Unexpectedly, but the euro and the pound sterling traded with the opposite correlation yesterday. Oddly, there were no reasons for this. At least, the macroeconomic statistics could hardly be the plausible excuse for the opposite correlation. The UK released data on the labor market. The unemployment rate accurately coincided with the consensus and remained flat in November. The data had been published long before the market picked up steam. EUR/USD traded mainly flat during the European session. The instrument gained impetus during the New York trade. So, the euro weakened in light of the interview by Olaf Scholz and the official survey of the Federal Union of German Industries (BDI). Germany's Chancellor stated that the domestic economy is on a sound footing and there is no recession on the horizon. In contrast, German manufacturers are braced for GDP contraction in 2023 at least by 0.3% for the obvious reason: sky-high energy prices.

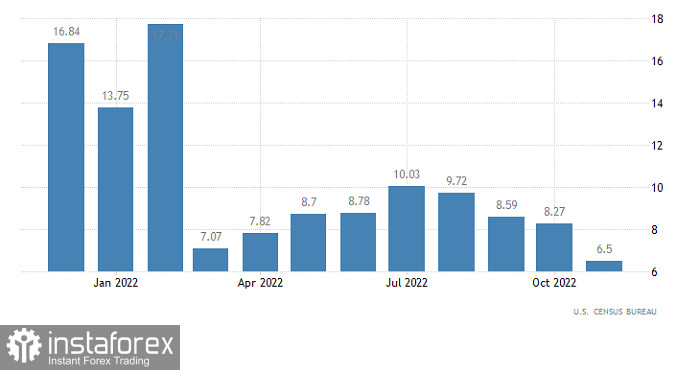

Europe managed to avoid the worst-case scenario of disruptions in energy supplies and running heating systems, albeit at a high cost. Nowadays, European consumers have to pay twice higher utility bills as last year. Interestingly, energy prices were viewed as elevated last year. As a result, the Federal Union of German Industries states openly that manufacturers are losing competitive advantage due to inflated energy prices. Hence, they have to relocate part of their production facilities to other countries with lower energy costs. The market gave priority to German manufacturers than to the Chancellor. Remarkably, Germany is the powerhouse of the Eurozone. In turn, if it slips into a recession, the state of affairs in other countries will be much worse. Nevertheless, today the single European currency is able to recoup its yesterday's losses because of the US economic data. US retail sales are expected to decline to 5.0% from 6.5% on year. Besides, US industrial production could have eased to 1.8% from 2.5%. If such meaningful economic indicators go down, this is bearish for the US dollar. As for the Eurozone, it doesn't make sense to take into account inflation data because it will be the revised data. It should confirm the preliminary reading which has been already priced in by the market.

US Retail Sales, y/y

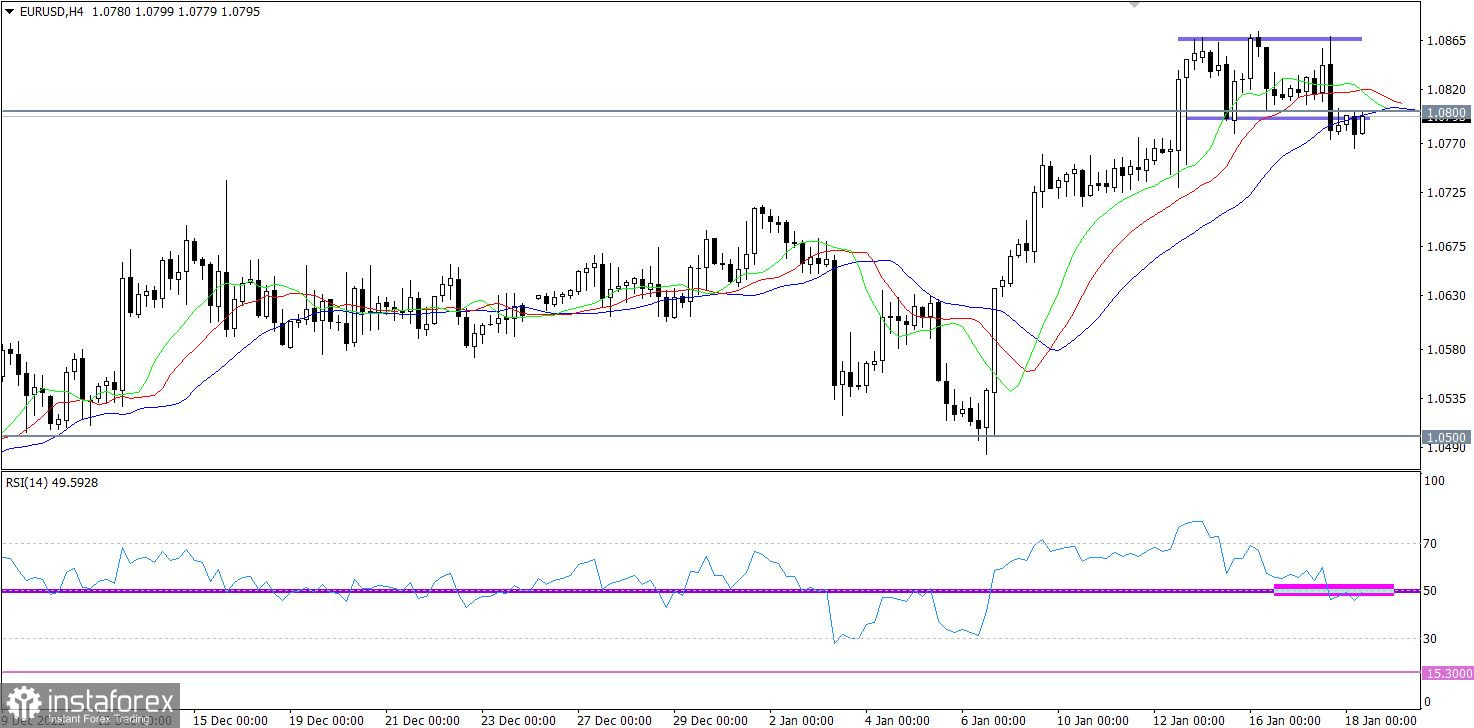

After a stage of a flat market, EUR/USD dipped below 1.0800 which indicates traders' interest in short positions. Despite intraday fluctuations, the price didn't change radically yesterday.

At the moment when the price settled below 1.0800, the H4 RSI had already crossed the 50 line from top to bottom. This means an increase in short positions on the euro. Please be aware that the indicator has been hovering along the average level which means uncertainty among market participants.

Moving averages on the H4 Alligator are intersected with each other which means sideways trading. On the daily chart, moving averages are directed upward which corresponds to the overall bullish cycle.

Outlook and trading ideas

Despite the fact that the price managed to stay below 1.0800, there is no clear technical signal that the range-bound market is over. Thus, it is better to wait for the price to settle below 1.0770 t least on the 4-hour chart to check the sellers' intention.

Until then, EUR/USD is set to remain in the range between 1.0800 and 1.0870.

Complex indicator analysis suggests mixed signals for the short-term and intraday trading on the back of the flat market. The overall bullish sentiment is still valid for the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română