Yesterday was significant for many reasons than only the news on American inflation, which decreased significantly to 6.5% and led to the devaluation of the US dollar. In a fairly "dovish" statement, Patrick Harker, president of the Philadelphia Federal Reserve, advised against raising interest rates excessively. He thinks it will be sufficient to slightly reach the level of 5%, followed by a protracted hiatus. Such a statement meets the expectations of the traders themselves under the current circumstances. Let me remind you that there have been reports that the Fed may increase the rate to 5.5% or even 6% in recent weeks. The FOMC members themselves aggressively "fed" these reports by speaking in unison about the necessity of continuing to tighten the PEPP. However, the subsequent inflation data revealed that prices are declining steadily, negating the need to hike the rate much to avoid putting more strain on economic expansion.

"Although I anticipate the Fed to increase interest rates several more times this year, I believe the days of a single 75 basis point increase are likely behind us. In the future, I believe a 25 basis point increase will be acceptable "said Harker. As a result, yesterday's inflation report significantly reduced traders' expectations for the final rate. Given that the ECB refrained from making such claims, the dollar was given fresh justification to keep sliding.

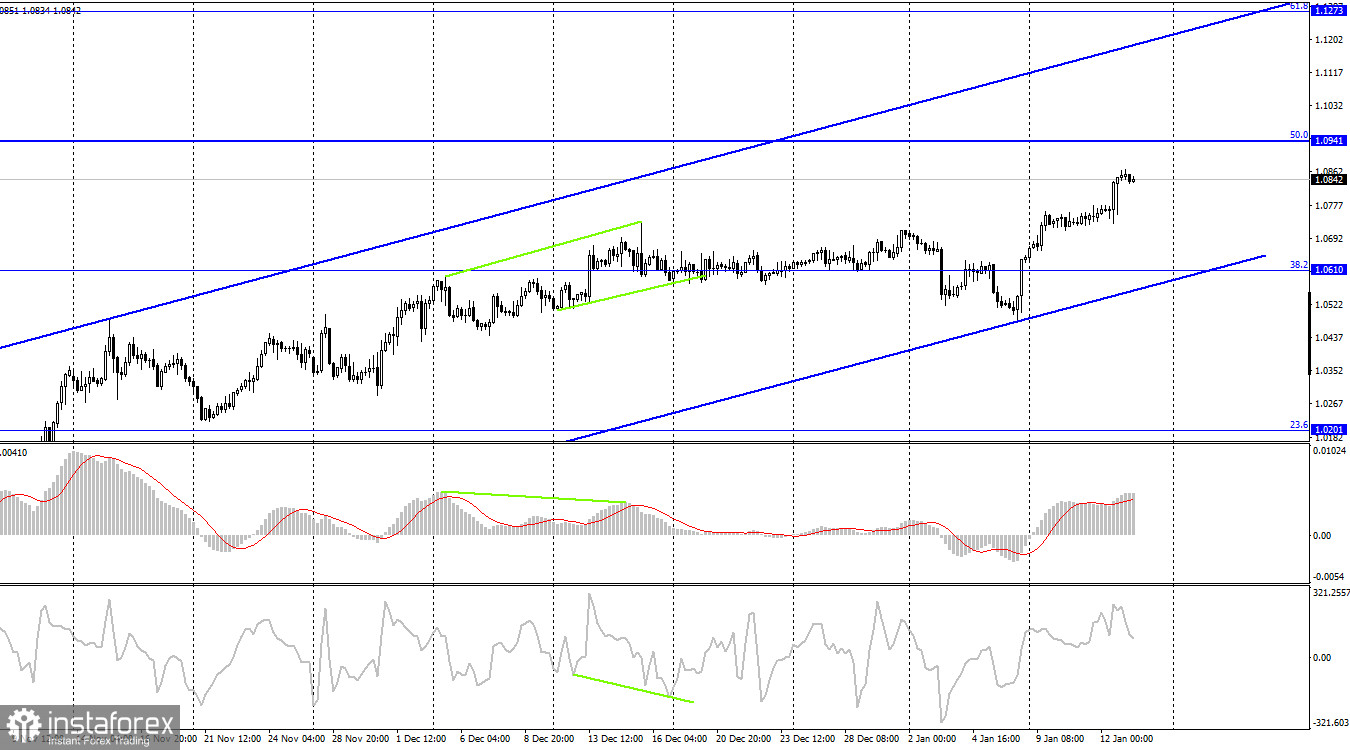

The pair reversed in favor of the euro on the 4-hour chart, and the decline toward the corrective level of 50.0% (1.0941) resumed. The US dollar will benefit from the comeback in prices from this level, and some prices may fall in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish."

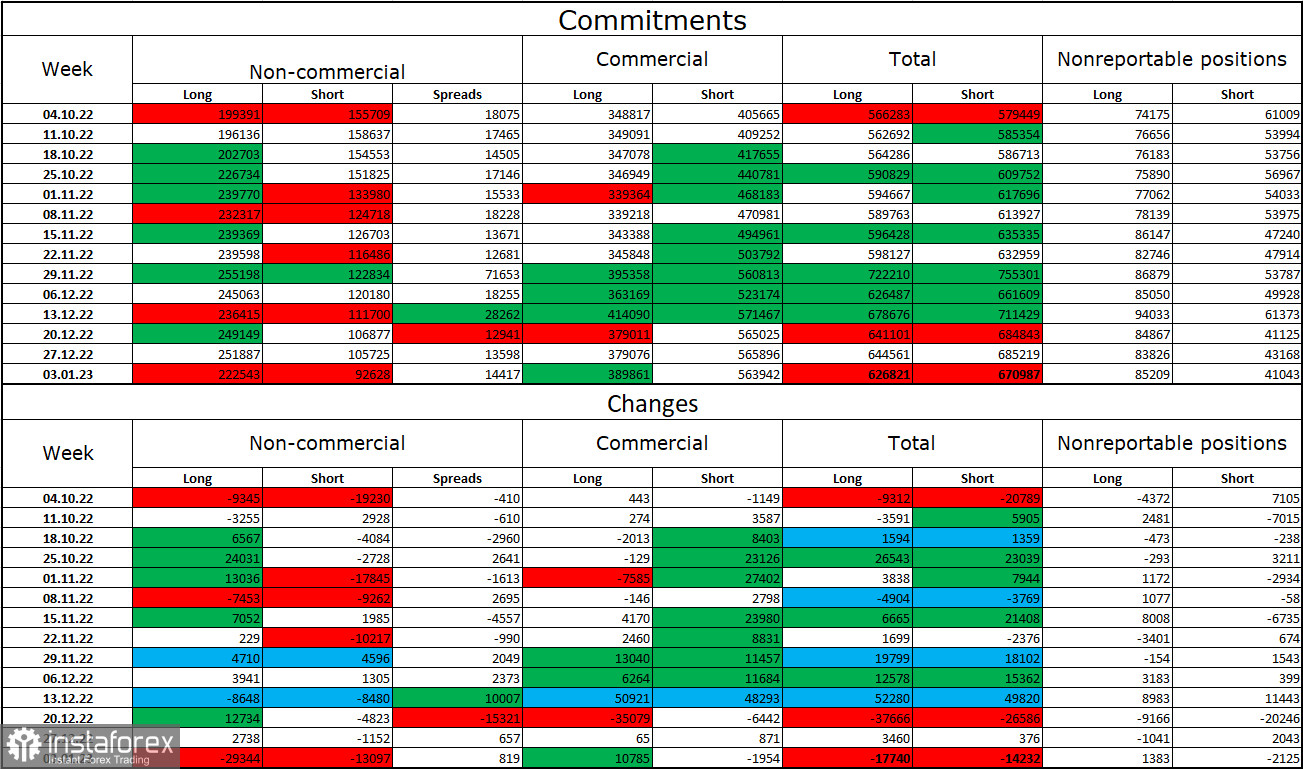

Report on Commitments of Traders (COT):

Speculators closed 29,344 long contracts and 13,097 short contracts during the previous reporting week. Large traders' optimism is still positive, but it has waned over the past two weeks. Currently, 222 thousand of long futures and 92 thousand of short contracts are all concentrated in the hands of traders. According to COT statistics, the value of the euro is now increasing, but I'm also conscious of the fact that there are 2.5 times more long positions than short positions. The likelihood of the euro currency's expansion has been increasing over the past few weeks, much like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Going beyond the ascending corridor on the 4-hour chart, however, would signal a strengthening of "bearish" positions soon.

The United States and the European Union's news calendar:

EU - amount of industrial production

US - University of Michigan's consumer sentiment index

The European Union and the United States each have one, albeit not particularly significant, entry on their respective economic calendars for January 13. The background information's impact on today's traders' attitudes will be minimal.

Forecast for EUR/USD and trading advice:

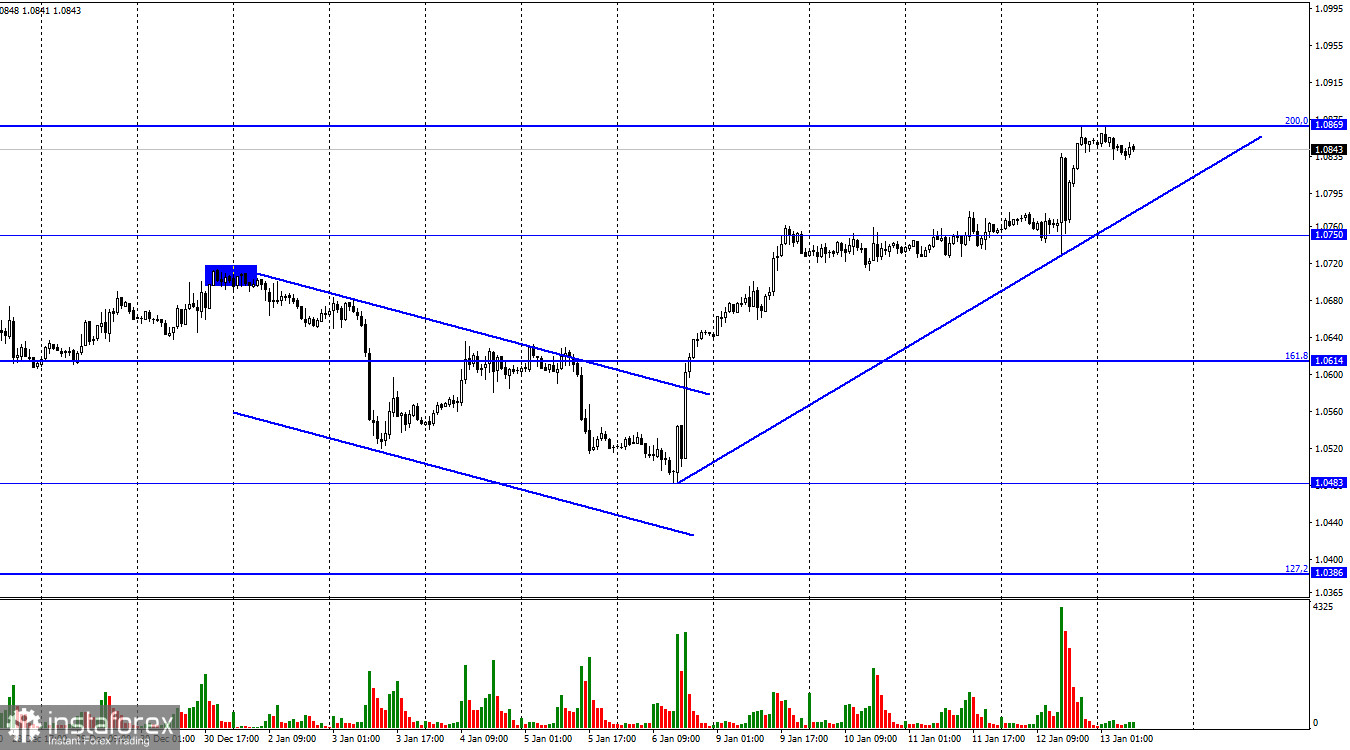

When the hourly chart bounces back from the level of 1.0869 with the trend line as its target, sales of the pair are possible. Alternatively, if the price closes below the trend line, 1.0614 and 1.0750 will be the next targets. With a target price of 1.0869, purchases of the euro currency are viable when it recovers from the trend line. Alternatively, if the price closes above 1.0869 and the goal is 1.1000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română