On Thursday, the GBP/USD and EUR/USD currency pairs displayed very comparable fluctuations. The price was close to the moving average line by the end of the trading day, continuing its upward trajectory. The market's response to the US inflation news was the same as it was for other currency pairs: the dollar first had a strong decline before experiencing a sharp rise. Although we've already stated that such a market reaction cannot be deemed sensible, the British pound has been trading in contrast to the euro in recent weeks. In recent weeks, the pound sterling has at least managed to exhibit a corrective movement, which is already quite positive and helps us realize that traders are not simply initiating long positions without considering the "foundation" and macroeconomics. Given that it is currently above the moving average, the march to the north can proceed. While there is no sell signal in the form of consolidation below the moving average, it is not worth selling, even though we think it would be ideal for the pair to adjust down a little bit more.

It should be recalled that market participants have recently given extremely little weight to British figures. The market's reaction to Friday's stories from the UK might not be affected because they are increasingly just ignored. However, from the perspective of the same monetary policy as the Bank of England, the UK's GDP and inflation indices are similarly crucial. However, the market feels that it should only rely on the Fed's actions, both present, and future, for some reason. Remember that the Bank of England hiked the rate eight times in the previous year, but the pound purposefully disregarded this information for the majority of the year.

Another QE program has been completed by the Bank of England.

The British regulator revealed yesterday that the $19.3 billion in securities it had managed to amass under the most recent QE program had been fully sold off from its balance sheet. In actuality, this scheme cannot be regarded as QE in the strictest sense. For those who may not recall, Liz Truss and Kwasi Kwarteng presented the "anti-crisis plan" in September, which called for tax cuts in the UK and different compensation plans for the British owing to a dramatic rise in the price of electricity. Following this information, the yield on Treasury bonds started to increase at an all-time high, which indicates sales to participants in the debt market. The Bank of England started purchasing bonds to stabilize the yield situation. The buying period, which covered October 14–28, had envisioned substantially greater volumes. All of these securities have currently been put back into circulation.

Recall that the Central Bank of Great Britain decided to begin a program of quantitative tightening back in the fall. This program includes the sale of securities from the bank's balance sheet that were accumulated as part of stabilization efforts during the pandemic. But last September, it was forced to repurchase them. Along with the ECB and the Fed implementing similar programs, the rate increase and the QT program should work together to combat excessive inflation. This news is not very significant for the British pound, but it cannot be ignored because BA can now start the big unloading of its balance.

On the 24-hour TF, the pair is close to the key line, and it is not yet apparent whether it will consolidate above or below it. Nevertheless, the technical picture still permits further expansion. The chances are now 50/50.

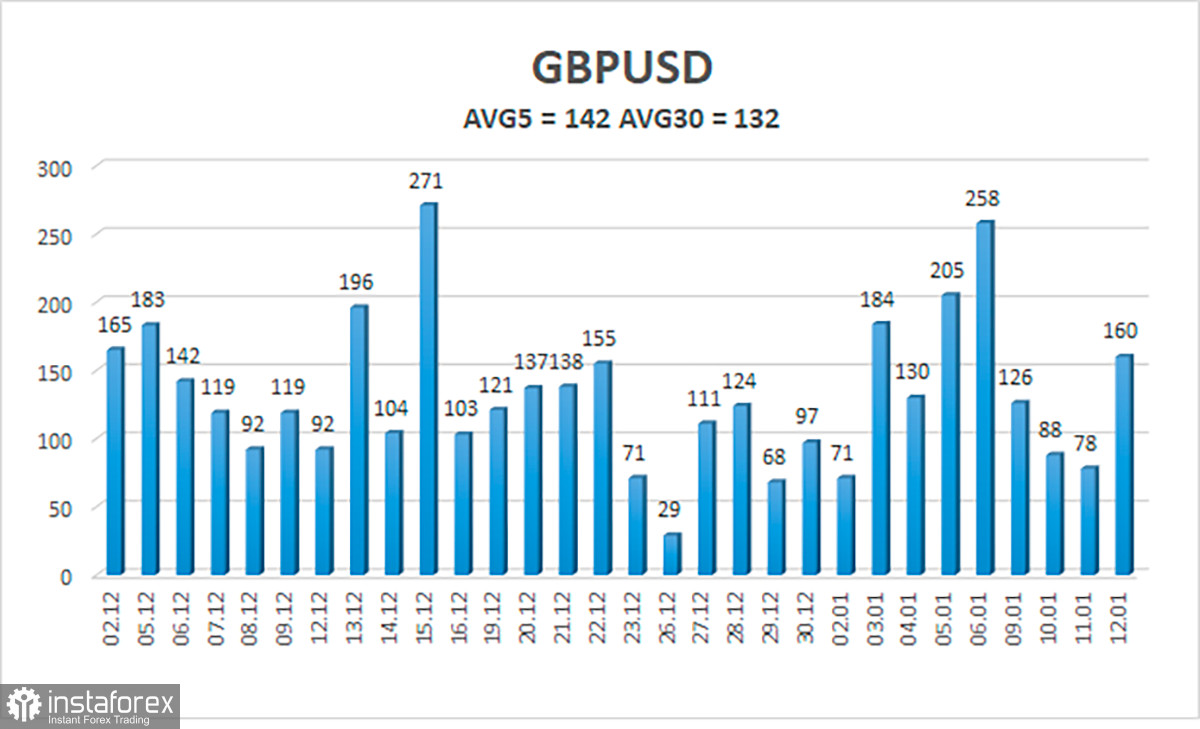

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 151 points. This figure is "high" for the pound/dollar exchange rate. Thus, we anticipate movement inside the channel on Thursday, January 12, with the levels of 1.1971 and 1.2274 acting as resistance. A potential continuation of the upward trend will be indicated by the Heiken Ashi indicator turning back to the top.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2329

Trading Suggestions:

In the 4-hour period, the GBP/USD pair bounced off the moving average and started trading higher again. Therefore, until the Heiken Ashi indicator swings down, it is still possible to hold long positions with goals of 1.2329 and 1.2358. If the price is firmly anchored below the moving average, short trades can be opened with goals of 1.2074 and 1.2024.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română