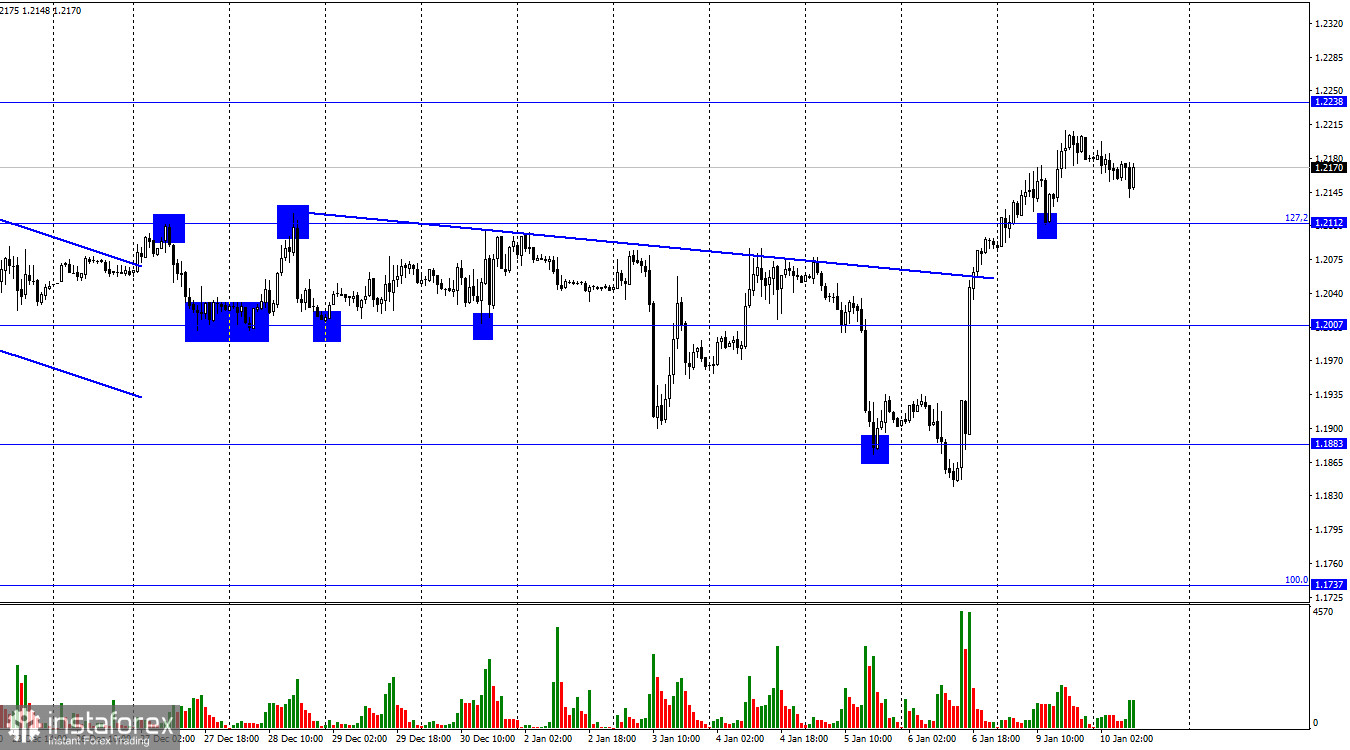

On Monday, the GBP/USD pair secured above the corrective level of 127.2%, or 1.2112, and subsequently retraced from it, according to the hourly chart. The British pound may continue to rise until it reaches a level of 1.2238. As prices rise off of this level, some will fall in the direction of 1.2112, helping the US dollar. The likelihood of further growth toward the next level of 1.2342 will rise if consolidation occurs above 1.2238.

On Friday and Monday, I had the same concerns regarding the expansion of the British and European markets. I find it very difficult to conclude that Friday's payroll and unemployment numbers were bad for the US dollar. Although the non-manufacturing sector's ISM business activity index was also released on this day and performed much worse than traders had anticipated, I'm not sure why the market valued it more highly than statistics on the labor market and unemployment. Even answering the question of whether traders' unrealistic expectations based on the nonfarm payrolls report or the ISM business activity index were the precise cause of the dollar's decline is tough for me. Bull traders are taking advantage of the fact that, in one way or another, the British population is expanding.

Jerome Powell, the president of the Federal Reserve, will talk today and might stick with the "hawkish" language. At least, that's what I anticipate from him given that several FOMC members have already stated in speeches from last week that the rate will be raised over 5% and that it will then stay there for a considerable amount of time. In my opinion, the Fed president won't likely take a more dovish stance. In my opinion, the dollar can improve its situation at this time, and bear traders can intensify their pressure on the pair thanks to American numbers released on Friday.

The pair finished within an ascending trend corridor on the 4-hour chart, which I believe to be the most significant development given that traders' sentiment is currently shifting to "bearish." Although the British pound is merely increasing following the development of a "bullish" divergence, the decline in quotes may resume in the direction of the Fibo level of 161.8% (1.1709). The US dollar may benefit from the pair's exchange rate rebounding from the correction level of 127.2% (1.2250), and the continuation of the downturn. The likelihood of continuous expansion toward the following correction level of 100.0% (1.2674) will increase if the price closes above 1.2250.

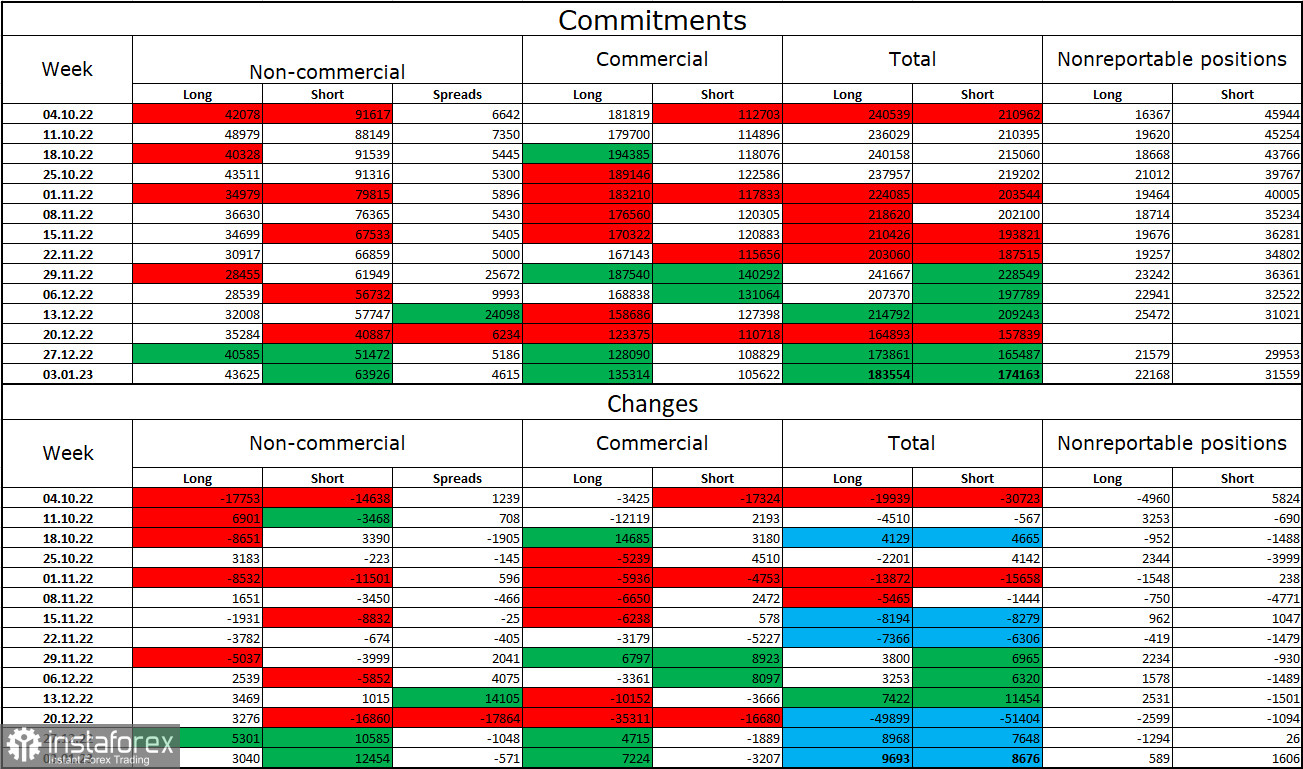

Report on Commitments of Traders (COT):

The sentiment among traders in the "non-commercial" category over the last week has shifted more "bearish" than it did the week before. Speculators now hold 3,040 more long contracts than short contracts, a difference of 12,454 units. However, the major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has drastically changed over the previous few months, and presently there are only roughly 20,000 more long positions than short positions held by speculators. There was a threefold change a few months ago. As a result, the pound's chances have greatly improved recently. The 4-hour chart crossed above the three-month climbing corridor, thus the British pound may soon start sliding again.

The following is the UK and US news calendar:

United States - Mr. Powell, the Fed's chairman, speaks

Jerome Powell's address will take place in the USA on Tuesday, while there are no economic events scheduled at all in the UK. The background information may have a significant impact on traders' emotions today.

GBP/USD prediction and trading suggestions:

If the British currency closes below the level of 1.2112 with a goal of 1.2007, I advise selling it right now. Alternatively, you can sell if the price rises from 1.2238, with a target of 1.2112. On the hourly chart, I suggest buying the pound when it recovers from 1.2112 with a target of 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română