The EUR/USD closed the trading week at 1.0832. The bears failed to take revenge, though they tried, pulling the price to the 1.0782 target. But the situation was obviously not in favor of the dollar. Bears used the Friday factor ahead of the weekend, but even this couldn't help them end the trading day within the frame of the 7th figure.

Overall, last week was in many ways decisive. The US CPI growth report, which reflected a slowdown in US inflation, allowed bulls to build an uptrend. The pair changed values, having conquered the 8th figure for the first time in 9 months. Now the following targets loom on the horizon: 1.0930 (the upper limit of the Bollinger Bands, which coincides with the upper limit of the Kumo cloud on W1) and 1.1000 (key price barrier, which is psychologically important). But the pair needs appropriate informational background in order to reach these levels.

The main locomotive of the pair's growth was, in fact, not the inflation report. It only launched dovish expectations regarding the Federal Reserve's further actions. For instance, after this report, the probability of the Fed rate hike by 25 points after the February meeting rose to 93%. Also, the market started to talk about the fact that the central bank will prematurely complete the current cycle of monetary tightening (by revising the level of the final rate) and even move to a rate cut at the end of this year.

The issue of slowing down the pace of monetary tightening may be considered solved, while other scenarios look unlikely so far. However, if Fed officials soften their stance and US macroeconomic indicators come out in the red, reflecting the slowdown of the US economy, dovish expectations will rise, thereby putting additional pressure on the dollar.

Monday

US trading floors will be closed on Monday as the country celebrates Martin Luther King's Day. Among the major data is Germany's wholesale price index (which is a leading indicator of inflationary pressures in the country). According to preliminary forecasts, the index will continue its downtrend. The Eurogroup meeting will also start on Monday - the stance of the heads of the relevant ministries (economy, finance) might have an indirect impact on the euro's values.

Tuesday

China will release key data on the country's economic growth in Q4 2022. According to most experts, the Chinese economy will show negative dynamics. The abandonment of the "zero-Covid" policy actually took place at the end of November, and at the same time, as the unprecedented outbreak of coronavirus in the country (covid temporarily "seized" a large number of workers and disrupted supply chains). But if the figures surprise the market by ending up in the green zone, the dollar will be under more pressure, amid growing interest in risky assets.

During the European session on Tuesday, the indices from ZEW institute will be published. It is expected that the index of business sentiment in Germany will remain in the red zone but it will show positive dynamics (the growth is expected to be from -23 to -15). The same dynamics should be shown by the ZEW index.

Also on Tuesday, the head of the Fed Bank of New York, John Williams, is expected to deliver a speech. His rhetoric may provoke higher volatility for the pair. Williams stirred up the markets with his hawkish mood in late December, right after the announcement of the results of the December FOMC meeting. In his interview with Bloomberg TV, he said that the growth of consumer prices in the US is "stubbornly high", that's why the central bank will raise the rate "as high as it will take to get the inflation under control". According to Williams, who has a permanent vote on the Committee, inflation in the United States has begun to ease, but a "much more significant slowdown is needed for the Fed to soften its stance on the need to tighten policy". If Williams changes his mind (given the latest CPI growth data for December), the greenback will once again come under pressure.

Wednesday

The main focus of EUR/USD traders will be US data. First of all, the US will publish data on retail sales. December sales are expected to be negative, just as it was in November. Sales will continue to decline both with and without auto sales. That's bad news for dollar bulls.

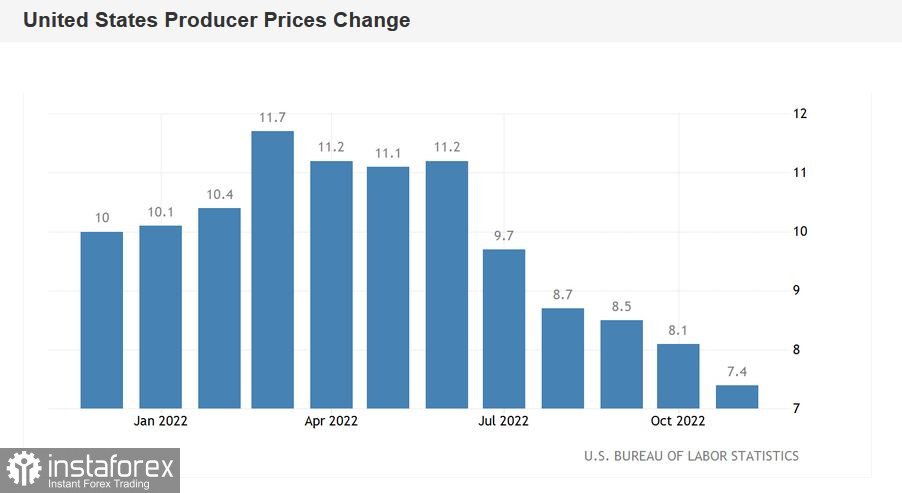

Also, bears will not be pleased with another indicator, which is the producer price index. As you know, this is an inflation indicator, which is closely watched by the Fed members. The index is forecasted to fall in December. Moreover, both the general indicator and the core one, excluding food and energy prices, are expected to decline. If the real figures coincide with projections, the bulls will get one more reason to make a price jump.

Also, the US will release data on industrial production. No good (for the dollar) news here either: in December the figure should come out in negative territory again (-0.1%), like in November (-0.2%).

And finally, Patrick Harker, head of the Fed Bank of Philadelphia, is expected to speak on Wednesday. Late last week he was the first Fed official to be straightforward, claiming a lower pace of rate hikes to 25 points because he thinks the peak of inflationary growth is over and the labor market is "in great shape". He is likely to stick to this position on Wednesday, putting additional pressure on the dollar.

Thursday

Thursday is also an eventful day in terms of fundamentals. On Thursday, the minutes of the European Central Bank December meeting will be released, which might support the single currency (if it shows a hawkish attitude of the policymakers). However, the impact of the document will be limited as many central bank officials have already voiced their position after commenting on the latest data on inflation in the eurozone.

However ECB President Christine Lagarde's speech is likely to trigger higher volatility in the pair, especially if she will join the hawkish wing of the Governing Council.

Thursday's U.S. session will feature the Philadelphia Fed Manufacturing Index (expected to be slightly higher but still in negative territory), the growth rate of building permits (expected to be positive) and the Initial Jobless Claims. On January 19, several Fed officials - Lorie Logan, Susan Collins and Lael Brainard will also speak.

Friday

Finally, on the last trading day of the week, there will be no important macro data. That said, several Fed officials will speak that day: Patrick Harker, Christopher Waller and John Williams. If we talk about the reports, we can highlight the index of home sales in the secondary market of the US (further decline is expected).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română