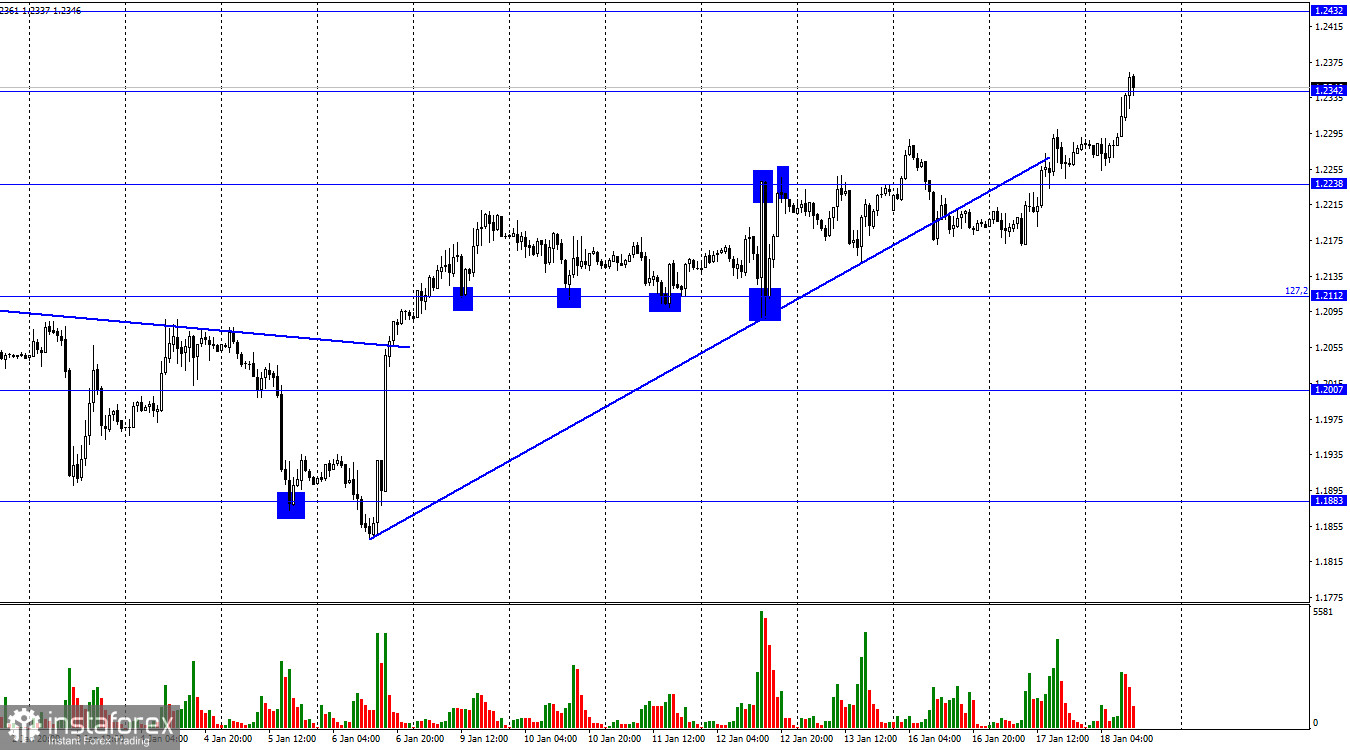

The GBP/USD pair made a reversal in favor of the British on Tuesday and consolidated above the level of 1.2238, according to the hourly chart. And today I continued the growth process and completed the closing above the level of 1.2342. As a result, the expansion of quotes can proceed in the direction of the level of 1.2432. Bear traders received nothing by closing below the rising trend line; instead, the British pound just took a break for a single day.

Today, there are no concerns about the pound's rise. A UK inflation report that was published early in the morning flopped. The CPI could only drop from 10.7% to 10.5% after the Bank of England raised interest rates for a full year, despite Andrew Bailey, the bank's president, speaking yesterday about a sharp decline in inflation in 2023. Traders could only infer one thing from this report: the Bank of England must further tighten the PEPP and has no choice but to do so. The rate should be increased as swiftly and forcefully as is practicable, which will unavoidably trigger a recession. Let me remind you that before, Rishi Sunak and Andrew Bailey declared the start of a recession. If the Bank of England does not ignore the biggest inflation in 40 years, the current recession will get worse.

What, though, will the Bank of England select as its primary objective? High inflation is countered by maintaining economic growth or a slight slowdown. Even accounting for the decline in the price of energy resources, inflation is unlikely to decline significantly if the rate is not hiked (minus the British). A recession will unavoidably occur if the rate keeps rising and will only get worse with each subsequent increment. Despite the dire circumstances, traders continue to place bets on a rise in the British pound's current exchange rate. This is the only factor driving the pound's growth. The afternoon's numbers and comments from FOMC members should have little impact on traders' moods.

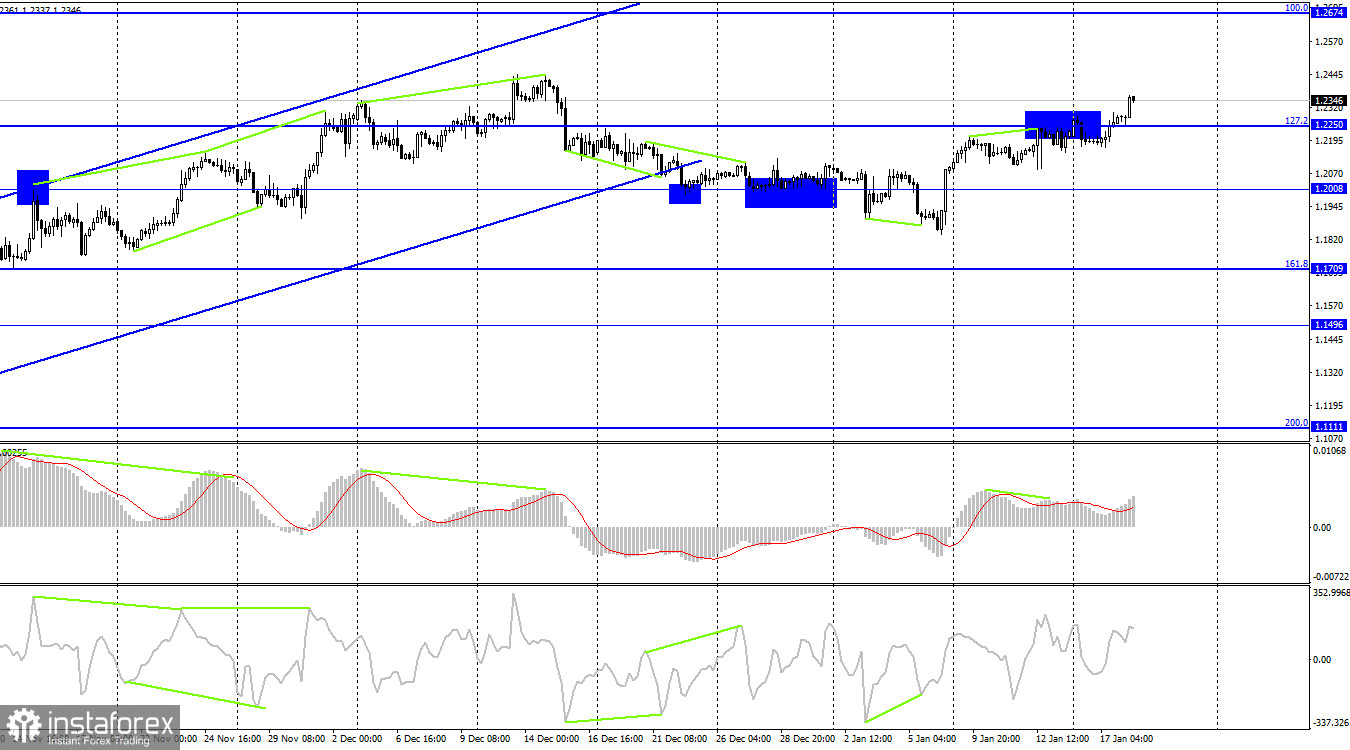

On the 4-hour chart, the pair has maintained above the corrective level of 127.2% (1.2250), which gives us confidence in additional gains to the next Fibo level of 100.0% (1.2674). The divergence that was "bearish" has been reversed. There are no new divergences in the making. The bears may temporarily return to the market if the rate of the pair is fixed at 1.2250.

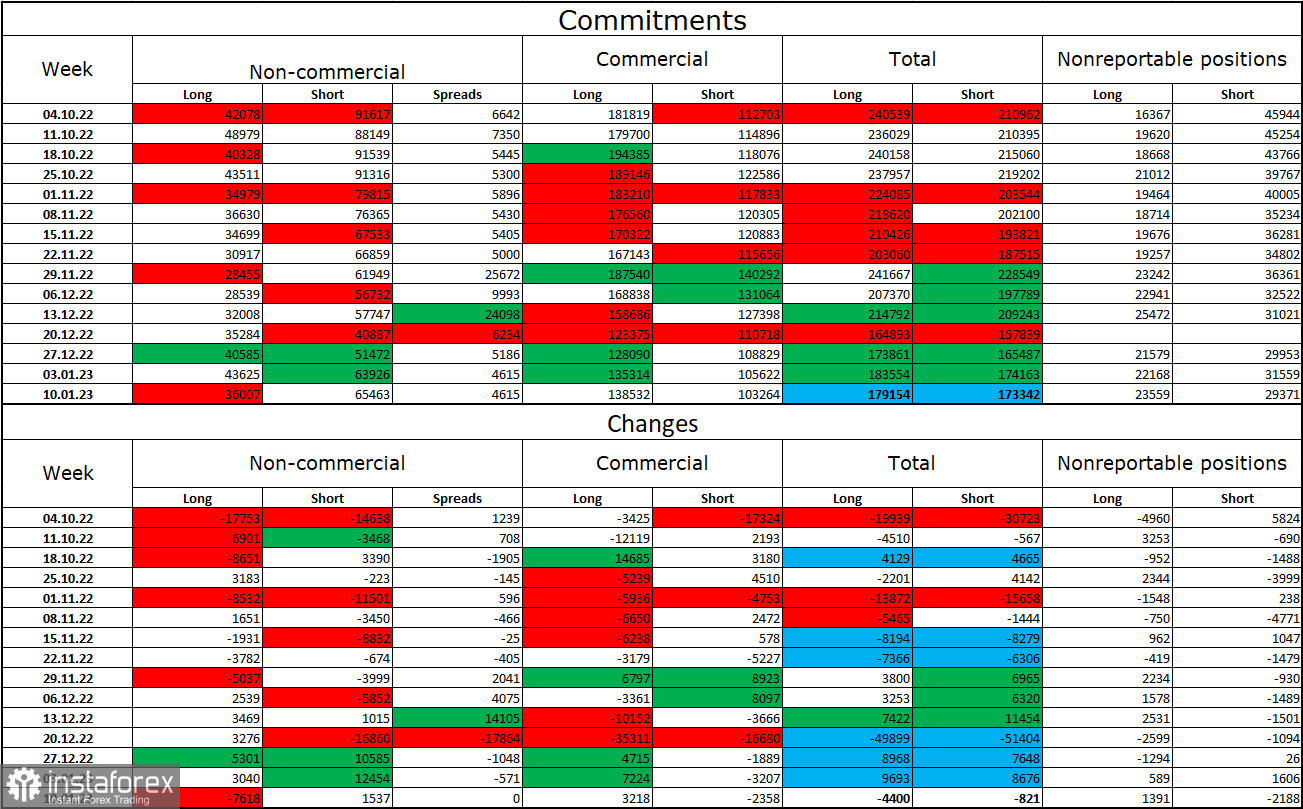

Report on Commitments of Traders (COT):

The sentiment among traders in the "non-commercial" category over the last week has shifted more "bearish" than it did the week before. Speculators' holdings of long contracts declined by 7,618 units, while their holdings of short contracts grew by 1,537. The major participants' collective attitude is still "bearish," and there are more short-term contracts than long-term ones. The situation has shifted in favor of the British over the last few months, but today the number of long and short positions in the hands of speculators has nearly doubled once more. As a result, in recent weeks, the outlook for the pound has once again declined. On the 4-hour chart, there was an escape beyond the three-month ascending corridor, and this development may prevent the pound from continuing its recent rise trajectory.

News calendar for the USA and the UK:

UK – consumer price index (07:00 UTC).

US – retail sales volume (13:30 UTC).

US – volume of industrial production (13:30 UTC).

US – producer price index (PPI) (13:30 UTC).

US – Fed's "Beige Book" (17:00 UTC).

The schedule of economic events for Wednesday in the US is quite exciting, while in the UK, the lone report for the day has already been made public. The information background may have a weak to moderate impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

If quotes are fixed below the level of 1.2342 on the hourly chart with a goal of 1.2238, sales of the British pound are possible. On the 4-hour chart, I suggested buying with a goal of 1.2342 when the price closed above the level of 1.2250. This objective has been completed. When closing over 1.2342 with a goal of 1.2432, new purchases are available.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română