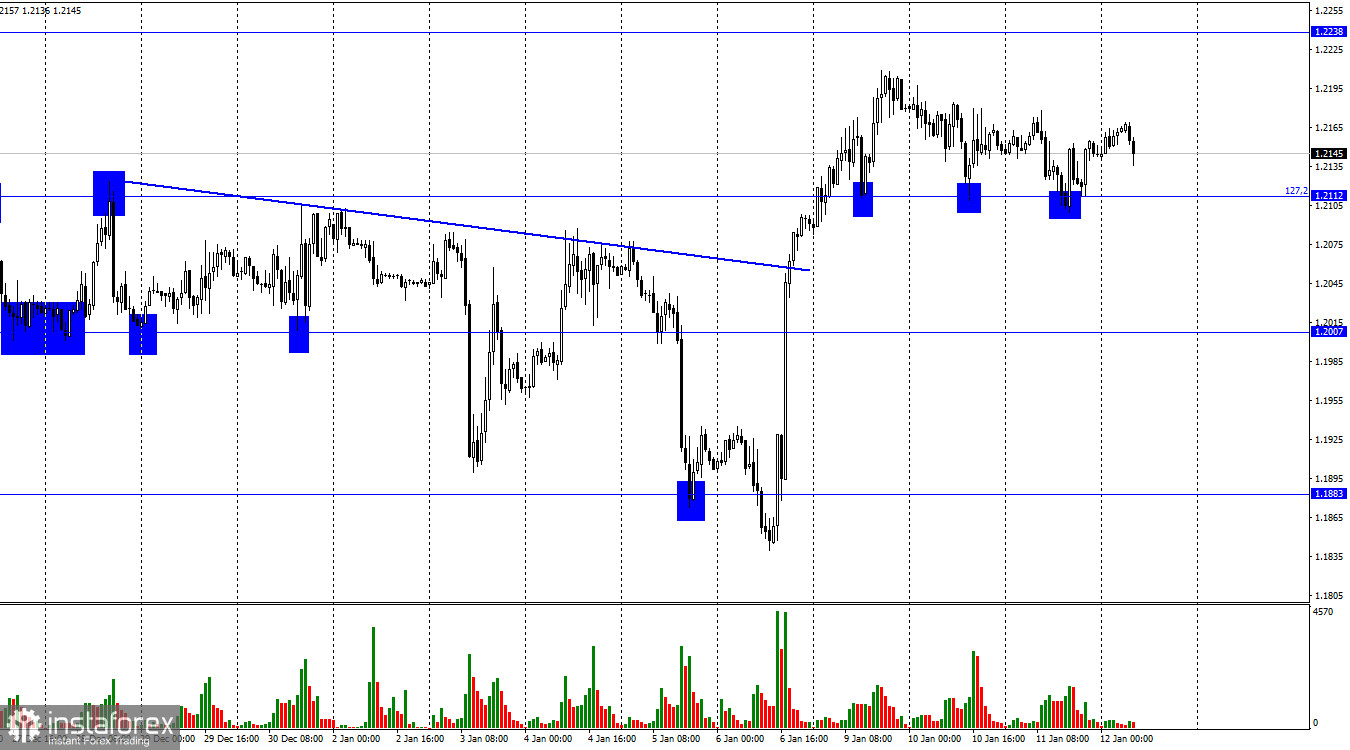

Hello, dear traders! The 1-hour chart shows that GBP/USD fell to the 127.2% retracement level of 1.2112, rebounded from it, and went toward the level of 1.2238 on Wednesday. Consolidation below 1.2112 may lead to a bearish reversal with the target at 1.2007. However, in case of another rebound from the mark, the pair may rise to 1.2238.

This week is marked with an empty macroeconomic calendar both in the eurozone and the UK. In addition, Fed Chair Jerome Powell's speech had no effect on trader sentiment. The US will deliver an inflation report today. The UK will see the publication of GDP data tomorrow.

UK GDP reports are now of crucial importance as it is the British economy that is forecast to contract the most in 2023. As a reminder, the US may avoid a recession, and the eurozone is seen slowing down just slightly as energy prices have stabilized in recent months. UK inflation is still high despite interest rates at 3.5%. Clearly, it will go down one day. However, most experts anticipate consumer prices to fall by just 4-5% from the current 10.7% in 2023. In other words, inflation is likely to remain high and the Bank of England will have to keep hiking rates in order to bring it to the 2% target.

In the meantime, a strike movement over wage grievances is growing in the country. Rishi Sunak's government has no intention to raise wages yet as this could again accelerate inflation. The economy has already entered a recession and is highly unlikely to come out of it as long as the regulator raises rates.

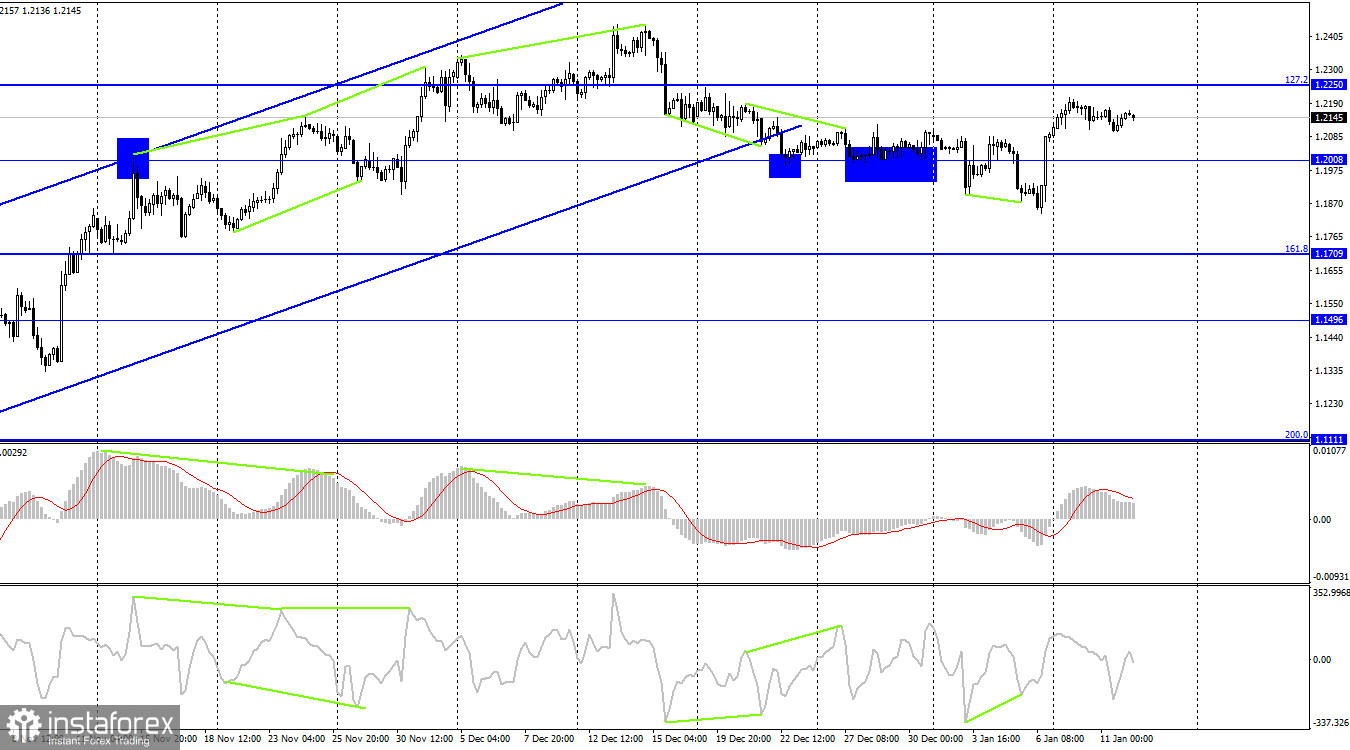

In the 4-hour time frame, the pair closed below the ascending corridor. Trader sentiment turned bearish. The quote may go down to the 161.8% Fibo level of 1.1709. However, after a bullish divergence, the pair has mostly been on the rise. A bounce off the 127.2% retracement level of 1.2250 may lead to a bearish reversal and the extension of the downtrend. Meanwhile, if the pair closes above 1.2250, we may see a bullish continuation toward the 100.0% retracement level of 1.2674.

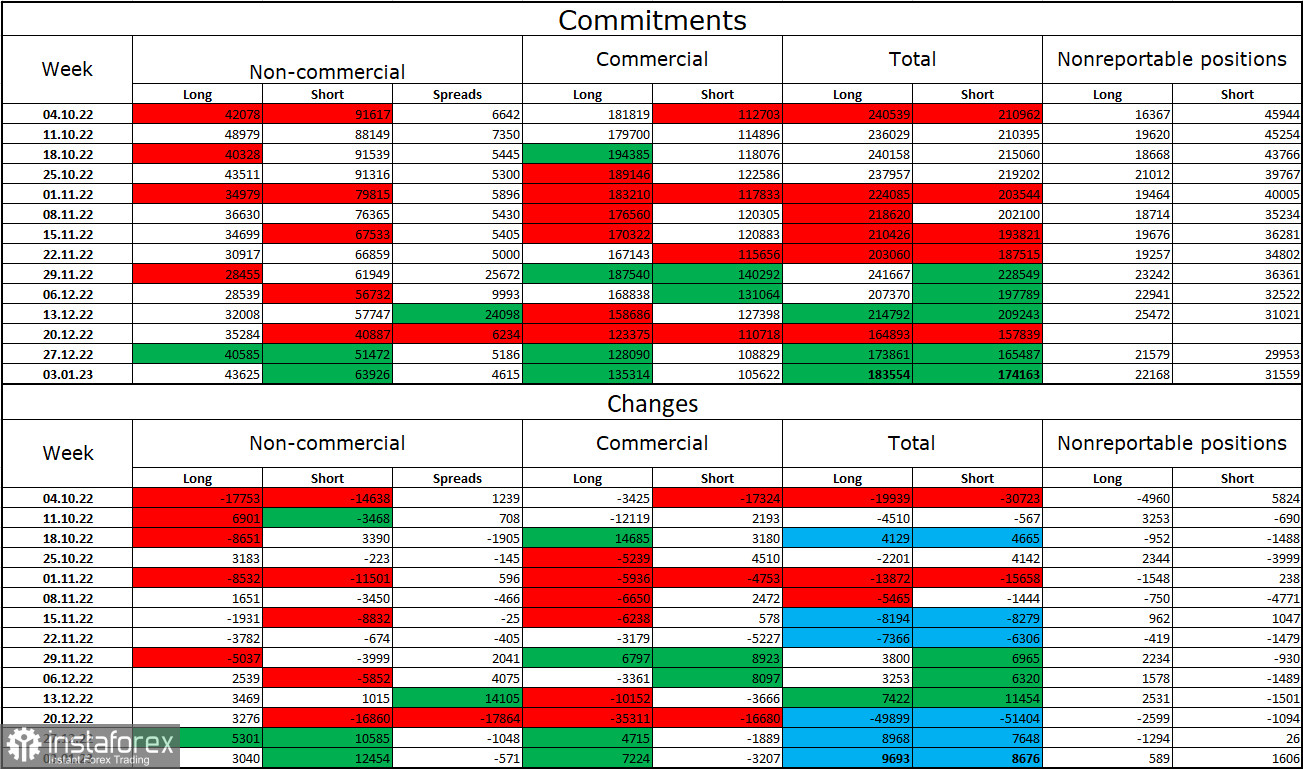

Commitments of Traders:

The bearish sentiment of non-commercial increased last week. Speculators opened 3,040 new long positions and 12,454 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Over the past few months, the situation had dramatically changed with a gap between longs and shorts being about 20,000. A few months ago, there was a threefold difference. Thus, the outlook for the pound/dollar pair has greatly improved lately. Still, in the near future, the British currency may again be bearish as the price has left the 3-month ascending corridor on the 4-hour chart.

Macroeconomic calendar:

United States - Inflation Rate (13-30 UTC); Initial Jobless Claims (13-30 UTC)

United Kingdom – no macro releases

On Thursday, fundamental factors will have a mild influence on market sentiment.

Outlook for GBP/USD:

It will become possible to open short positions if the pair closes below 1.2112 with the target at 1.2007. Meanwhile, if the pair rebounds from 1.2112 on the 1-hour chart, it will become possible to go long with the target at 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română