to close the gap by around 100 points and conduct a comeback to the level of 1.0869 in the first part of the day. The US dollar will benefit from the quotes' recovery from this level once more, and a close above it will raise the chances of additional expansion toward the next level of 1.1000.

The European euro saw a very strong morning. The lone report of the day, which was about inflation in the EU, had been known to traders for a while, but the bulls started to build up their holdings once more. The final estimate of the consumer price index decreased to 9.2% in December, but it is obvious that this was not the cause of the increase in the value of the euro. Let me remind you that the ECB may decide to end its tightening policy earlier due to the quick decrease in inflation. A 100-point increase on the report, the value of which has been known for a long time and was meant to cause the currency to fall, is completely not what I expected. In the case of the ECB, this logical chain cannot function at 100% because inflation is still quite high.

However, a report on inflation in the UK was also made public at the same time, and it slowly decreased from 10.7% y/y to 10.5% y/y. And the development of the euro currency was probably caused by this news. The pound easily dragged its "comrade" in Europe up with it. The report on British inflation will be discussed in the accompanying review, but for now, I'll just say that the bulls once again had justification for increasing their positions and succeeding in their objectives. The bulls' onslaught on the 1.0869 level is still holding, but if it continues, it might not. Several US reports and speeches by FOMC members will be presented in the afternoon.

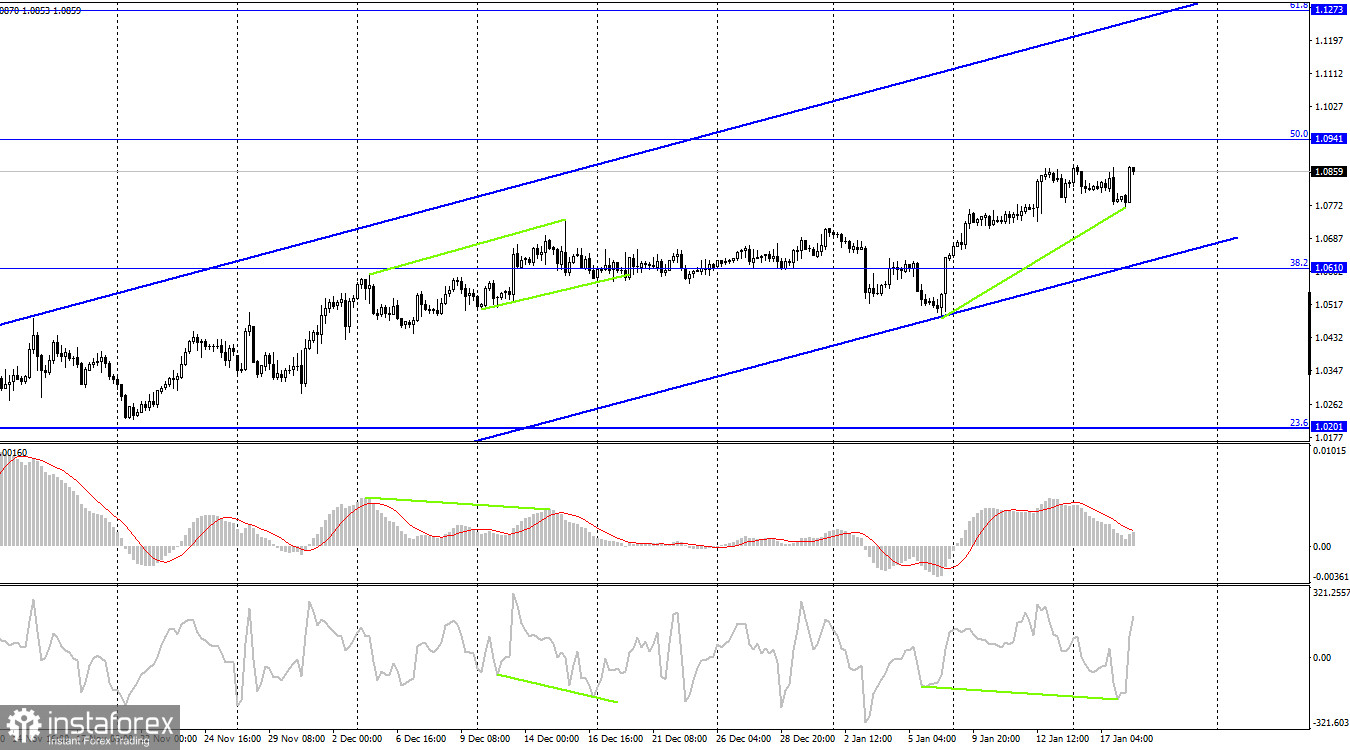

The pair had a new turnaround in favor of the euro on the 4-hour chart, and it is now advancing toward the corrective level of 50.0% (1.0941). The US dollar will benefit from the comeback in prices from this level, and some prices may fall in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish." I don't anticipate the euro falling significantly before the corridor closes.

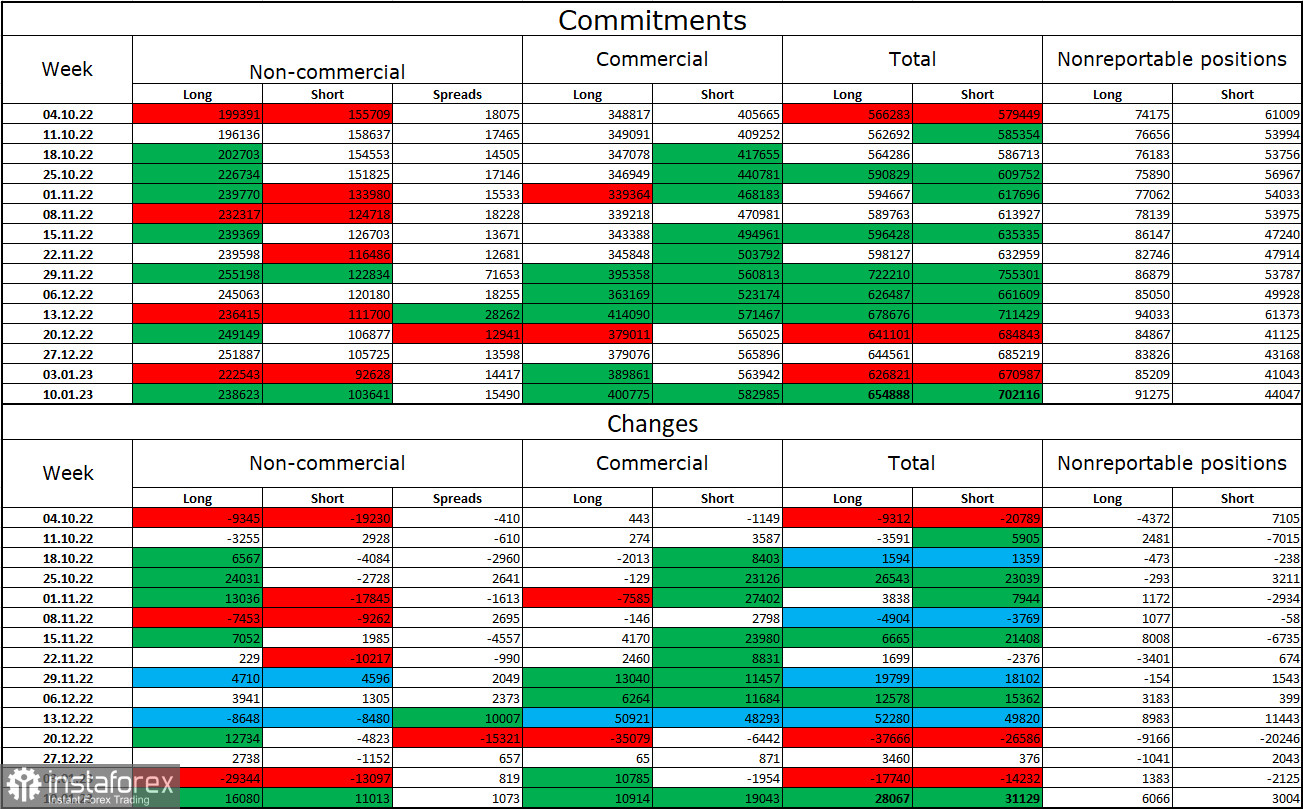

Report on Commitments of Traders (COT):

Speculators opened 11,013 short contracts and 16,080 long contracts over the previous reporting week. Major traders' attitude is still "bullish" and getting stronger once more. Currently, 239 thousand long futures and 104,000 short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is 2.5 times larger than the number of short positions. The likelihood of the euro currency's expansion has been increasing over the past few weeks, much like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Going beyond the ascending corridor on the 4-hour chart, however, would signal a strengthening of "bearish" positions soon.

News calendar for the USA and the European Union:

EU – consumer price index (10:00 UTC).

US – retail sales volume (13:30 UTC).

US – volume of industrial production (13:30 UTC).

US – producer price index (PPI) (13:30 UTC).

US – Fed's "Beige Book" (17:00 UTC).

There are quite a few events listed for January 18 on the economic calendars of the European Union and the United States, with the majority taking place in the afternoon. The background information will have a weak to moderate impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, sales of the pair are probable if it recovers from the level of 1.0869 with goals of 1.0750 and 1.0614. With goals of 1.0941 and 1.1000, purchases of the euro currency are conceivable when the hourly chart closes above the level of 1.0869. For initial purchases, the rebound from 1.0750 is also favorable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română