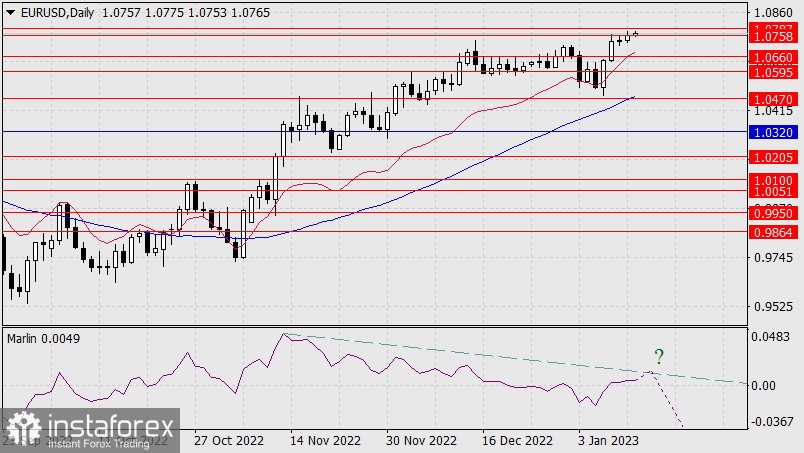

The euro is set to master the target range of 1.0758-1.0787 this morning. According to our main scenario, I expect the formation of the price divergence with the Marlin oscillator and the euro's reversal to a medium-term decline.

It is impossible to predict how high the price will still be able to grow in case the CPI falls, but from a purely technical perspective, a reversal can take place even from current levels, which indirectly implies CPI values are higher than forecasts.

The forecast for December CPI is 6.5% y/y versus 7.1% y/y in November, while the forecast for the core index is 5.7% y/y versus 6.0% y/y. It is likely that this strong decline in inflation is causing traders to expect them with excessive optimism. The forecast for monthly inflation, or more precisely core CPI for December, is 0.3% versus 0.2% in November, with the overall monthly CPI forecast at 0.0% versus 0.1% a month earlier. In other words, the data could end up disappointing. Albeit not by much, but enough to keep investors from buying counter-dollar currencies.

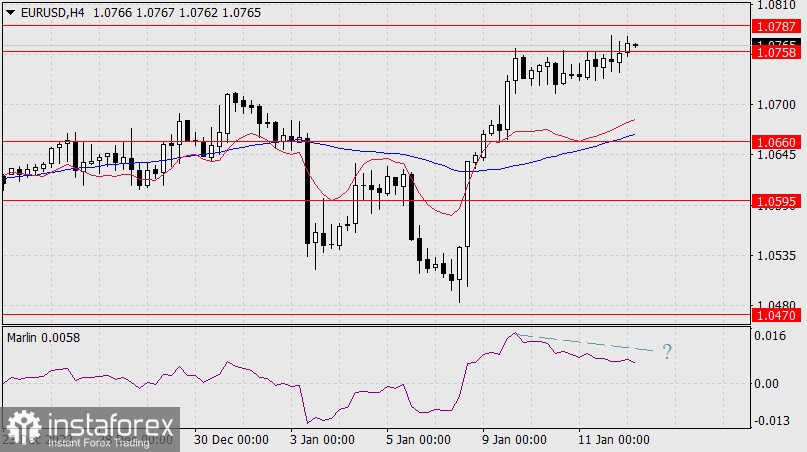

On the four-hour chart, the price and the Marlin oscillator have a structure similar to the formation of a divergence. We have to wait for the US inflation report and make a decision according to the market behavior.

The uptrend will break in case the price falls below 1.0660, that is, when it crosses the support of the MACD line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română