Today, January 12, Thursday, the US dollar dropped significantly once more. Let me remind you that last Friday, reports on the unemployment rate, the labor market, and business activity were released in the United States for the first time in 2023. 223 thousand people were employed, the unemployment rate declined to 3.5%, and the ISM index unexpectedly went below the 50.0 level. Generally speaking, the only ISM index that is detrimental to the dollar is the one for the services sector. The remaining news is all favorable in my opinion, but the demand for the US dollar is still down significantly. The demand for the dollar was steady at the start of this week, but today data on inflation in the United States was released, which did not appear to startle the market but sparked a strong reaction. The market anticipated a decrease in the consumer price index of 6.5% y/y, which exactly happened. The market also anticipated a 5.7% y/y decline in the base index. There were no additional significant occurrences today.

It turns out that although both results from the same report were almost exactly in line with predictions, the demand for US dollars nonetheless decreased, preventing both instruments from starting (or continuing) to build the correction portion of the trend. It is vital to note that the subsequent activities of central banks, in this case, the Fed, are more significant than inflation itself. Michelle Bowman, one of the FOMC's voting members, recently predicted that the rate will increase because inflation is still too high. At a Florida event, Bowman stated, "I believe we can cut inflation without a big economic slump as the jobless rate continues at its historic lows. Other FOMC members had previously argued for the continuation of monetary policy tightening. However, the market appears to be responding that all interest rate increases have already been fully absorbed by the US dollar's constantly declining demand. The rate is anticipated to climb to a maximum of 5.5% by the market, though it may be lower following today's inflation report

It is important to keep in mind that the demand for the currency is supported by a tighter monetary policy. Therefore, as expectations for the rate decline, so does the demand for the currency. Therefore, from a wave perspective, I continue to anticipate the development of downward trend sections. Despite their significant length and complexity, the market indicates that it is willing to build upward segments. Only figures on British GDP, European and British industrial production, and the American University of Michigan's consumer sentiment index are available this week. The recession in the UK has reportedly already started, thus the most significant GDP data is likely to show a decrease. If this is the case, it would be difficult to predict that the GDP will increase over a single month.

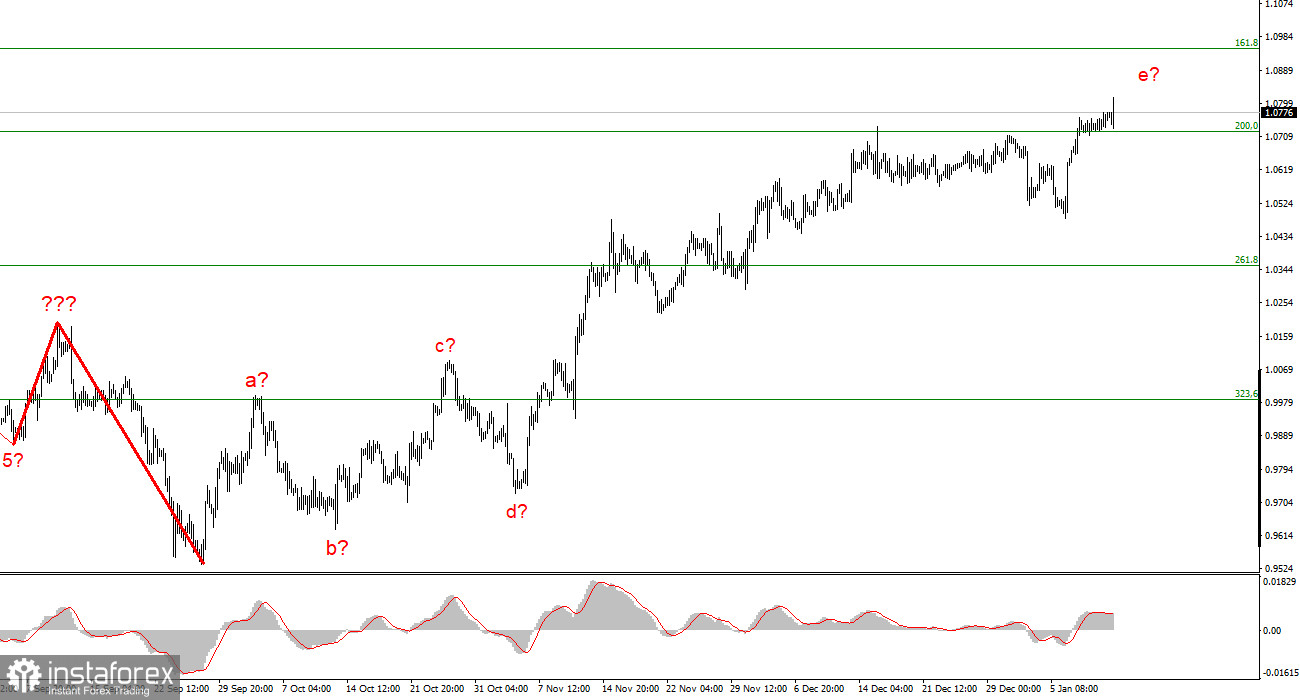

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted 0.9994 level, or 323.6% per Fibonacci. The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening.

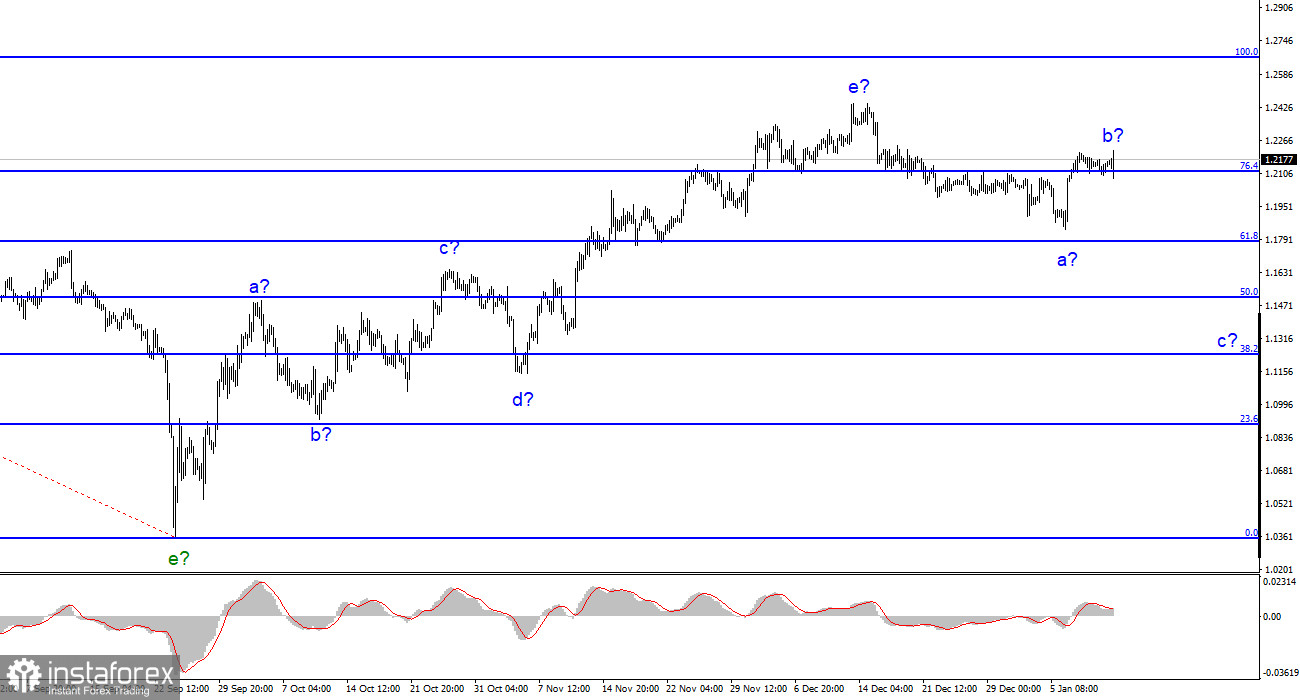

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over, however, it might yet take a lengthier shape than it does right now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română