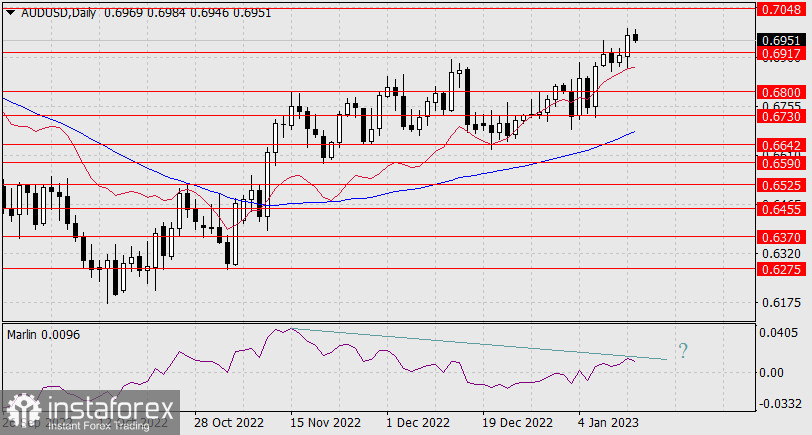

The Australian dollar rose 61 pips on Thursday due to good data on lower US inflation. The 0.7048 target level is about 80 pips away. It is possible for the price to reach that level, but the possible divergence from this level will be much stronger than the one from the current levels.

This morning's figures from Australia and China are pessimistic. Home loans in Australia fell by 2.0% m/m, investment lending for homes fell by 3.6%, China's trade surplus increased to $78 billion in December from $69.8 billion in November, but exports fell by 9.9% in December compared to the same month in 2021, while imports dropped 7.5% on a yearly basis, less than the expected 9.8%. As a result, we expect the price to settle at the support of 0.6917. Consolidation under the level, which will not happen today, will open the next target at 0.6800. But for now we are watching the development of moderate growth.

On the four-hour chart, a price divergence has formed with the Marlin oscillator. The general trend is still growing. After the end of the correction, the price can rise to the 0.7048 target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română