When to go long on GBP/USD:

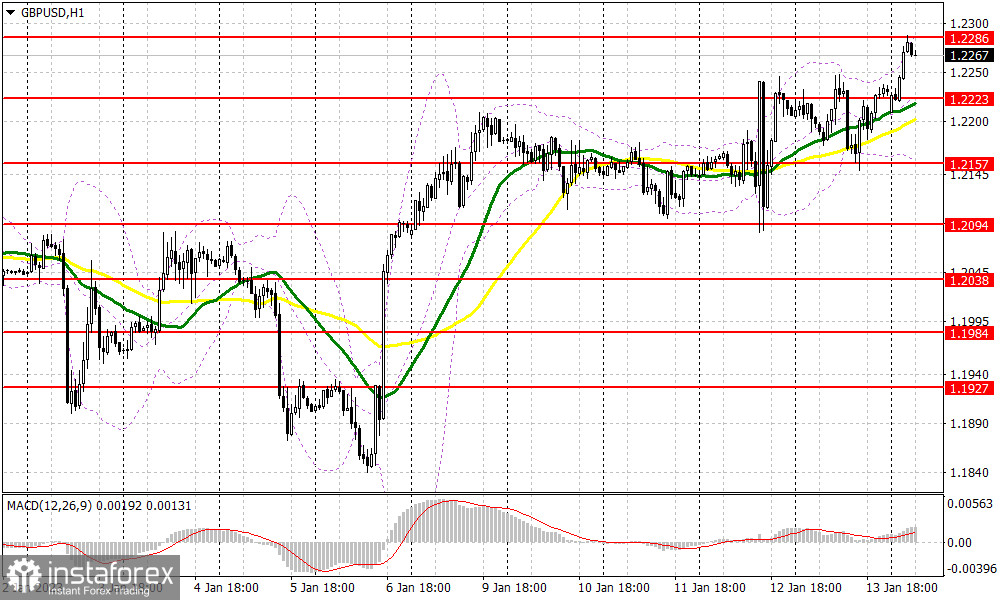

In today's Asian session, the bulls have already managed to reach 1.2223 and now their main task for the European trading session is to protect this level. A decline and false breakout of this level is a good buy signal. With this we can establish a stronger uptrend, hoping that the UK and the EU can reach an agreement on unresolved issues regarding Brexit. The nearest target will be the resistance of 1.2336, where I recommend to lock in profit. A more distant target will be 1.2386. If the bulls lose 1.2223 and the pair falls below this mark, I wouldn't be in a rush to open long positions. Better to wait for the pair to reach support at 1.2157 and buy the pound there, targeting an intraday correction of 30-35 pips. You can also buy GBP/USD around 1.2094.

When to go short on GBP/USD:

Bears need to regain control of 1.2223, as moving averages benefiting bulls are passing below this level. The bears will be able to do so since Bank of England Governor Andrew Bailey will deliver a speech today. His dovish statements about interest rates will put pressure on the pair. It will lead to a breakdown below 1.2223, and an upward retest will produce a sell signal to reach 1.2157, where I recommend locking in profits. A more distant target will be the low of 1.2094. If the pound is still in demand during the European session, don't be in a rush to sell. Better to wait for a test of the new high at 1.2286, and sell the pound there, if the pair performs a false breakout at this mark. You can sell GBP/USD immediately if it bounces off around 1.2336, or even higher from 1.2386, targeting a downward intraday correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages. It indicates that the bulls are trying to seize the initiative.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română