On Tuesday, the EUR/USD currency pair continued to rise and showed no signs of wanting to begin a reversal. The first two trading days of the week had essentially no fundamental or macroeconomic background, but traders still could not see any reason to fix at least some of the profit on long holdings. Therefore, the technical situation is unchanged at this time. While we have been anticipating a significant downward correction for more than a month, we also recognize that this is merely a basic hunch. We cannot think of any justifications for the European currency to have grown so strongly in such a short amount of time. There is now no sell signal, but the price is still above the moving average line on the 4-hour TF and above the lines of the Ichimoku indicator on the 24-hour.

Many analysts' recent economic and currency forecasts have made mention of the Chinese economy. They present completely disparate arguments at the same time that frequently conflict with one another. For instance, the removal of COVID's "zero tolerance" policy is considered a benefit for the world economy and volatile currencies. Everyone is aware that the US dollar often emerges as the most secure and stable currency when uncertainty occurs. Right now, the situation is reversed. The Celestial Empire's economy is expanding, but at the same time, birth rates are declining, and population growth is declining for the first time in 60 years. We've long accepted that the Chinese population is growing, but since 400 million of the nation's 1.5 billion people are seniors, international experts are now raising the alarm. Since there will always be more retirees, if there is no growth, there will also be no economic growth and a recession. The Chinese government has already started encouraging more children to be born by removing limitations on having one or two children in a family and instead giving financial advantages to each child. This news, in our opinion, only serves as background information and does not directly affect the movement of the euro/dollar pair.

The ECB officials' language continues to be "hawkish."

The ECB and Fed's interest rates are currently one of the most important factors affecting the foreign currency market, as has been stated numerous times. We think that market participants are still buying euros because they anticipate a significant rate increase in the European Union but not a comparable process in the United States. It's straightforward: Since the Fed's rate has nearly reached its maximum, it makes no sense to raise it quickly. The next two meetings are expected to see two increases of 0.5% each, followed by an increase of 0.25%, according to the ECB rate. Representatives of the ECB claim that by the end of 2023, inflation should have reached the target level. They also anticipate that a dramatic fall in the price of gasoline and oil will have a favorable impact on the inflation rate. While we somewhat concur with Philip Lane and Isabel Schnabel, we think that inflation may not be moderate enough to prevent rate increases in the coming months. In any scenario, the euro currency will no longer have any motivation to demonstrate growth if the ECB also completes the tightening program. So far, we are unable to identify any causes for the European currency to increase during the majority of this year. We might claim that it is currently partially fortunate because the market frequently ignores favorable news for the currency.

Lucky is the lucky one, though. One cannot dismiss the expansion of the euro as completely irrational. It is unstable and not very promising, in our opinion. One of the riskier currencies is still the euro, and nobody can predict what surprises 2023 will bring. We are certain that the euro may plunge once more if new global tensions develop. The euro could quickly decline once the ECB has finished hiking rates. The euro may drop quickly if the EU economy does go into recession.

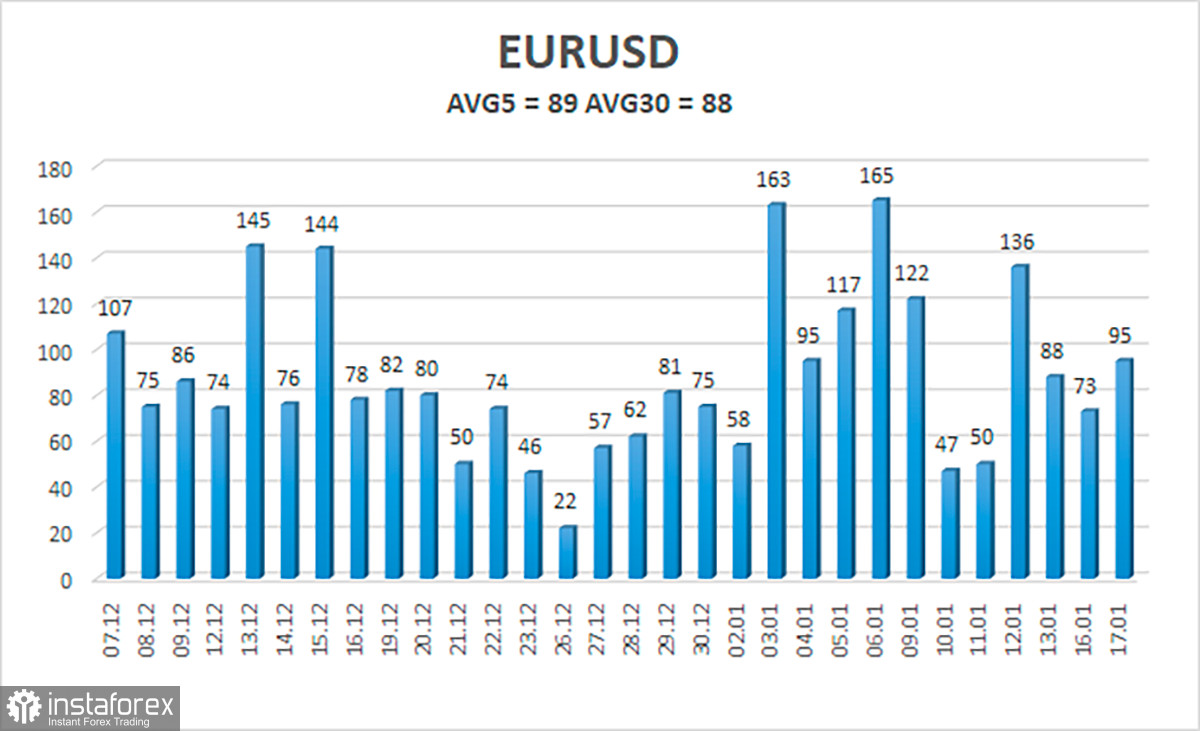

As of January 18, the euro/dollar currency pair's average volatility for the previous five trading days was 89 points, which is considered "normal." So, on Wednesday, we anticipate the pair to fluctuate between 1.0704 and 1.0882. The Heiken Ashi indicator will turn back up to signal the start of the upward movement.

Nearest levels of support

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

Trading Suggestions:

The moving average has undergone a new micro adjustment in the EUR/USD pair. At this point, we can take into account opening additional long positions with goals of 1.0864 and 1.0882 if the Heiken Ashi indicator reverses direction and moves higher or the moving average recovers. After the price is locked below the moving average line, you can start opening short positions with targets of 1.0704 and 1.0620.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română