Focus has shifted to stock markets as the corporate earnings season begins. However, activity was noticeably lower than usual because yesterday was a holiday in the US.

Most likely, the cautious post-New Year rally will continue today as Morgan Stanley, Goldman Sachs and some other companies will release their reports. If the data exceed expectations, demand for those companies' shares will rise, which will lead to a new wave of decline in dollar and Treasury yields.

Market players look into corporate earnings reports because it indicates just how much damage to business the central bank's rate hikes give. If the overall reporting season turns out to be positive, then a soft landing could be expected in the US instead of a hard spiral into recession. In that case, investors will see a pause in rate hikes not only in the US, but also in other regions.

There is a huge chance that ahead of the release of key economic data from both the US and Europe, demand for equities will rise, accompanied by a decline in dollar after a slight correction. This will continue if inflation slows down and the figures on retail sales show a negative trend. It could also force the Fed to take a pause after raising the rate by 0.25% on February 1. In the event that dollar declines, gold and oil prices will rush up, with the former seeking further gains.

The positive trend in markets will persist until the end of January.

Forecasts for today:

AUD/USD

The pair is consolidating above 0.6945. Continued positive sentiment caused by a strong GDP data from China could push it to 0.7065 .

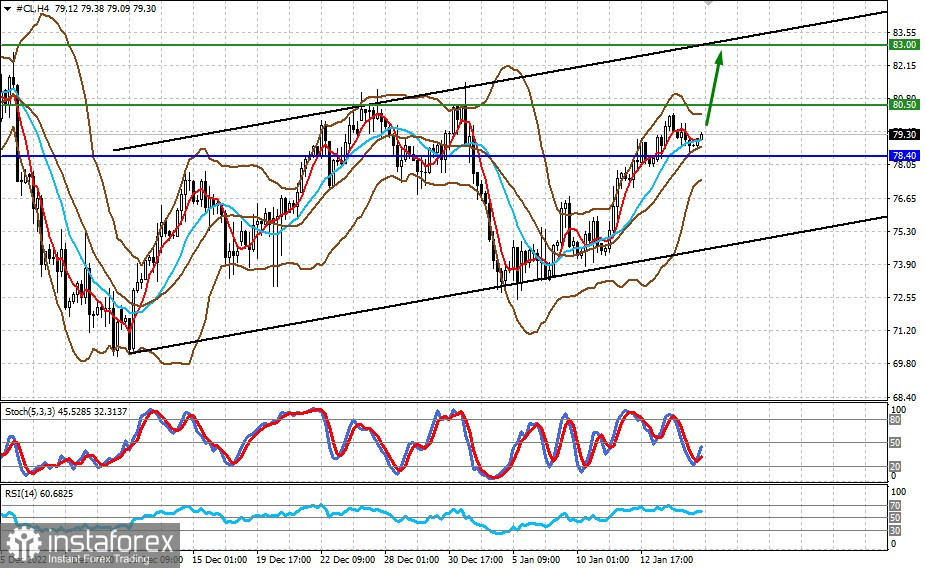

Oil

Oil is trading above 78.40 in the US. It could reach 83.00 if the price breaks above 80.50, which will happen in China's GDP data exceeds expectations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română