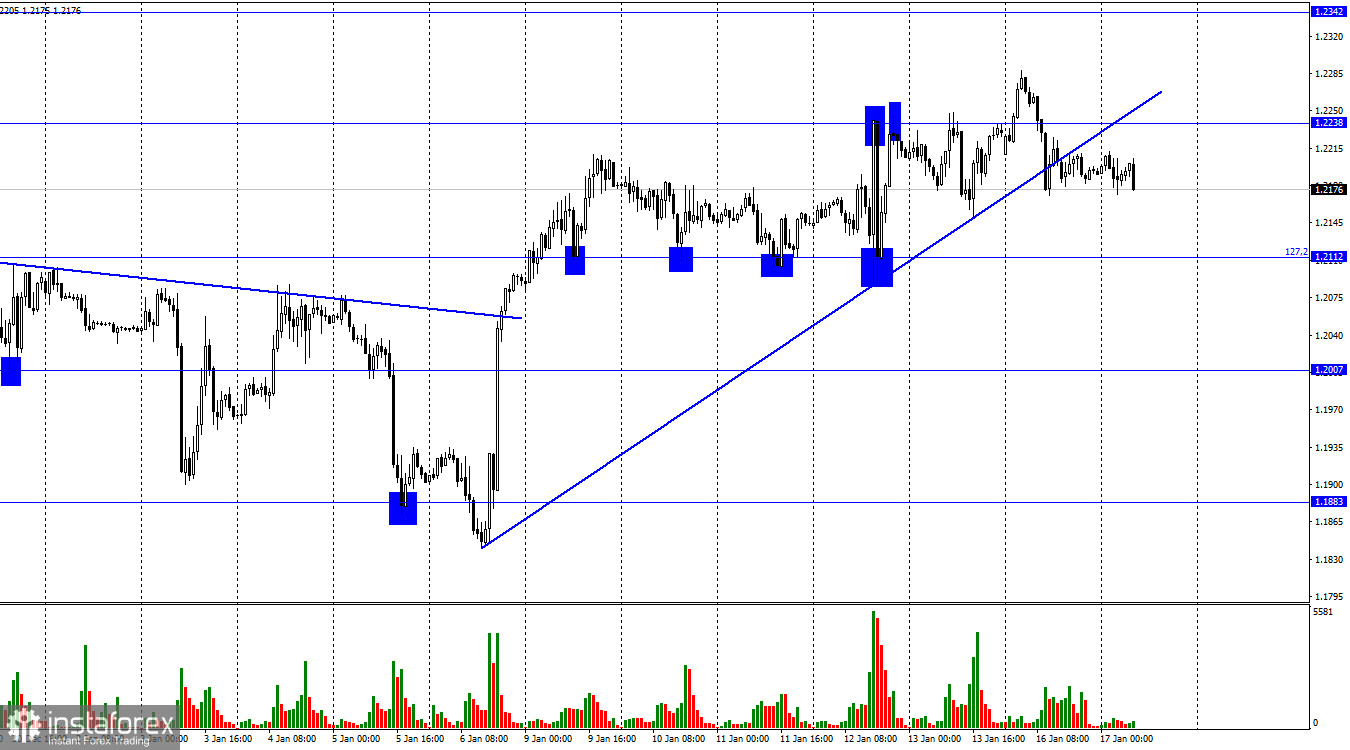

Hi, dear traders! On the 1-hour chart, GBP/USD reversed on Monday in favor of the US dollar and settled below 1.2238 and the ascending trend line. Thus, trading sentiment could have turned bearish. The price could continue its decline towards 1.2112, the 127.2% Fibonacci correction.

The information background was sparse yesterday. US financial markets were shut for the bank holiday, Martin Luther King Day. So, GBP/USD traded in the thin market in the second half of the day yesterday. Today the information environment is more interesting. The UK reported on its unemployment (3.7% in November) and wages (+6.4% in November). The market gave a lukewarm response because the actual readings came in line with market expectations. Today Bank of England Governor Andrew Baily is due to speak which is going to be a high-impact event.

For your reference, some economists believe that that the Bank of England is likely to compete the cycle of rate hikes in the coming months. Despite the fact that inflation is still raging, the British economy might go through a serious recession. Hence, the regulator could give up its plans to bring it down to the target of 2%. Or such plans might be put off for a while. At present, the chance of a rate hike by 50 basis points in February could be not as high as previously. All in all, Andrew Bailey might assure traders that the central bank aims to pursue the same monetary policy. Conversely, he might admit that the pace of further rate hikes could be revised and moderated. Under the first scenario, the pound sterling could gain ground. In the second case, the bears will enter the market. I reckon the odds are that both the euro and the sterling will weaken this week because the bulls have failed to defend the two trend lines. Commonly, these trading instruments reveal a similar dynamic.

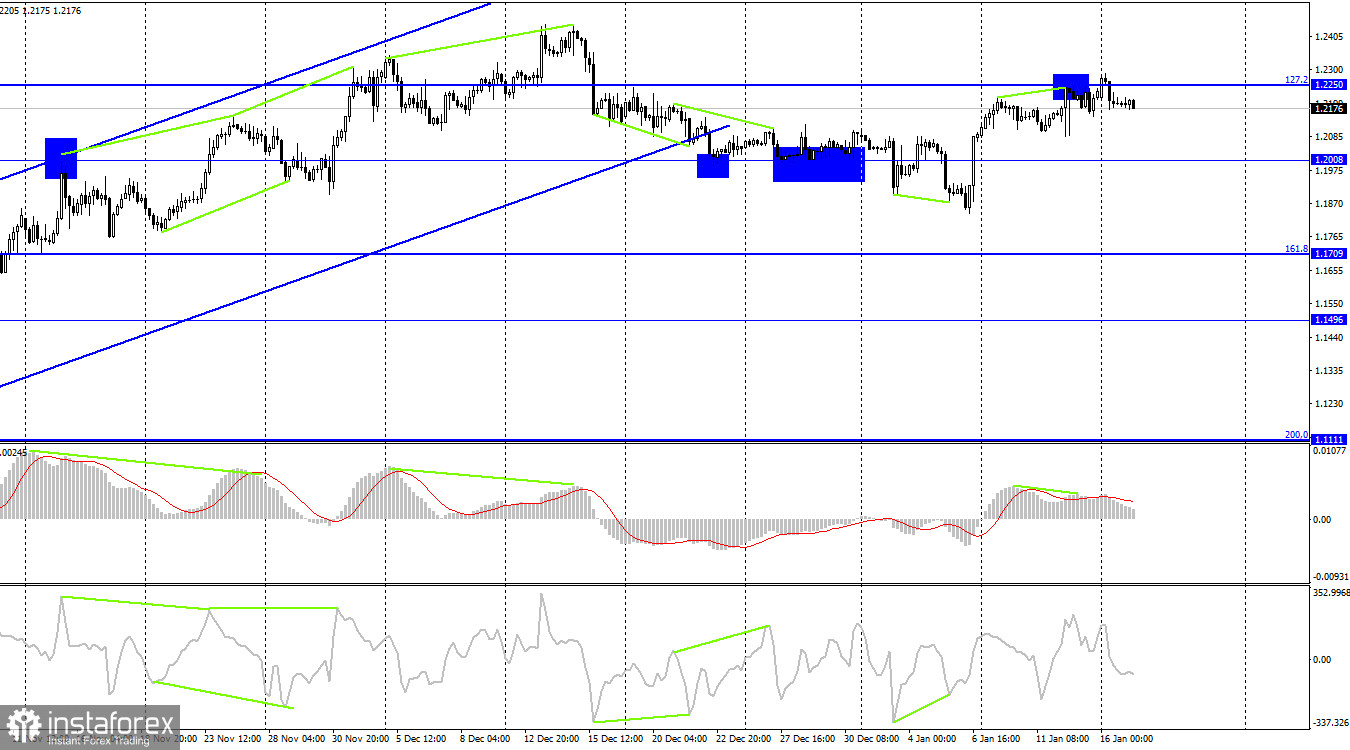

On the 4-hour chart, the currency pair rose to 1.3350, the 127.2% Fibonacci correction. The MACD indicator generated a bearish divergence that emerged right away. Therefore, GBP/USD might reverse in favor of the US dollar and might begin a slide towards 1.2008. If the instrument closes above 1.2250, this will cancel the divergence and reinforce the likelihood of further growth towards 1.2674, the 100.0% Fibonacci level.

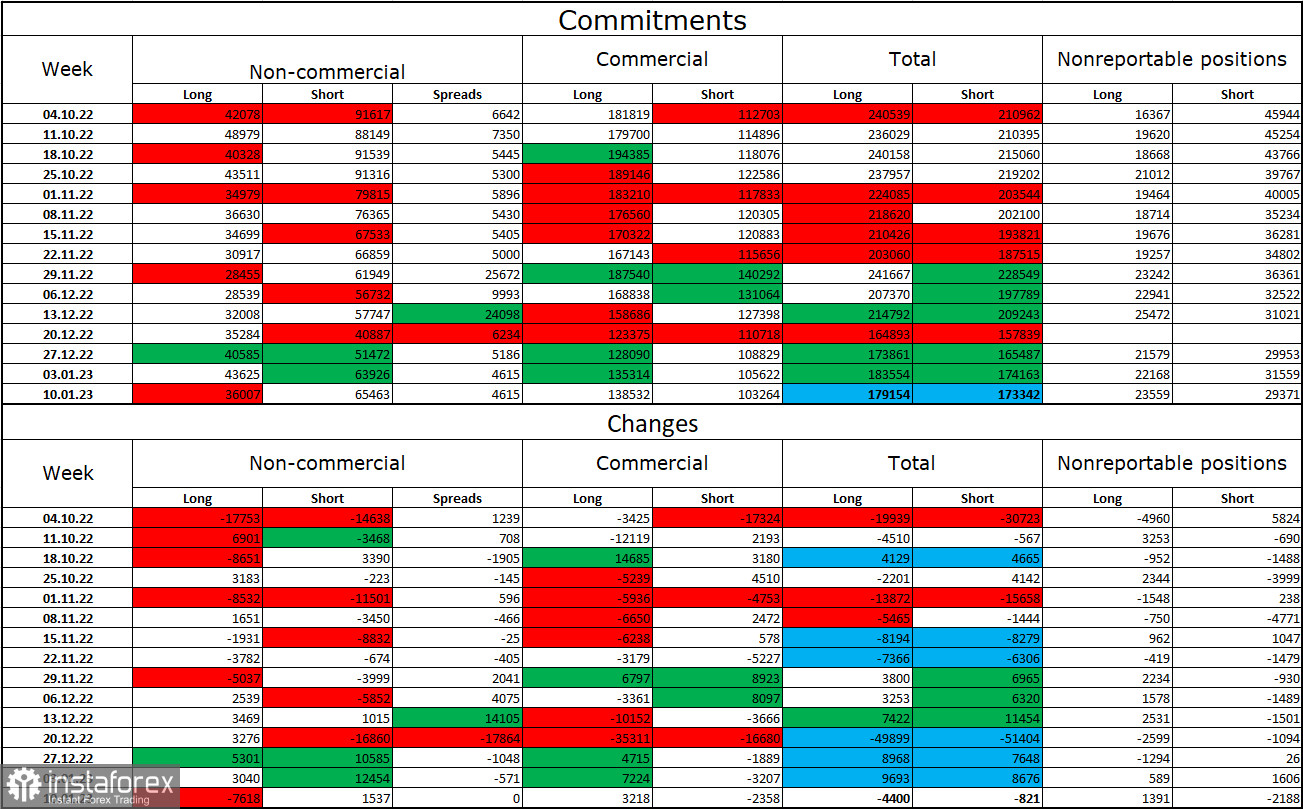

Commitments of Traders (COT):

The sentiment of non-commercial traders turned more bearish last week from a week ago. The number of long contracts held by speculators decreased by 7,618, whereas the number of short contracts still remains higher than the number of long ones. In the last few months, the situation had been changing in favor of the pound sterling. At present, the difference between the number of long and short contracts is virtually two-fold. To sum up, the outlook for the pound sterling has been getting worse over the last weeks. On the 4-hour chart, the pair escaped from a three-month ascending corridor. This price action could disrupt GBP's further advance which seemed highly probable last week.

Economic calendar for US and UK

UK: Average Earnings (07-00 UTC).

UK: Unemployment Rate (07-00 UTC).

The economic calendar is empty for the US on Tuesday. The UK has already released its economic data today which did not arouse any interest among investors. So, the information background will be of no importance to market sentiment until the end of the day.

Outlook for GBP/USD and trading tips

We could sell GBP/USD in case the price settles below the trend line on the 1-hour chart with the target at 1.2112. Now such positions could be maintained open. We could go long on GBP/USD on the condition the price closes above 1.2250 on the 4-hour chart with the target at 1.2342. Another option is to buy the pair when the price rebounds off 1.2112 on the 1-hour chart with the target at 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română