I focused on the level of 1.2148 in my morning forecast and suggested making decisions about joining the market there. Let's analyze the 5-minute chart to see what transpired there. Around the start of the European session, the decline and the development of a false breakdown at 1.2148 gave us a great signal to purchase the pound to maintain the bullish trend, which at the time of writing resulted in a gain of more than 35 points. Since not much happened throughout the second half of the day, I did not adjust my plan.

You require the following to open long positions on the GBP/USD:

Everyone is anticipating Jerome Powell's comments and how he will respond to the latest positive US labor market data. All of last year, Powell expressed dissatisfaction with how things were going in that country and lamented the rapid wage increase that continues to fuel the expansion of retail sales and drive inflation to new highs. The pressure on the pair can rise in the afternoon if Powell sticks to his hawkish stance. The buyers' sole choice, therefore, is to safeguard the nearest support level of 1.2148. Similar to what I stated previously, I encourage you to watch for the decrease of the GBP/USD and the subsequent construction of a false breakdown there. Only this will provide a buy signal to maintain the new upward trend and enable you to go back to 1.2204 and break beyond this range. The sellers' stop orders will be hit by a breakthrough and a top-down test of 1.2204, triggering a buy signal and a more abrupt upward move with the 1.2260 update. I advise taking profits at 1.2301, where an exit over 1.2260 with a similar test will open up growth opportunities. The vicinity of 1.2350 will be a further aim. If the bulls are unable to handle the challenges and miss 1.2148, I anticipate the emergence of a stronger negative reversal. It is recommended to start long positions on a downturn and a false breakdown in the region of the following low of 1.2094, where the moving averages are siding with the bulls. For this reason, I suggest you not hurry into purchases. I advise purchasing GBP/USD right away in anticipation of a recovery from 1.2037 to gain 30-35 points in a single day.

You require the following to open short positions on the GBP/USD:

Since the bears' inaction will not do them any good, it is time for them to become more active. Powell's speech will serve as the perfect impetus for this. There will continue to be a risk of a correction as long as trading is below 1.2204. However, another upward move will occur if the bears miss this range, so keep an eye on things. With growth, the occurrence of a false breakdown at 1.2204 will provide a great opportunity to sell the pound, and the morning support level of 1.2148 will be the sellers' next stop. With a rise to 1.2094 and the potential for updating 1.2037, where I advise fixing profits, only a breakout and a reversal test from the bottom up of this range will provide an entry opportunity to sell. The region around 1.1982 will be the farthest objective. Buyers of the pound will sense its strength with the possibility of GBP/USD growth and the lack of bears at 1.2204 in the afternoon, which, as I mentioned above, would cause a sharper upward move of the pair. In this instance, only a false collapse in the vicinity of the following resistance, 1.2260, provides a point of entry into short positions with an eye toward a fresh downward momentum. If there is no activity there, I urge you to sell GBP/USD right away at the highest price of 1.2301, but only if you are counting on the pair to fall back by 30-35 points over the day.

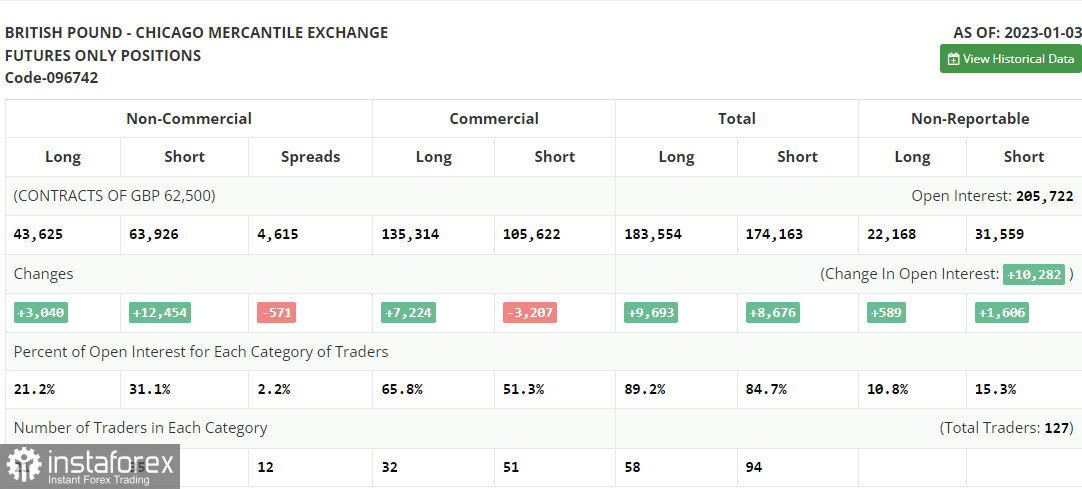

Long and short holdings increased in the COT report (Commitment of Traders) for January 3. The latter turned out to be nearly four times higher, which amply demonstrates the lack of confidence among buyers in the pound's promising future at the start of this year. This is bad news for the British pound since regulators won't change their approach just yet and will keep raising interest rates. The Bank of England will decrease interest rates, and the economy has already entered a recession, which is the key factor limiting the rise of the pound. You can easily ignore the growth of the pound in the first quarter of this year if the figures on inflation in the United States, which are anticipated in the near future, even signal its growth. According to the most recent COT report, short non-commercial positions increased by 12,454 to reach 63,926, while long non-commercial positions increased by 3,040 to reach 43,625. These changes caused the non-commercial net position's negative value to decrease to -20,301 from -5,603 the previous week. The delta's reversal to the downside demonstrates once more that no one is eager to purchase the pound at its current highs. The closing price for the week dropped from 1.2177 to 1.2004.

Signals from indicators

Moving Averages

Trading is taking place above the 30 and 50-day moving averages, which suggests that the pair will continue to increase.

Note that the author's consideration of the period and cost of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2204, will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română