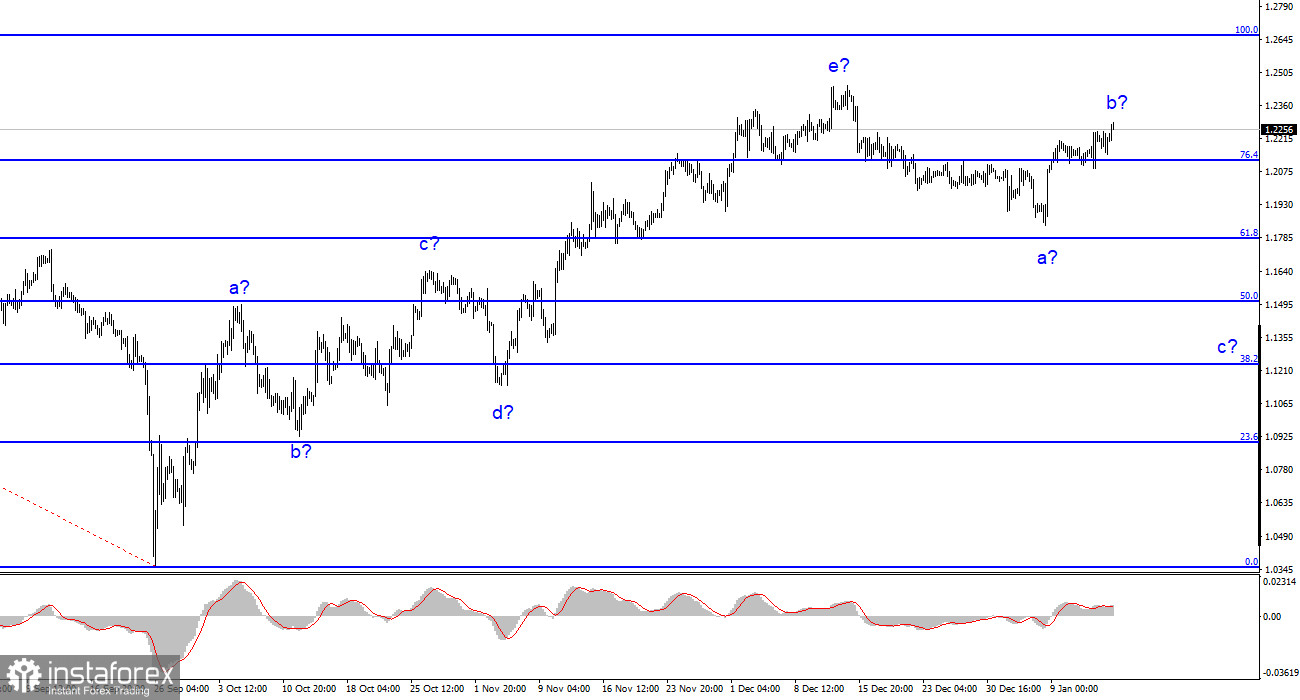

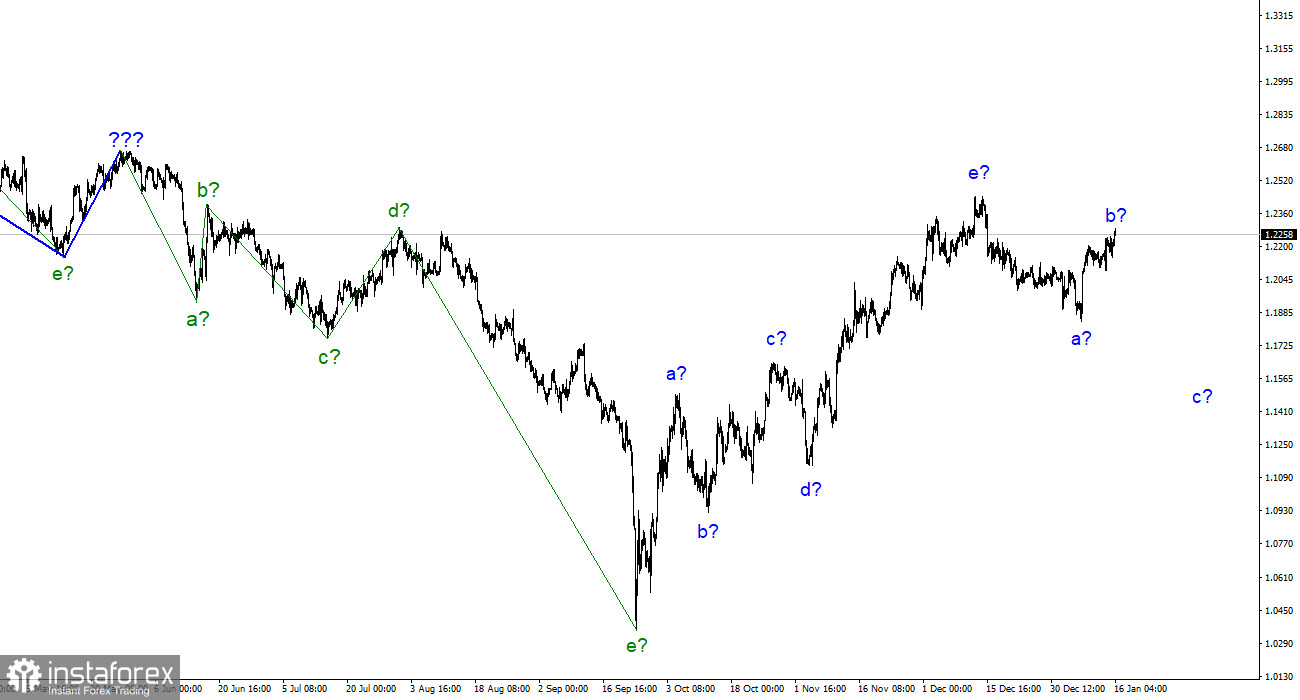

The wave markup for the pound/dollar instrument currently appears rather complex, but it doesn't call for any explanations and starts to diverge dramatically from the markup of the euro/dollar instrument. Our five-wave rising trend segment has the form a-b-c-d-e and is most likely already finished. Since there has been a very active departure of quotes from previously reached highs in recent weeks, the possibility of the British currency completing the upward trend segment is noticeably higher. As a result, I can say that the downward part of the trend has started to form and will include at least three waves. Additionally, the recent spike in the instrument's quotes could be wave b of this trend segment, which can take the form of a five-wave or a five-wave pulse. However, the drop in the British pound should continue because there has only been one downward wave created thus far, and it has not been in the strongest or most compelling form. There is no limit to how many times or how long the rising phase of the trend can become more convoluted, but this is not a typical occurrence. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

A decline in the pound could result from rising unemployment.

On Monday, the pound/dollar exchange rate decreased by 10 basis points. The building of wave b must be finished for it to be considered wave b at the current price levels. As a result, the demand for US money ought likely to start to increase today or tomorrow. However, there are no events scheduled for today in America, and all of the reports that were supposed to be released today in the UK will do so in a few hours. I want to concentrate on them.

Nothing can be expected from these reports at first sight. The unemployment rate is currently 3.7%, which is extremely low, but it will soon increase. Nearly all analysts agree with this. Many predict a growth of up to 5-6% for the current year, which will harm economic growth as people start to lose their employment and, as a result, spend less. The British economy is at the top of the list of nations where a severe or protracted economic slump is likely, so no one will be surprised by one today. As a result, today's unemployment rate could start to increase.

The payroll report is a murky document. Inflation in the UK is nearly twice as high as it is in the United States, so any gain in salaries below inflation is tough to consider favorable. Salaries will likely increase by 6.1-6.2%. Let me remind you that recent medical worker strikes in Britain started with demands for increased pay in the face of high inflation, the devaluation of the pound sterling, and high energy costs. In light of everything said above, I don't believe that current British statistics will support the demand for the pound. My opinion is that a scenario where the instrument decreases are more likely.

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1,1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over, however, it might yet take a longer form than it does right now. However, you should exercise caution when making sales at this time because the value of the pound tends to rise.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this is the case, a downward trend will likely be built for at least three waves, with a potential decline in the vicinity of the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română