Yesterday's US inflation data came out as forecasted. Despite a 0.3% y/y rise in the monthly core CPI, the index declined to 5.7% from the previous 6.0% y/y and the CPI was 6.5% y/y against the previous 7.1% y/y. The S&P 500 stock index was up 0.34%, the VIX volatility index, otherwise known as the risk index, was down 10.72%, and the yield on 5-year US government bonds fell from 3.66% to 3.53%.

All this lifted the euro by more than 90 points so it is able to continue the upward movement. The target level is 1.0990, which is the Fibonacci reaction level (not the standard one) of 314% from the August 28-October 4 movement.

There could also be a subsequent market reversal to a medium-term trend below parity, perhaps a reversal divergence will start to form from 1.0990. But for the time being, I expect EUR to rise until it grows tired of doing so.

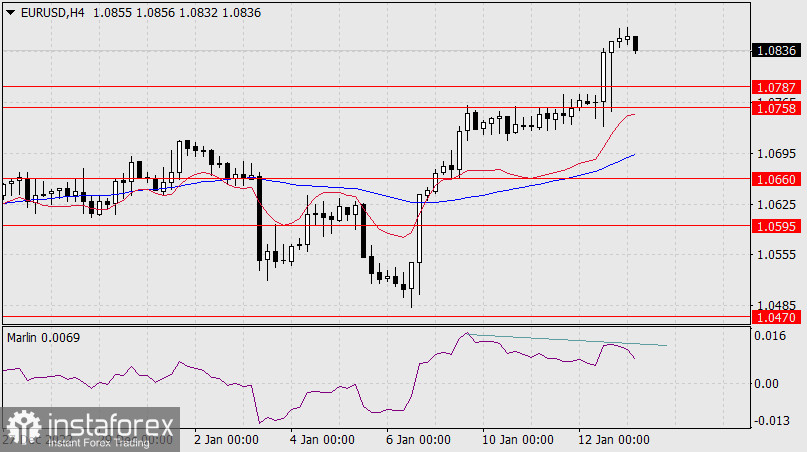

On the four-hour chart, a weak divergence is formed, which is a sign of forthcoming consolidation. Upon completion of the consolidation, I expect the pair to continue rising. The general trend on this chart is an uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română