EUR/USD nearly hit a 9-month high, rising to the eighth figure for the first time since April last year and hovering around 1.0868. However, this breakthrough should be viewed from a broader perspective, in the context of the ambitions to reach the main target of 1.1000. Last week, the 10th figure was looming somewhere over the horizon, whereas by now there is nothing left to this target, less than 200 pips.

The most important release of the week

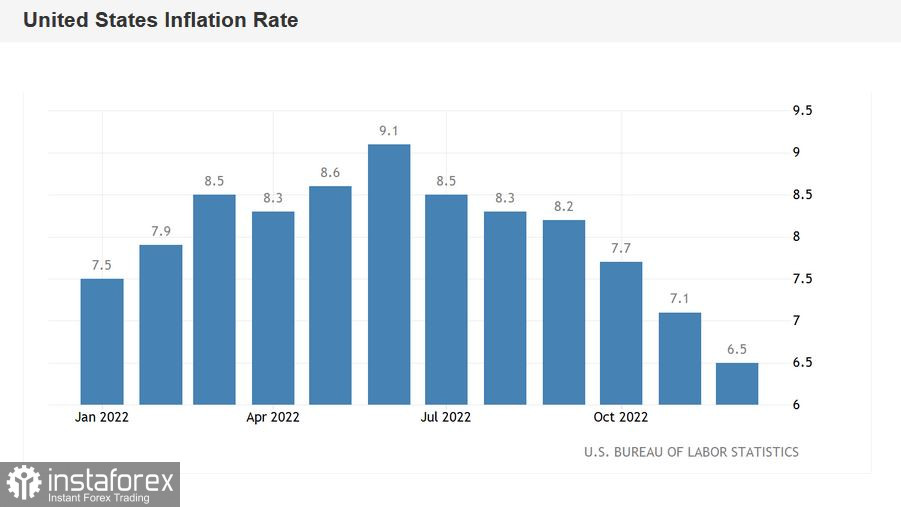

The latest US inflation data was released on Thursday, reflecting a further slowdown in price increases. This is the key report of the week, the consequences of which will be felt for quite a long time – until the Federal Reserve's first meeting this year. Speaking in the language of dry figures, the situation is as follows. The Consumer Price Index (CPI) for December showed a 6.5% rise in prices over last year, thereby showing a downtrend. We are seeing a persistent trend: the indicator has been declining for the sixth straight month, after reaching a peak of 9.1% in the summer. On a monthly basis, the CPI also disappointed dollar bulls as it decreased 0.1% over the prior month, falling into negative territory for the first time in a long time.

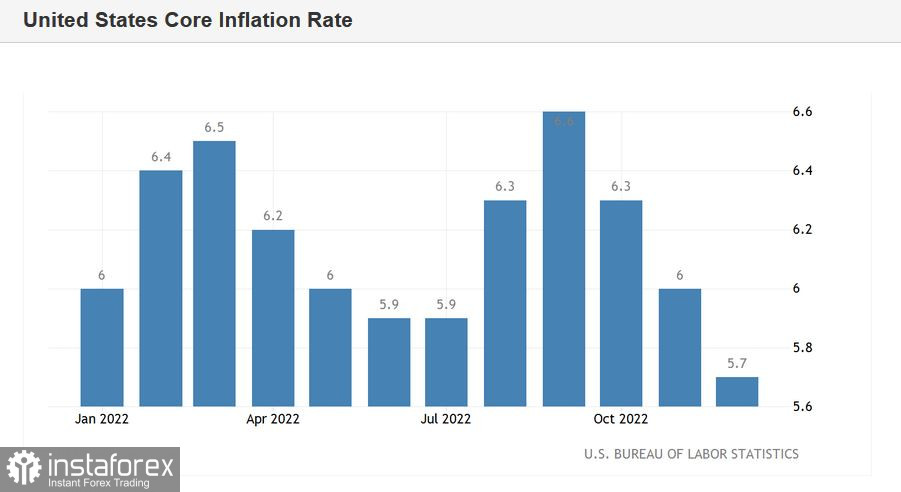

The so-called core CPI, excluding food and energy prices, showed similar dynamics. In December it was up 5.7% from a year earlier. Here we can also talk about the trend – the indicator shows a downtrend for the third straight month. Let me remind you that a 40-year high was recorded in September, when the core index jumped to 6.6%. But it was a peak value, after which the indicator gradually (but consistently) declined.

Last Friday, key data on the growth of the labor market in the US were published. The latest Nonfarm data was also not in favor of the dollar, although almost all components (except salary) came out in the green zone. In particular, the unemployment rate fell to 3.5% (from the previous value of 3.7%), while the growth rate of average hourly wages slowed down to 4.6% in annual terms. I would like to note that from January to September last year, the salary component consistently exceeded or corresponded to the 5% level. There has been a consistent downtrend since October.

In other words, amid a decrease in the unemployment rate, inflation is consistently slowing down. And it's not just about the dynamics of the CPI and the basic PCE index. For example, the structure of reports on the growth of the ISM manufacturing PMI and ISM services PMI also indicates similar trends: in particular, none of the six main manufacturing industries reported an increase in prices in December.

Consequences of the inflation data

Now we can say that the Fed can afford, firstly, to move to more moderate steps in the context of raising interest rates (that is, to slow down to 25 points), and secondly, to revise the peak value of the rates downward (at the moment, let me remind you, the Fed has declared a rate of 5.1%).

The relevant assumptions (especially with regard to the pace of monetary tightening) are not only being discussed in the foreign exchange market, they have already taken the form of a "stated fact". Judge for yourself. According to the CME FedWatch Tool, the probability of a 25-point rate increase at the February meeting last Friday (before the release of the Nonfarm data) was 55%. After the US labor market data, the odds increased to 77%. Whereas on Thursday, after the release of the inflation report, the chances of implementing a 25-point scenario jumped to 91.2%.

Traders are actually confident that the US central bank will reduce the rate hike starting from the first meeting in 2023. And this is despite the fact that on Monday, representatives of the Fed (Daly and Bostic) voiced rather hawkish stances, predicting the final rate in the range of 5.0 – 5.25% and allowing a 50-point increase in February. As you can see, the market has made its own conclusions based on the latest macro data.

At the same time, representatives of the European Central Bank almost in unison declare the preservation of the hawkish course, hinting at a willingness to support a 50-point rate hike at the next two meetings. Hawkish statements were made, in particular, by Martins Kazaks, Isabelle Schnabel, Robert Holtzman, Olli Rehn and Francois Villeroy de Galo.

Conclusions

All this suggests that the EUR/USD pair retains the potential for further growth. We can assume that after a possible bearish pullback, bulls will resume the upward movement. There is only one sufficiently significant resistance level on the way to the main price barrier (1.1000), which corresponds to the 1.0930 mark (at this price point, the upper line of the Bollinger Bands indicator coincides with the upper limit of the Kumo cloud on the W1 timeframe). In general, the ninth figure (and the 1.0930 mark itself) will be the bulls' next target in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română