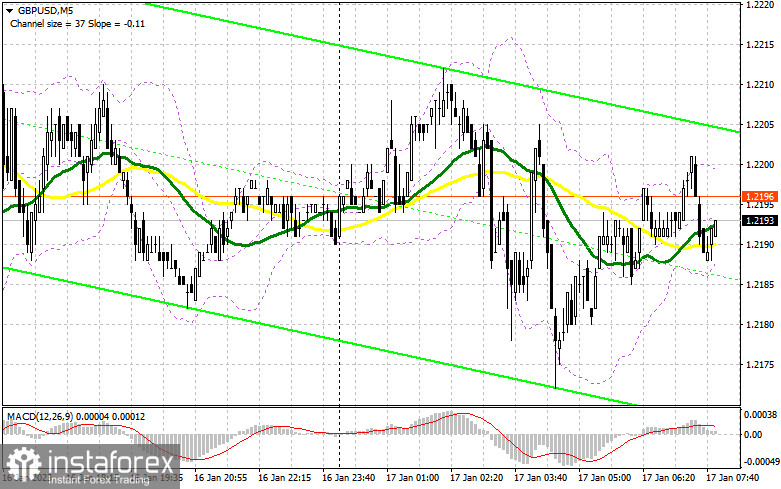

Yesterday, traders did not get any signal to enter the market. Let us take a look at the 5-minute chart to clear up the situation. In the second part of the day, the pair failed to reach the expected levels amid low volatility caused by a weekend in the US. Thus, there were no signals to enter the market.

Conditions for opening long positions on GBP/USD:

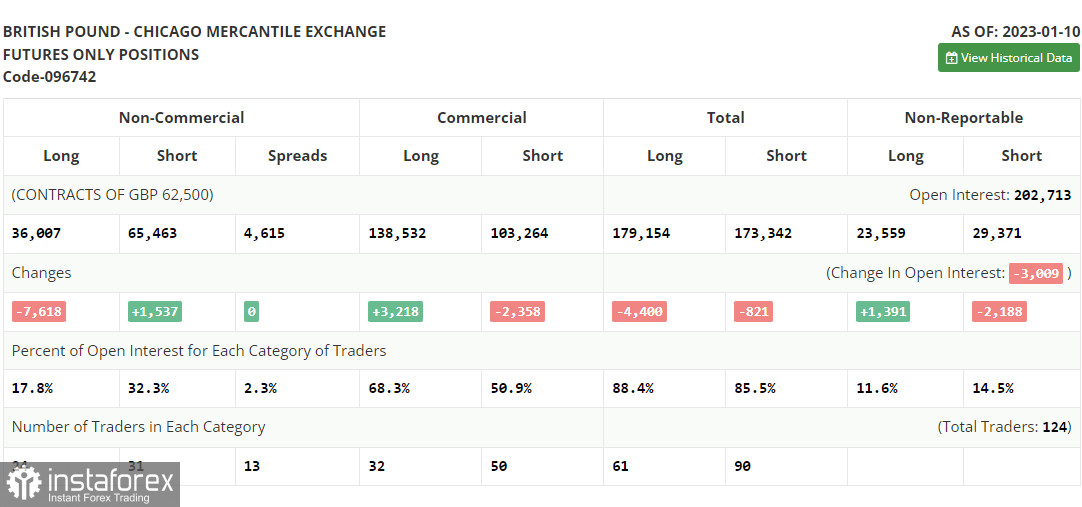

First of all, let us focus on the futures market situation. According to the COT report from January 10, the number of short positions jumped, whereas the number of long positions slumped. Notably, the report does not cover the US inflation figures published on Thursday. The data had a considerable influence on the market situation. That is why now, the situation is different. A decline in the US price growth recorded in December boosted demand for risk assets, including the British pound. Strong data on the UK labor market will allow the pound sterling to consolidate on the current highs and form a new uptrend. Traders should also pay attention to the comments that will be provided by the BoE's and the Fed's officials. The recent COT report unveiled that the number of short non-commercial positions increased by 1,537 to 65,463, while the number of long non-commercial positions dropped by 7,618 to 36,007, which led to a rise in the negative value of the non-commercial net position to -29,456 against -20,301 a week earlier. Notably, the negative value of the non-commercial net position has been rising for the third day in a row. This points to the fact that big traders do not expect an increase in the pound sterling and try to sell the asset. Be attentive when buying the asset at the current highs. The weekly closing price rose to 1.2182 from 1.2004.

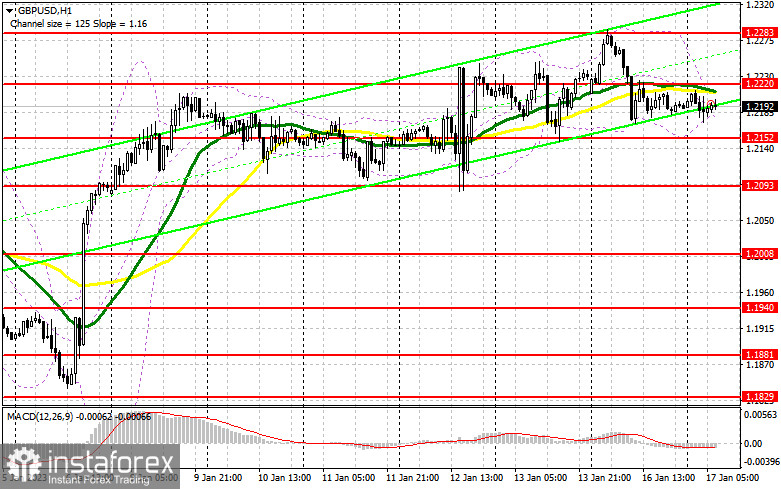

Today, the UK will publish a bulk of data on its labor market that will determine the pound's direction for the near future. Although the Bank of England does not need a strong labor market, it may help the country to cope with a recession. That is why strong data on a stable unemployment rate may lead to a further rise in the key interest rate, thus boosting the pound against the greenback. Traders expect data on the UK unemployment claims, unemployment rate, and average earnings. If the data is weak and the average earning index shows a slower rise, the pressure on the pound sterling will increase. In this case, only a false breakout of 1.2152 will give a buy signal, thus confirming the presence of those who want to buy the asset. In the event of this, the pound sterling will return to 1.2220, where there are bearish MAs. Without this level buyers of the asset are unlikely to form a new uptrend. If the price continues climbing after the news release, it may break 1.2220 and downwardly test it. In this case, it will rise to 1.2283, where traders should lock in profits. The farthest target is located at 1.2350. If the pound/dollar declines and buyers fail to protect 1.2152, bears will continue pushing the price lower. In the event of this, traders should avoid buying the asset until the price hits 1.2093. There, traders may go long only after a false breakout. It is also possible to open long positions just after a rebound from 1.2008, expecting a correction of 30-35 pips intraday.

Conditions for opening short positions on GBP/USD:

In the UK, strikes can start at any moment because of the plan proposed by the Prime Minister to raise the retirement age. This is a negative factor for the pound and like negotiations on Brexit and the implementation of the last points of the agreement, which have been violated since the signing of the entire protocol. Failure in this direction also means additional pressure on the pair. To build a more powerful downward movement, it is necessary to break below 1.2152. Before we expect the downward trend to continue, it would be nice to protect 1.2220 - a new resistance level formed yesterday. This will allow bears to prove their presence in the market. If GBP/USD grows after the labor market data, only the formation of a false breakdown at 1.2220 will give a sell signal. In this case, the pair may decline to the nearest support level of 1.2152. A breakout and an upward test of this range will give a sell signal with the target at the low of 1.2093. A more distant goal will be the area of 1.2008, where traders should lock in profits. If GBP/USD grows and bears fail to protect 1.2220, a new bullish trend will continue to form. In this case, the pair may climb to 1.2283. A false breakout of this level may give a sell signal. If there is no activity there, the pound sterling may jump to 1.2350. There, traders are better to sell the asset just after a rebound, expecting a decline of 30-35 points within the day.

Signals of indicators:

Moving Averages

Trading is performed slightly below 30- and 50-day moving averages, which points to a possible decline in the euro.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper limit of the indicator located at 1.2210 will lead to a new rise in the pound sterling. A breakout of the lower limit located at 1.2170 will exert pressure on the pair.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română