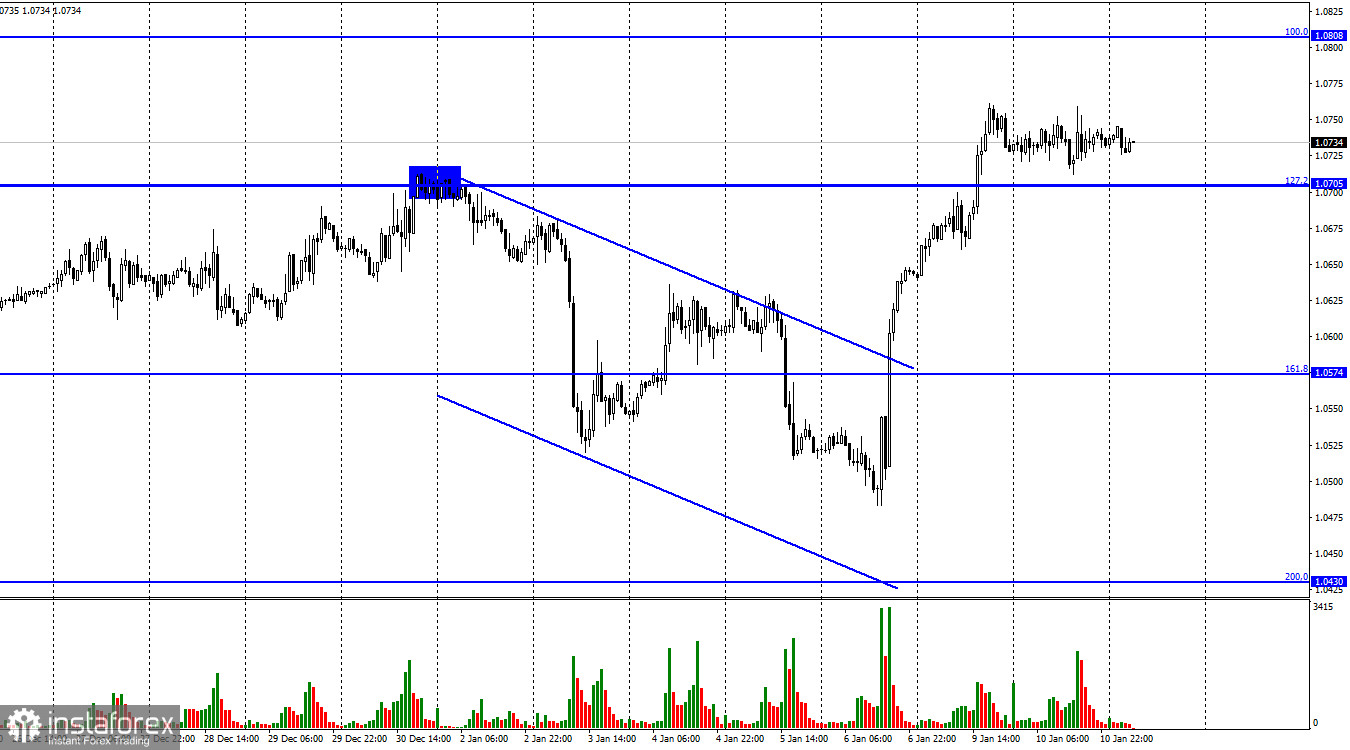

On Tuesday, the EUR/USD pair only moved horizontally. After the quotes have stabilized above the corrective level of 127.2% (1.0705), the euro's rise can be extended to the next Fibonacci level of 100.0% (1.0808). Closing the pair's exchange rate below 1.0705 will benefit the US currency and cause it to decline in the direction of the corrective level of 161.8% (1.0574).

There was no background news on Tuesday, and traders were expecting to take a rest following two busy days. Let me remind you that a slew of crucial economic numbers were presented on Friday, which traders interpreted negatively for the US currency, although practically all reports said "for" US dollar growth at first glance. However, traders judged the reports to be insufficient, and the dollar sank. I had not anticipated such a reaction, but sometimes you have to accept that the general opinion does not correspond with your own.

I cannot say that the information background for the euro or the dollar changed dramatically over the first week of January. Traders are still anticipating the Fed and the ECB to raise interest rates. And, as time passes, expectations for both central banks' interest rates rise. The only item worth noting is that there has been speculation that the Fed rate could be raised to 6% rather than the 5.5% anticipated in December. The ECB, on the other hand, is anticipated to do the same. In the sense of not hiking the rate to 6%, but instead extending and tightening the PEPP. Because of the timely drop in gasoline costs, the European economy can avoid a catastrophic recession in 2023. The market was most concerned about the European Union's energy issue, but these concerns have since diminished dramatically. The gas itself has vanished as a result of the drop in gas prices, but this is still good news for the entire European Union and the euro currency.

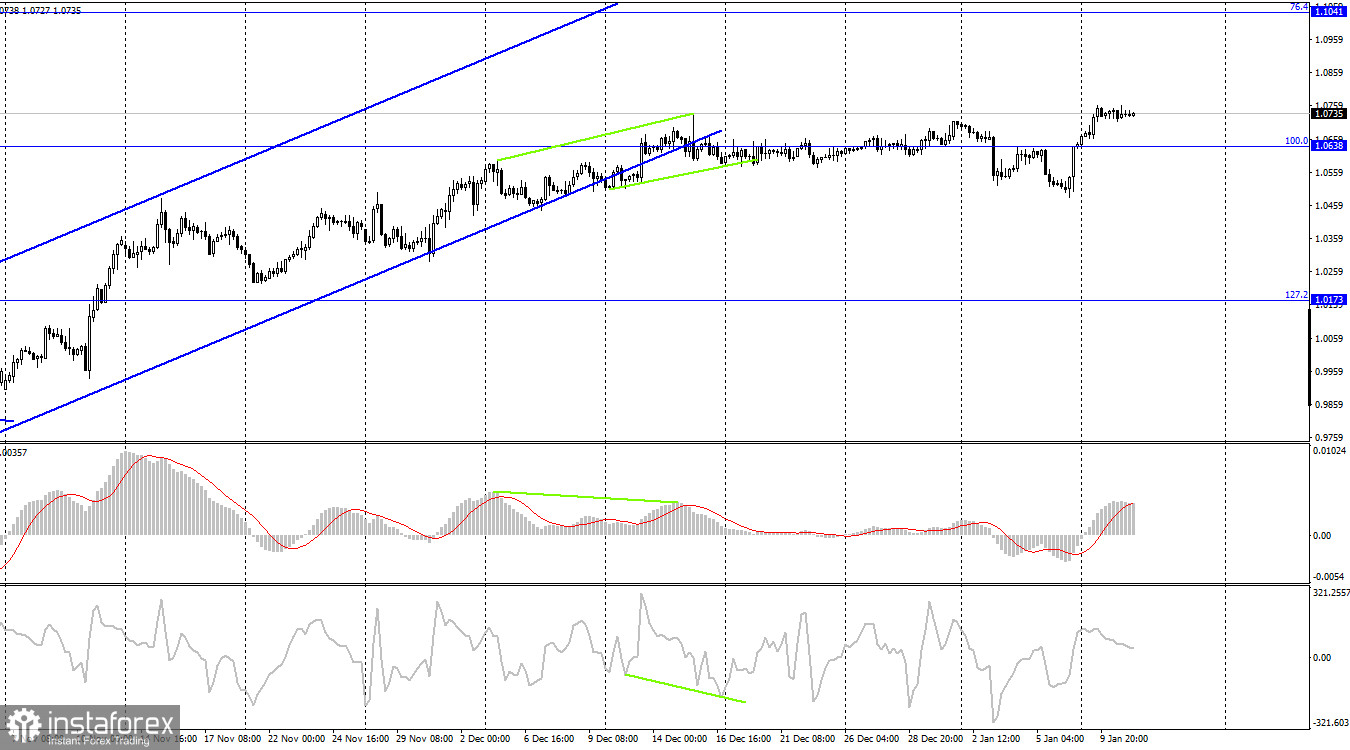

On the 4-hour chart, the pair reversed in favor of the EU currency and anchored above the corrective level of 100.0% (1.0638). Fixing above this level does not imply much on its own, especially as there have been numerous incidents in the last month. As a result, I recommend that you pay closer attention to the graphical analysis of the hourly chart. The CCI indicator is currently developing a "bearish" divergence, which could aid bear traders in returning to the market.

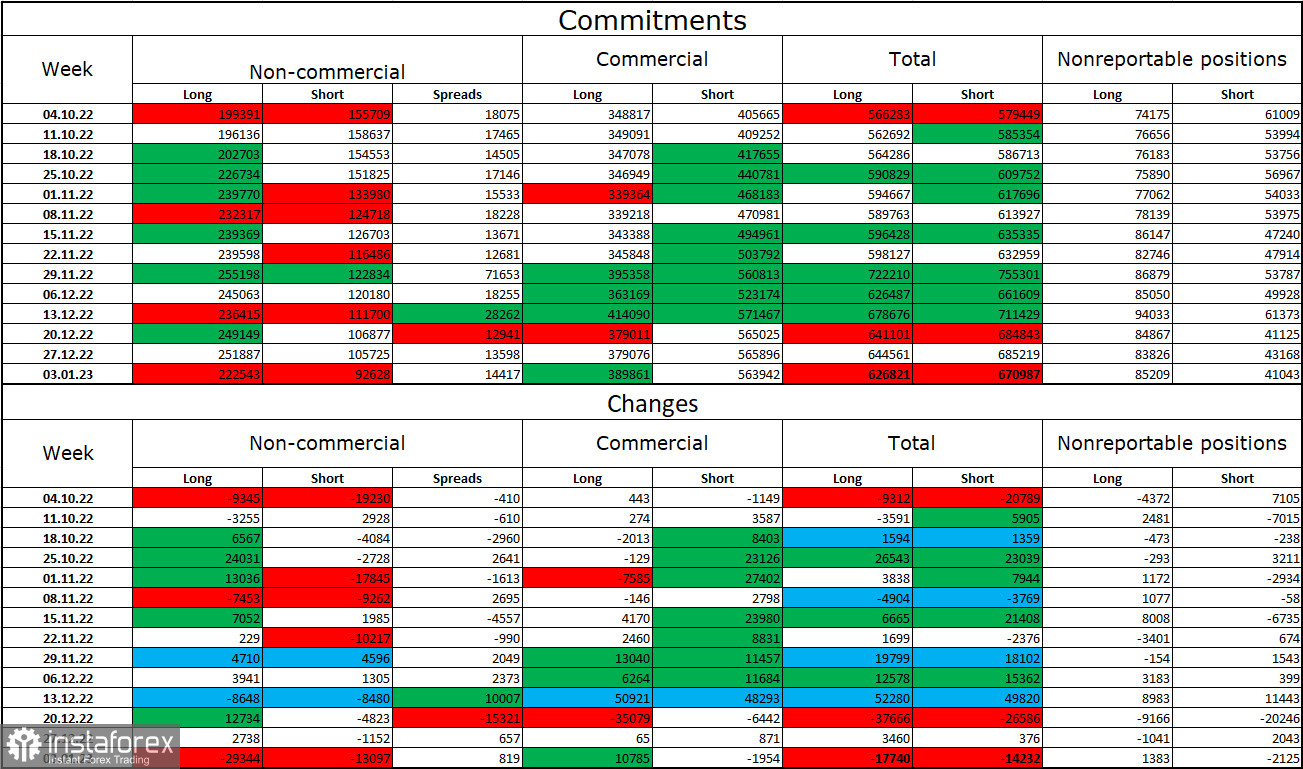

Report on Trader Commitments (COT):

Speculators closed 29,344 long contracts and 13,097 short contracts during the previous reporting week. The mood of large traders is still upbeat, although it has dipped in the last two weeks. The entire number of long contracts concentrated in the hands of speculators presently stands at 222 thousand, with 92 thousand short futures. The European currency is currently rising, as shown by COT reports, although it is worth noting that the number of longs is more than two and a half times that of shorts. The odds of the euro's growth have been steadily increasing in recent weeks, as has the euro itself, although the information background does not always support it. After a long "dark time," the euro's status continues to improve, so its prospects remain good. Going beyond the ascending corridor on the 4-hour chart, on the other hand, may indicate a strengthening of "bearish" positions in the near future.

News for the United States and the European Union:

The calendars of economic events for the European Union and the United States do not feature a single significant entry on January 11. Today's traders' moods will be unaffected by the background information.

EUR/USD forecast and trading recommendations:

Sales of the pair are conceivable if the hourly chart closes below 1.0705 with a target of 1.0574. Alternatively, a rebound from 1.0808 with a target of 1.0705 is possible. Purchases of the euro are conceivable if it recovers from 1.0705 with a target of 1.0808.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română