EUR/USD

Larger timeframes

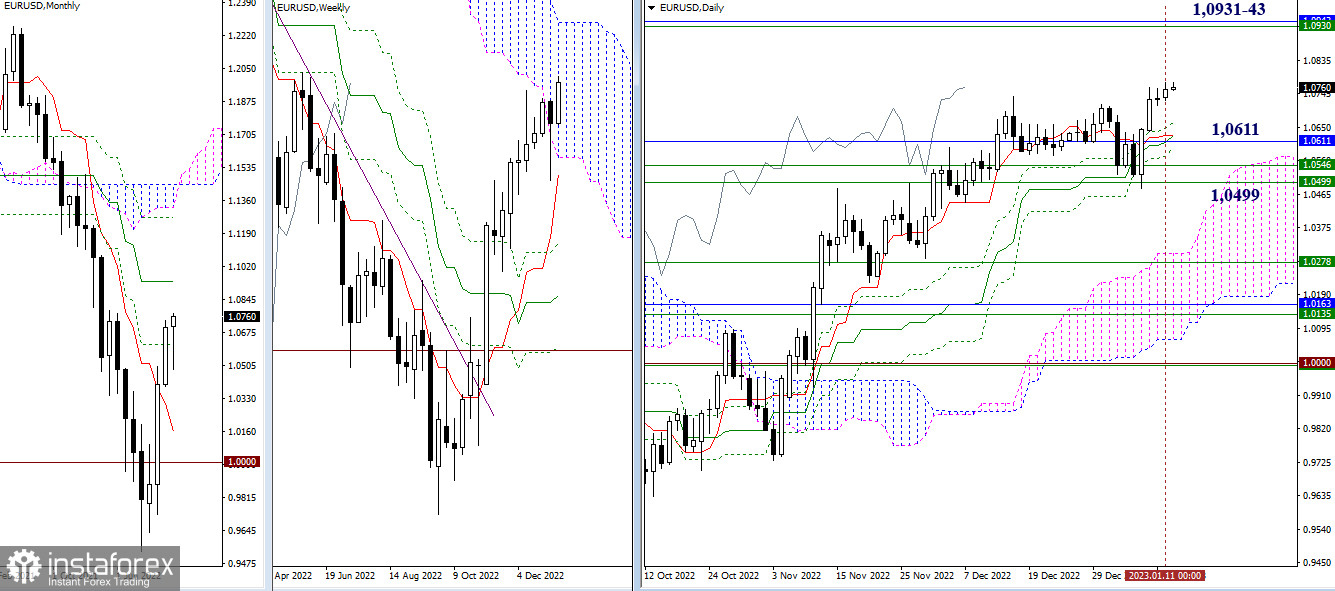

The bulls again printed a higher intraday high, but despite intraday moves, EUR/USD closed yesterday with a minor gain. The nearest upward target remains the same: 1.0931-43 (the upper border of the weekly cloud + a one-month trend line). In case instrument develops the downward correction, the price will first find support at the daily Cross of 1.0664-29. The next support levels are seen at 1.0611 and weekly support of 1.0546 – 1.0499.

H4 – H1

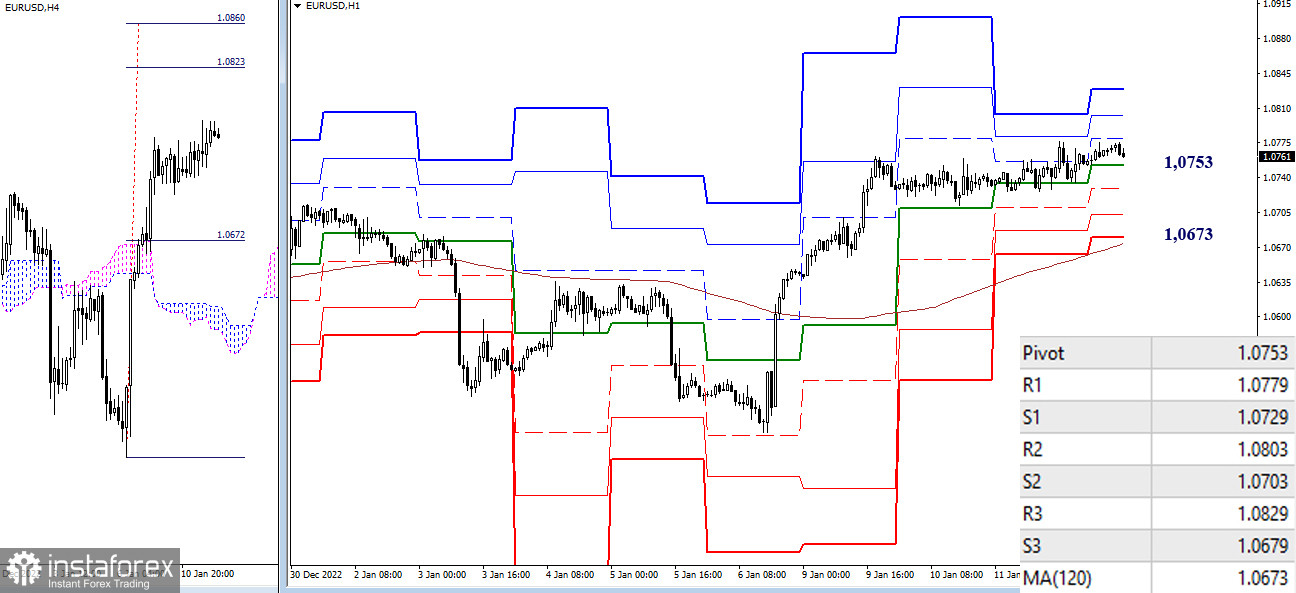

On smaller timeframes, EUR/USD has been trading sideways with a slight bullish bias for a few recent days. The euro bulls are holding the upper hand, using the central pivot level at 1.0753 as the main support of the ongoing move. In case the upward move continues today, the instrument will face resistance of classical pivot levels at 1.0779 – 1.0803 – 1.0829. Alternatively, if the bears enter the market, they will focus on passing support of classical pivot levels at 1.0729 – 1.0703 – 1.0679. Once they are passed, the bears will begin testing more significant support at 1.0673, a weekly long-term trend line.

***

GBP/USD

Larger timeframes

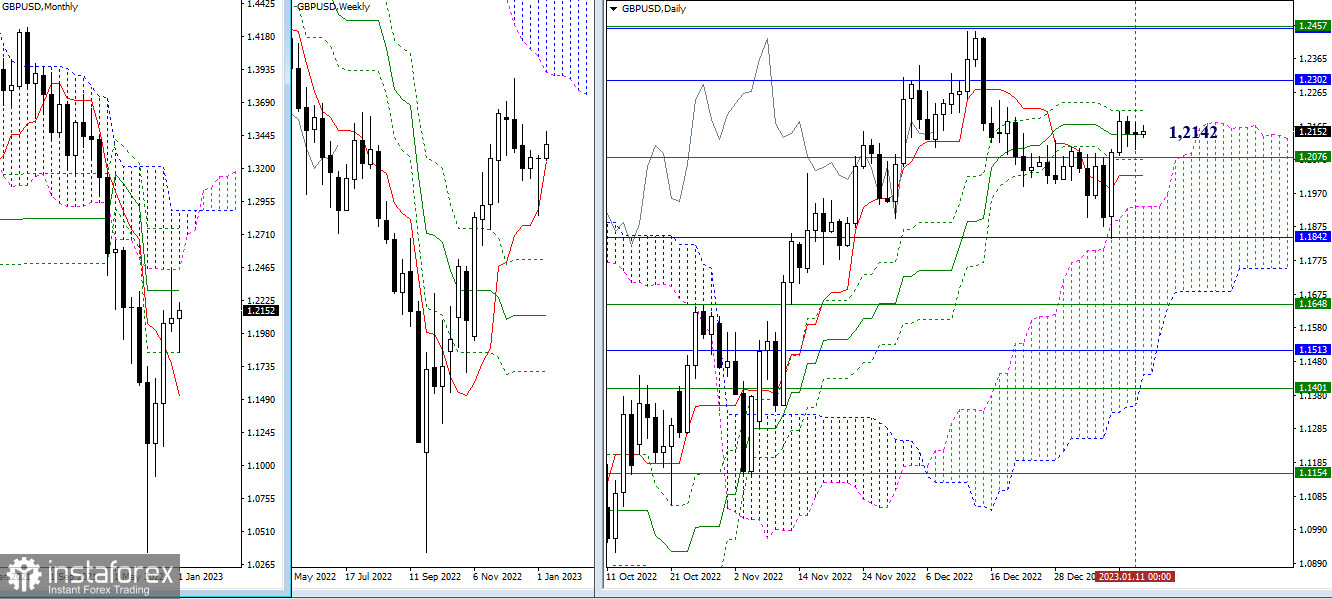

GBP/USD entered the gravity zone of 1.2142, the medium-term trend on the daily chart and slowed down its move. Under the current market conditions, the bulls have the following aims: to terminate the dead intraday Ishimoku Cross (1.2214), to test the resistance area of 1.2302 – 1.2457, and to adjust the price move.

If the bearish sentiment intensifies, in the next move, the price is expected to pass support levels of 1.2076 – 1.2025 – 1.1933 – 1.1842. After the price settles below the above-said support levels, the instrument will be able to rebound according to the scenario of December.

H4 – H1

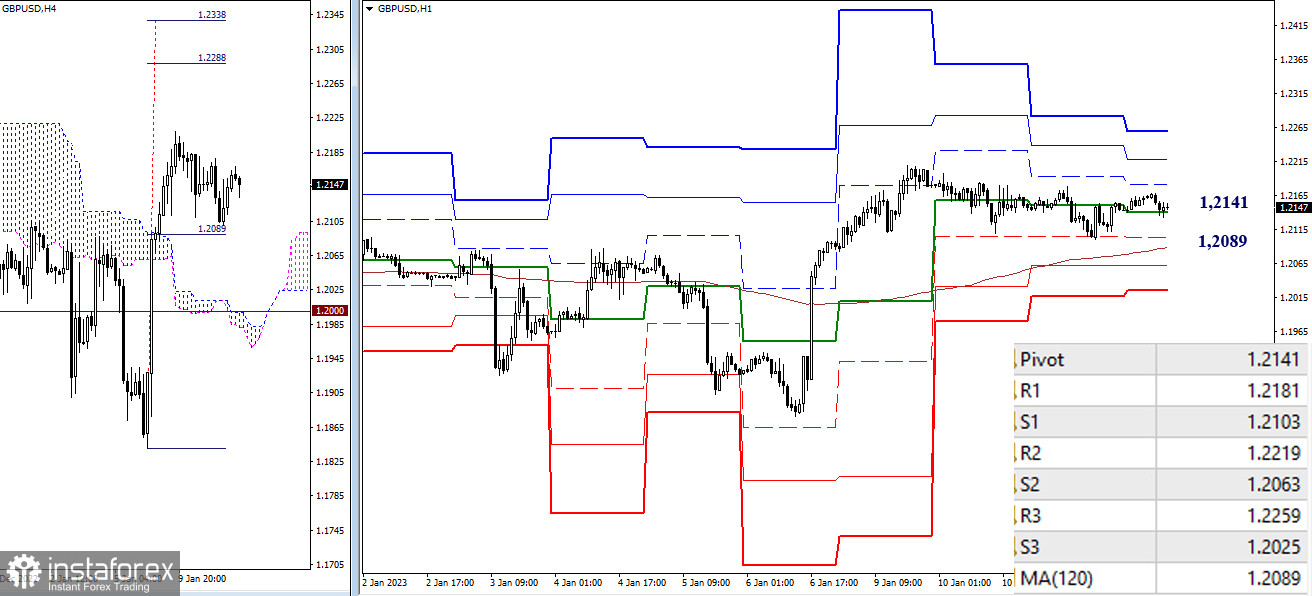

On smaller timeframes, the bulls are still setting the tone. Nevertheless, GBP/USD has been going through a downward correction lately. For the correction, the central pivot intraday level which is seen at 1.2141 today serves as the main downward target. The ongoing downward correction is finding support which coincides with a one-week long-term trend line of 1.2089. If the price settles below it and then consolidates its down move, this action could change the current balance of trade forces on smaller time frames. The lower intraday support levels can be spotted at 1.2063 and 1.2025, they are classical pivot levels. In case the bulls assert themselves, they will focus on the resistance of classical pivot levels of 1.2181 – 1.2219 – 1.2259.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română