Jerome Powell will speak today, an inflation report for December will be released on Thursday, and reports on unemployment and the US labor market were released last week. These reports and events, in my opinion, can legitimately be regarded as the most significant ones at this time for the foreign exchange market. Let us evaluate them to see if there is any chance of creating downturn sections for the British and European markets.

So, the most recent number on payrolls did not surprise me and cannot be classified as robust or poor. Since March of last year, there have been fewer and fewer monthly payrolls created, from 398 thousand to the present 223 thousand. The unemployment rate is still 3.5%, which is the lowest it has been in 50 years, at the same time. How should we interpret these numbers? I believe there is a very slight downward trend, but it cannot be taken seriously because of how faint it is. Allow me to elaborate. It would be unrealistic to expect economic indicators to respond in any way to the Fed's rate hikes over the last year. Although the rate has reached its highest levels in decades, payrolls continue to show upward trends each month, and unemployment is still relatively low. I think that when monetary policy is tightened, the US economy responds extremely gradually. The outcomes might have been considerably worse.

Now that inflation has been falling for five consecutive months, the sixth reduction will be announced on Thursday. It makes little sense for the Fed to continue tightening monetary policy at the current rate given that inflation is progressively declining. In my opinion, the rate of growth will slow down by roughly 4%. The Fed will continue to raise the rate in stages of 50 or 25 basis points until it reaches 4%, which may take three to four months. However, everything is proceeding without a hitch in the direction of the rate's April peak value. Similar to the UK, the situation is very different within the European Union. There, the rate must be gradually raised because the inflation rate is still too high to anticipate it falling to at least 5-6% at the current level of interest rates. But in Britain and the EU, there is now a pressing concern: Can the economy take the further tighter monetary policy?

It turns out that while in the US everything is moving smoothly towards the Fed's refusal to tighten, in the EU and the UK, the rate can theoretically grow for a very long time. Both central banks can also decide to stop raising the rate because the economy may fall into a serious recession, which can be avoided in America. It is very difficult to predict when the dollar will start to rise because rates are currently so important to the foreign exchange market. Until we know the Bank of England's and the ECB's plans, this is especially true. The events stated at the start of the study cannot, in light of the foregoing, predict what will happen to the dollar in the upcoming months.

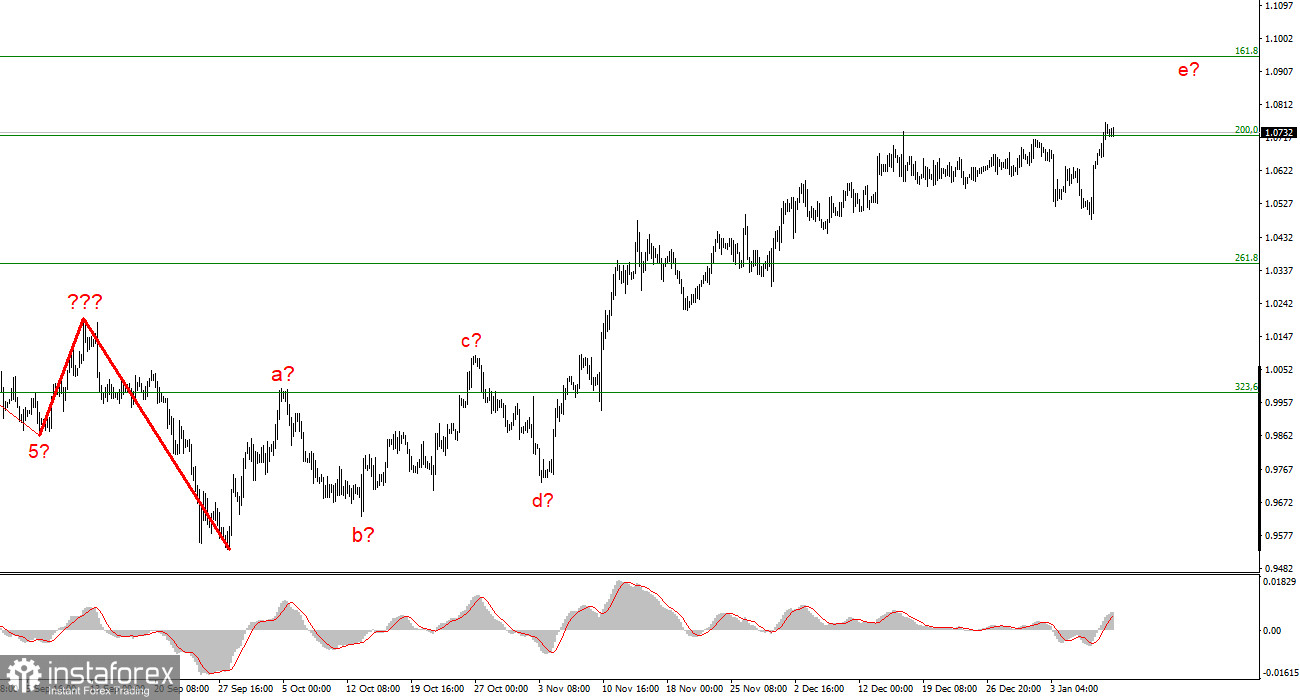

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with objectives close to the predicted Fibonacci level of 0.9994 (323.6%). A failed attempt to break through the 1.0726 level suggests that the instrument may decrease in the upcoming weeks; however, it is possible to complicate and lengthen the rising portion of the trend. The likelihood of this scenario is still relatively strong.

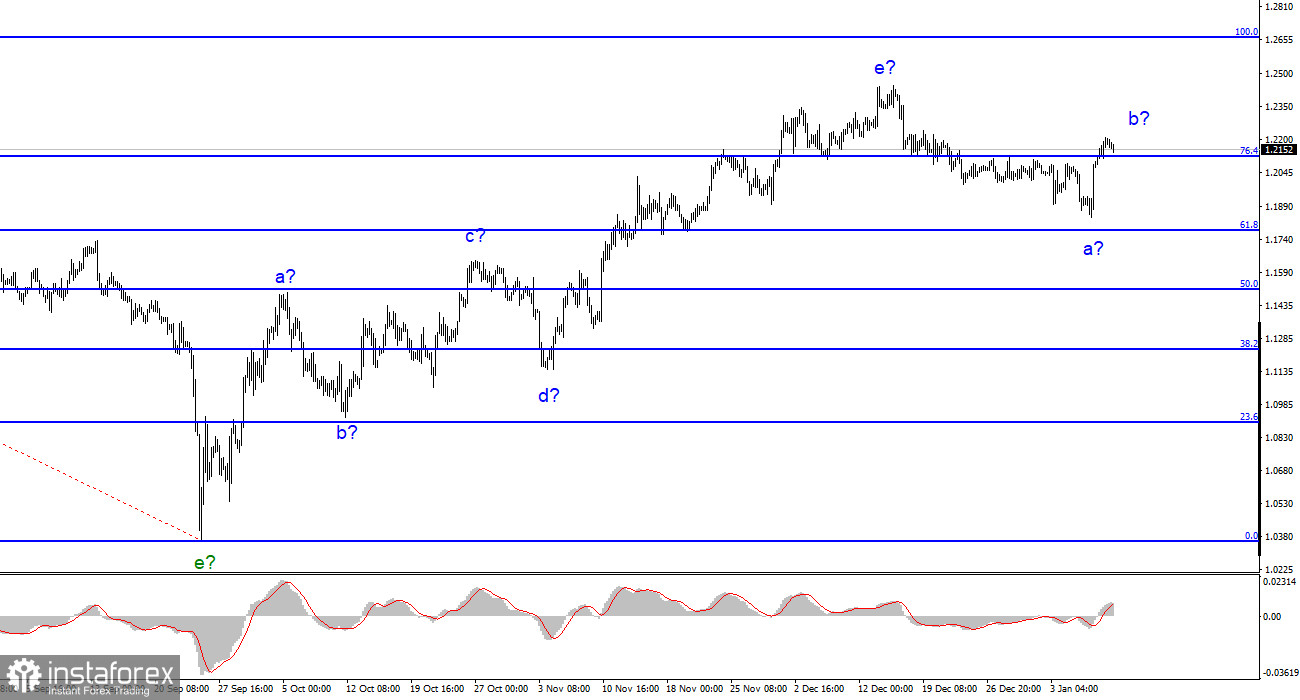

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. Right now, I still suggest sales with objectives near the level of 1.1508, which corresponds to a 50.0% Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română