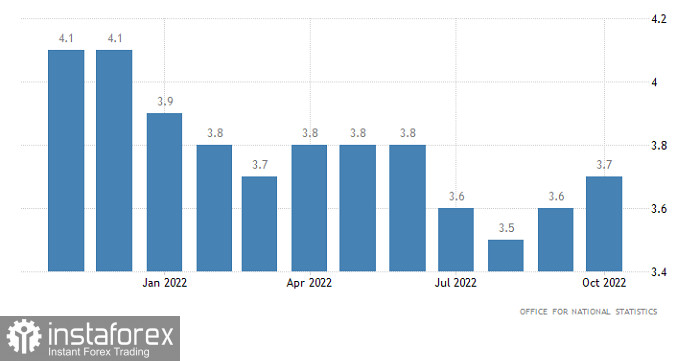

There is no wonder that the market got stuck amid the absolutely empty macroeconomic calendar. Today, the market is expected to remain stagnant despite the UK labor market reports. According to the forecast, the unemployment rate should remain unchanged. Thus, there is no reason to move.

What is more, tomorrow, the UK will disclose its inflation figures, whereas the US will report its retail sales and industrial production data. The publication of numerous important reports in one day and the long-lasting absence of macroeconomic news will boost the market. Traders will hardly take a risk until then. That is why the market is likely to remain stagnant, thus preparing for tomorrow's publications.

UK Unemployment Rate

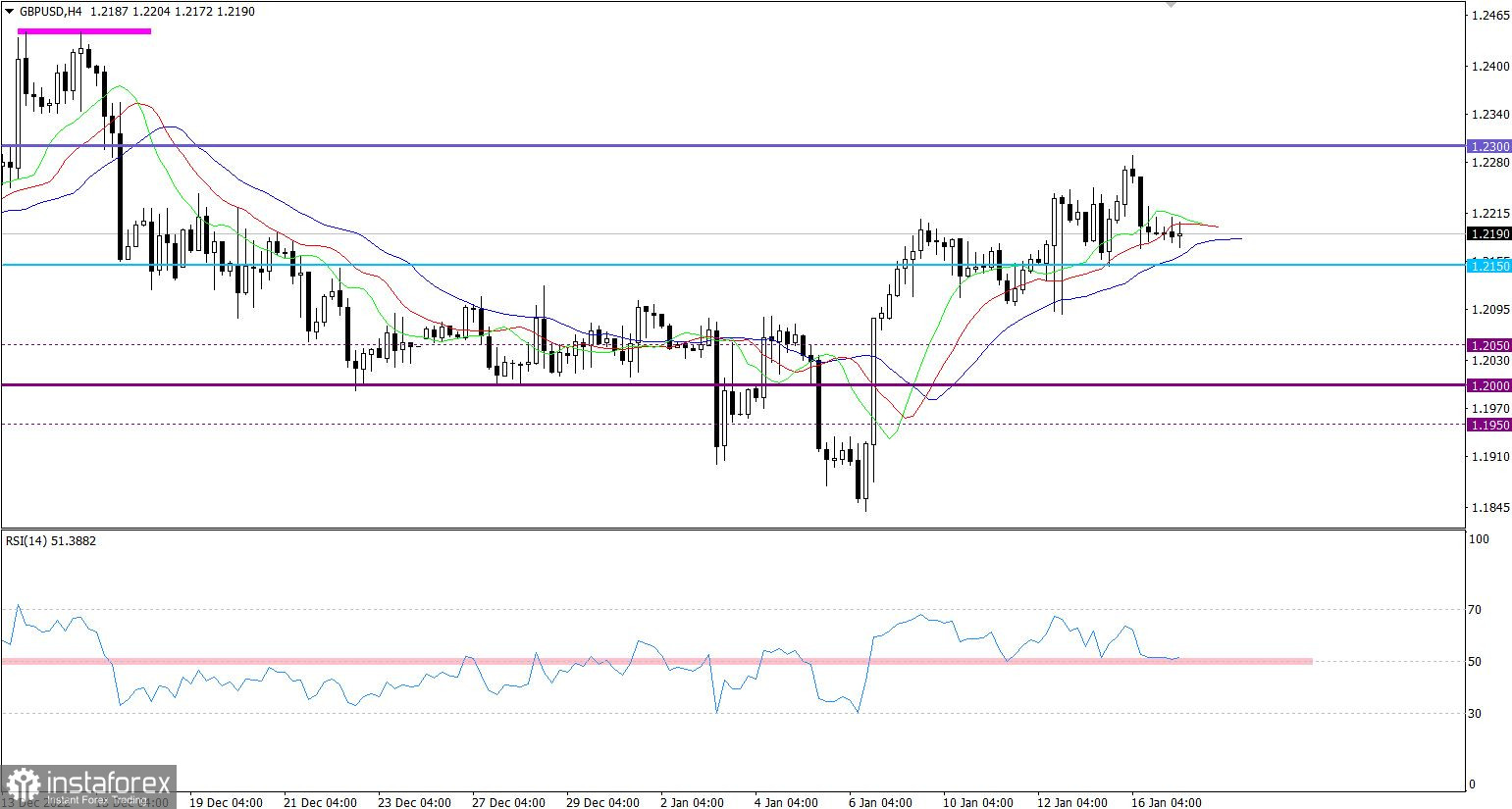

Approaching the resistance level of 1.2300, the pound/dollar pair caused a decline in the volume of long positions. As a result, the pair dropped by about 100 pips and entered the sideways channel.

On the four-hour chart, the RSI technical indicator is moving along the mid line 50, which corresponds to stagnation. Notably, the indicator did not settle below the middle line, which points to the bullish sentiment among traders.

On the four-hour chart, the Alligator's MAs have an initial intersection between the green and red lines. This technical signal points to stagnation. On the daily chart, the MAs are headed upwards, which corresponds to the upward cycle.

Outlook

The existing stagnation could also be considered an accumulation process, which may cause new price swings. The intermediate support level is located at 1.2150, while the resistance level could be seen at 1.2300.

Under the current conditions, considerable changes will take place only after the price settles beyond either control level at least on the four-hour chart.

In terms of the complex indicator analysis, we see that in the short-term and intraday period, the indicator is showing mixed opportunities. In the mid-term period, the indicator is pointing to the upward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română