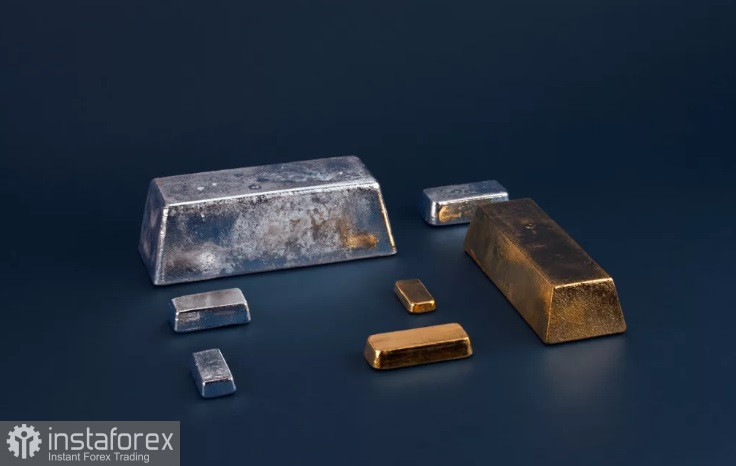

Gold rising beyond $1,850 at the start of the new year will create new momentum for the metal and attract new investors.

Greg Harmon, founder and president of Dragonfly Capital Management, said he is optimistic about the long-term potential of gold as the uncertainty in financial markets will continue to support the attractiveness of the metal as a safe haven asset. There is also a shift in markets as bond yields continue to trade near their highest level in 12 years, holding support above 3.50%.

As for how much gold an investor should have in their portfolio, Harmon said between 1% and 2% might be appropriate. He added that he does not see the metal as a hedge against inflation because its price is mainly determined by investor demand.

Alongside gold, Harmon said he also sees some potential in silver since its prices have risen significantly from October's two-year lows. And even though there is a strong resistance around $24 and $26, a rise above $30 will take the metal to historical highs.

"Silver has a lot of momentum and we haven't seen it stop like gold," Harmon said. "If it goes up to $30, there's nothing to stop it from going higher."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română