Risk appetite surged since the start of the new year, putting pressure on dollar across markets. In fact, by the middle of January, all major global stock indexes had gained markedly, with European and Chinese indicators leading the way. US indicators, on the other hand, were struggling to keep up.

The main reasons for this changes are: firstly, there is China's move away from lockdowns, which, in itself, is a strong stimulus for the stabilization of the world economy and the evasion of a full-blown economic crisis. Commodity prices are the ones primarily supported by news from China, which indicates existing business activity.

The second reason is the noticeable increase in expectations that the Fed, after raising its key interest rate on February 1 by 0.25%, will take a pause in order to observe developments in the national economy. If that happens, even the hawkish statements of some Fed members on the need to continue raising interest rates above 5% could not dampen market sentiment.

But for today, market activity will be subdued as it is a holiday in the US - Martin Luther King Day. Movement will resume at the release of important reports, such as the consumer inflation in Canada, Eurozone and the UK. Japan will also hold a monetary policy meeting, but attention will be given more to the US data, namely the CPI report, retail sales and volume. Market players should also anticipate the speech of ECB President Christine Lagarde, who may comment on the outlook of the ECB's interest rate.

All signals are pointing to the continuation of positive dynamics in marketsm, atleast until the end of January 2023.

Forecasts for today:

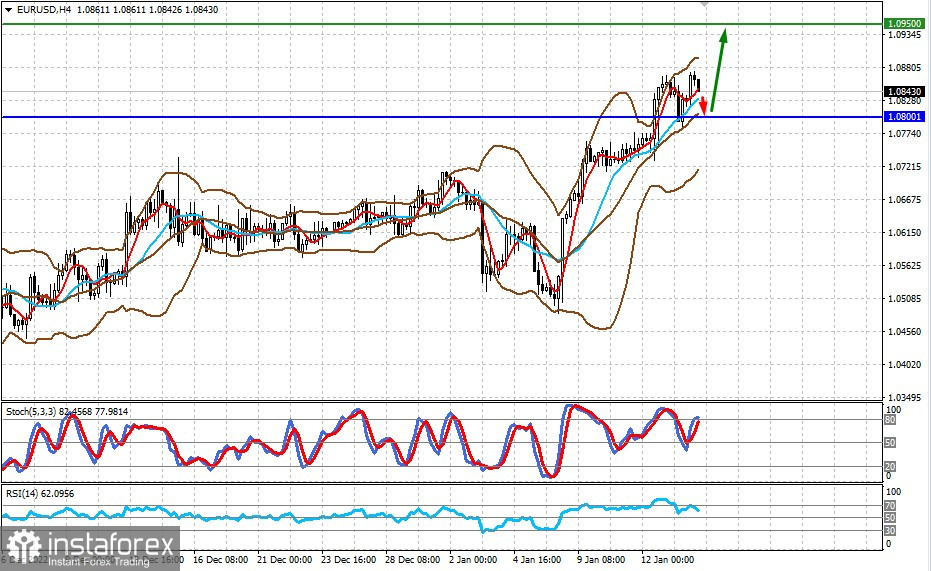

EUR/USD

Downward correction can be seen in the pair, primarily due to declining market activity caused by the holiday in the US. Most likely, the pair will continue rising towards 1.0950 after a local decline to 1.0800.

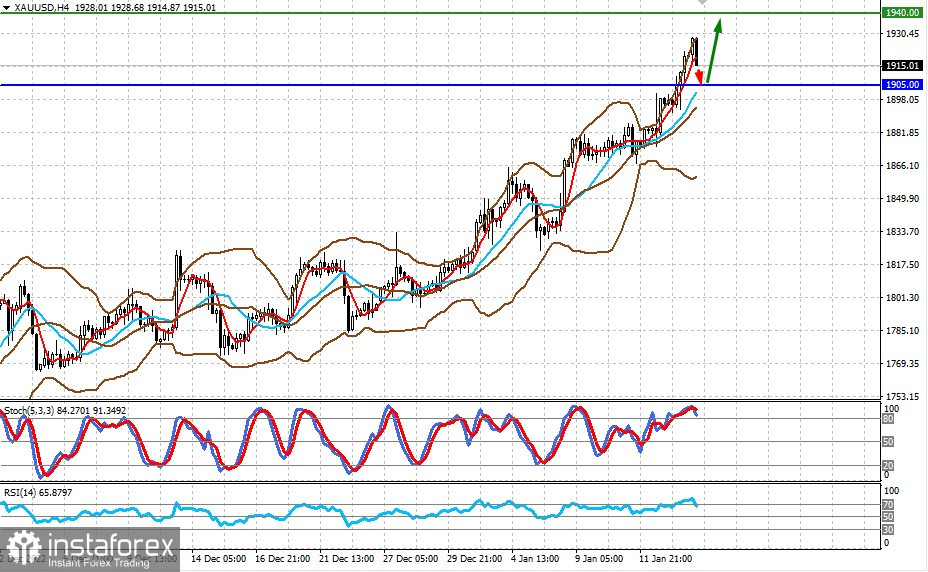

XAU/USD

Gold is also correcting downwards. It could fall to 1905.00 and then resume rising towards 1940.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română