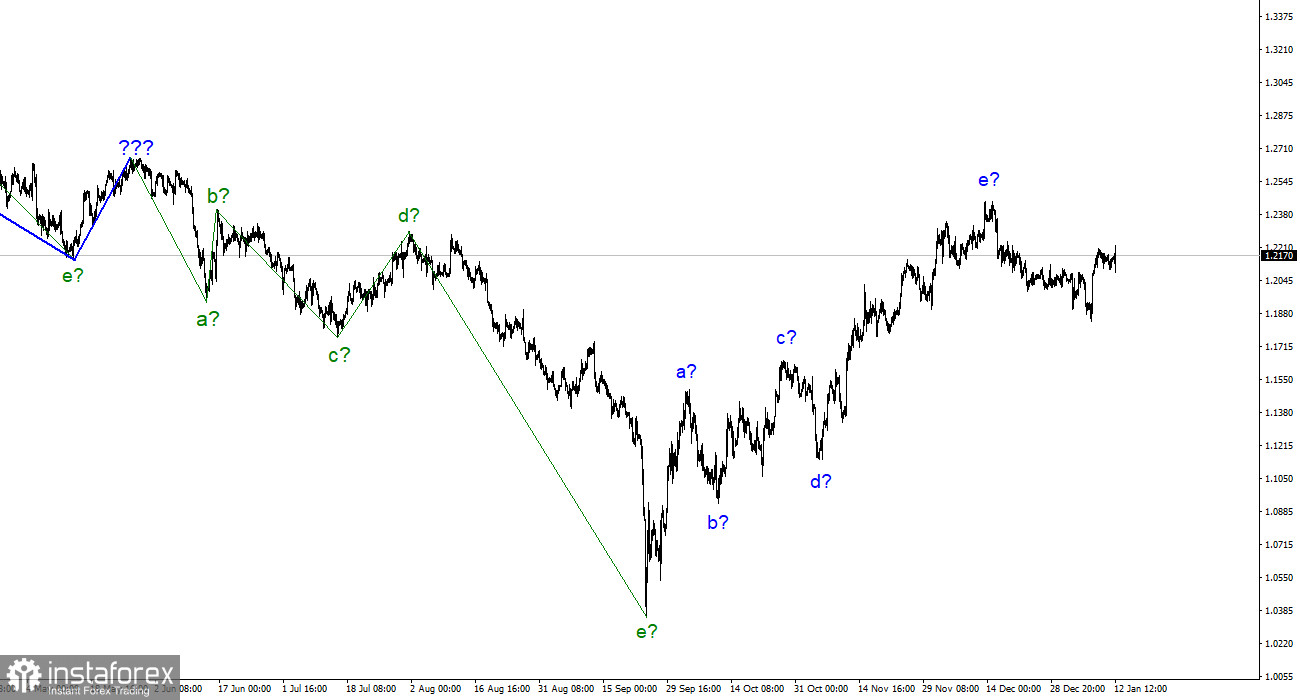

The wave markup for the pound/dollar instrument currently appears rather complex, but it doesn't call for any explanations and starts to diverge dramatically from the markup of the euro/dollar instrument. Our five-wave rising trend segment has the form a-b-c-d-e and is most likely already finished. Since there has been a very active departure of quotes from previously reached highs in recent weeks, the likelihood of the British pound completing the upward trend segment has increased noticeably. As a result, I can say that the downward part of the trend has started to form and will include at least three waves. Additionally, the recent spike in the instrument's quotes could be wave b of this trend segment, which can take the form of a five-wave or a five-wave pulse. However, the drop of the British should continue because there has only been one downward wave created thus far, and it has not been in the strongest or most compelling shape. Naturally, the rising portion of the trend can continue for an indefinite amount of time and have any duration. This situation, however, is not a typical one. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

The corrective wave b is still accumulating.

On Thursday, the pound/dollar instrument's exchange rate rose by a modest 70 basis points. The US currency avoided collapsing, which is already a major plus given the current situation. The intended wave b can continue to develop for a few more days now that it has split into three waves. The entire upward phase of the trend will become more challenging for the British if the rise in quotations persists into the following week. All of this makes me think of the portion on the downward trend that was finished with construction a few months ago. The development of five-wave descending structures followed by a maximum of one wave ascending was then something we routinely saw. History is cyclical.

At this point, it is crucial to comprehend not just the measures that central banks will conduct in 2023 but also what the markets anticipate from central banks in that year. And thus far, all indications point to the markets anticipating further significant tightening of monetary policy from the ECB and the Bank of England, but not from the Fed. Such anticipations might sustain strong demand for the euro and the pound for several more months, complicating the upward trend section for both currencies in multiple ways. I can only reach this conclusion at this time based on my research of the market's response to the most recent significant reports. If this supposition is true, the British pound can increase in value by another 300–400 points, or possibly more, since there is no upper bound on this expansion. The only thing that can stop the dollar from losing more ground is statements made by officials from the ECB and the Bank of England about switching to a more gradual tightening of monetary policy. Such reports have not yet surfaced.

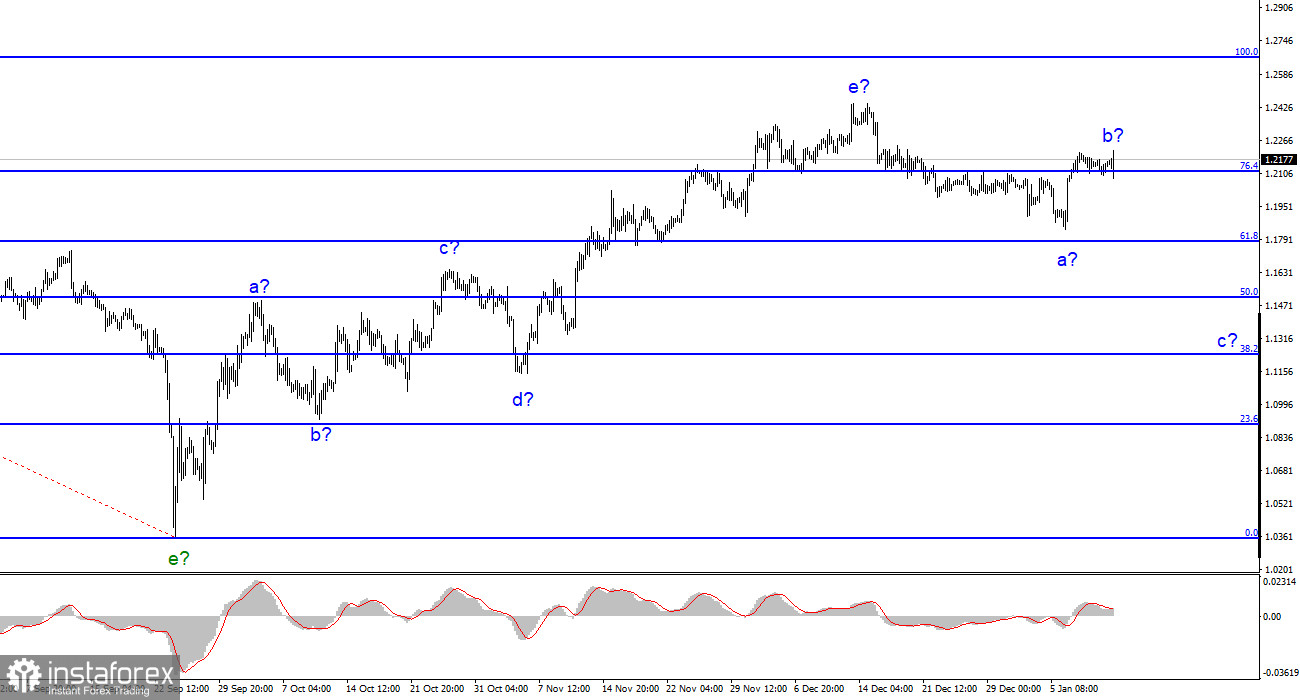

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over, however, it might yet take a longer form than it does right now.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished. If this is the case, a downhill portion will likely be built for at least three waves, with a potential decline in the vicinity of the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română